France is recognised as one of the leading countries in promoting electromobility, but the reduction in incentives for purchasing electric vehicles (EVs) at the start of this year has generated a wave of uncertainty in recent months.

The changes to the flagship eco-bonus, one of the most valued aids for those opting for sustainable mobility, have impacted both individuals and businesses.

Industry experts offer various interpretations of the recent performance of the zero-emission vehicle market.

Clément Molizon, General Delegate of Avere-France, points out that “there are technical explanations, but it is also necessary to revitalise the dynamics by leveraging the new models that are arriving.”

According to Molizon, political instability, combined with economic and inflationary crises, has caused concern.

He asserts that “it is crucial to ensure budgetary continuity and solid commitments to instil confidence in both households and businesses, in order to maintain an ambitious trajectory.”

On the other hand, Cecil Coulet, Head of European Public Affairs at Équilibre des Énergies, tells Mobility Portal Europe that the modifications to the eco-bonus have indeed impacted the market decline.

“Given that EVs remain a more expensive option than combustion vehicles, it was predictable that their progress would slow down once higher-income customers—the so-called ‘low-hanging fruit‘ of the electric transition—had made the switch,” he argues.

Coulet also emphasises the need for support programmes, especially for lower-income consumers, to prevent further deceleration.

He highlights the importance of developing a second-hand market for electric cars as part of the solution.

Conversely, Bassem Haidar, an electric mobility Engineer, offers a more situational perspective to Mobility Portal Europe, suggesting that the decline is not directly related to changes in incentives.

“The bonus changed several months ago, so it is not the main factor. Rather, it is due to two reasons: the summer holidays, which always bring a decrease in sales, and the Olympics, as many Parisians decided to leave the city during this period,” Haidar says.

Reduction of incentives in France: What changes?

The decree published in February 2024 confirmed what many had feared: the eco-bonus, which covered up to 27 per cent of the purchase cost of an electric car, has undergone significant cuts.

While the incentive remains for lower-income individuals, it has been reduced for higher-income households from 5,000 to 4,000.

Additionally, eligible vehicles now have to meet strict environmental and weight requirements.

The conversion bonus, which facilitated the transition from polluting cars to electric models, has also been modified.

The maximum limits for the bonus have been reduced, particularly for vans and business units, raising concerns in key sectors such as transport and logistics.

The decision by President Emmanuel Macron to exclude imported cars from China from the subsidy has not helped either, given that these vehicles represent a more affordable option for facilitating the transition to electric mobility.

The subsidy dilemma: When is the “right time” to withdraw them?

The right moment to remove incentives is a delicate issue.

According to experts, eliminating incentives is only viable when the total cost of ownership of an EV is on par with that of a combustion vehicle.

This has not yet occurred uniformly across all car categories or for all consumers.

While electric vehicles have become more accessible, the initial price remains significantly higher, particularly for middle and lower-income families.

For instance, an urban electric car has an average cost of around 35,000 euros, while the minimum value for SUVs is about 40,000.

Information from Engie highlights that, in 2023, the Dacia Spring is the most affordable electric car in the French region, starting at 20,800 euros.

Other accessible models include the Renault Twingo E-Tech, starting from 25,250 euros, the Leapmotor TO3 at 25,990 euros, and the Volkswagen e-up electric at 27,400 euros.

Nonetheless, the price differences between these models and others on the market are considerable, with luxury cars like the Mercedes EQS exceeding 135,000 euros.

In conclusion, the future of electromobility in France will depend on how the government and businesses manage this transition.

The reduction of incentives presents new challenges but also offers an opportunity to rethink stimulus policies, focusing on infrastructure, accessibility, and long-term sustainability.

As the country navigates these changes, the goal remains clear: achieving cleaner and more accessible mobility for all.

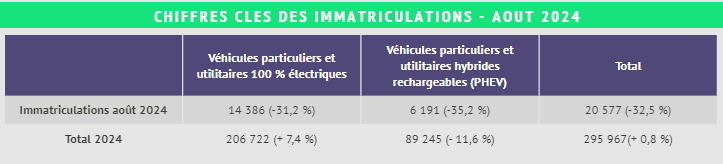

Matriculations in the French territory

In August 2024, there were 20,577 registrations of EVs and plug-in hybrids (PHEVs), representing a 32.5 per cent drop compared to the same period in 2023, according to data from Avere-France.

Plug-in hybrids have been particularly affected, experiencing five consecutive months of decline.

However, this poor performance must be understood in the context of a generally weakened automotive market: August marked the fourth consecutive month of decline in new car registrations, making it one of the worst months in the last decade for the passenger car sector.

Although a seasonal drop during the summer was anticipated, the results were worse than expected.