As 2025 approaches, the European automotive industry faces the critical challenge of meeting the new and stringent CO₂ emission targets set by the European Union (EU).

In this context, Renault and Stellantis are positioned to play a crucial role.

According to the latest report from Transport & Environment (T&E), both manufacturers are set to launch a series of affordable electric models that could reshape the mass market.

The T&E report highlights that by 2025, up to seven electric models priced under 25,000 euros are expected to be available, a supply that will be crucial for meeting the manufacturers’ goals.

“In 2025, these models could represent between 300,000 and 400,000 units, equivalent to ten to 15 per cent of the battery electric vehicle (BEV) market,” explains the T&E report spokesperson to Mobility Portal Europe.

“These units will support the growth of the BEV market, which could reach up to 2.8 million units,” adds the T&E spokesperson.

Although this figure is significant, there remains concern among sector specialists.

Will the availability of affordable vehicles be enough to meet the rising demand, given that BEVs are expected to capture 24 per cent of the market by 2025?

The need for reasonably priced electric cars is evident.

A YouGov study for T&E showed that 35 per cent of new car buyers would opt for an electric vehicle if the price was below 25,000 euros, which could translate into an additional one million units sold each year.

Presently, 25 per cent of European consumers are already willing to purchase a zero-emission vehicle at current prices.

It is reasonable to think that with more affordable options, this percentage could increase by ten per cent or more.

However, this raises a key concern: whether the availability of these budget cars will be able to cover a demand potentially exceeding the current supply.

Which affordable models will be launched?

Renault is positioning itself as a major player in the electrification strategy.

The French brand plans to launch accessible models such as the Renault R5, priced at 24,900 euros, and the Renault R4.

These vehicles, along with others like the revamped Dacia Spring and the Renault Mégane electric, could significantly contribute to boosting the brand’s electric vehicle sales.

According to T&E projections, the Renault-Nissan-Mitsubishi consortium could achieve a 17 per cent share of electric car sales by 2025, leading to a 68 per cent reduction in CO₂ emissions.

On the other hand, Stellantis, the conglomerate grouping brands such as Fiat, Peugeot, Citroën, Opel, and Alfa Romeo, is betting on a combination of electric models and hybrid versions to meet its emission reduction targets.

The group plans to launch the affordable Fiat Grande Panda, priced under 25,000 euros, and the Citroën e-C3, with a starting price of 19,990 euros.

Stellantis is expected to capture an 18 per cent share of the electric vehicle market, supported by the production of new models like the Opel Frontera and the Alfa Romeo Stelvio, in addition to increasing the hybrid offerings like the Citroën C3 and the Opel Corsa.

While the aforementioned companies lead the race to offer affordable models, other manufacturers are also advancing in this direction.

BMW is expected to achieve a 48 per cent reduction in CO₂ emissions due to the growth of its electric models such as the iX1, iX3, and i5 BEV, and the launch of the Mini Aceman electric, which will enable it to reach 25 per cent of electric vehicle sales by 2025, according to GlobalData.

Isabel Richter, Head of Sustainability Communication at BMW, tells Mobility Portal Europe about the importance of sustainability within the group’s corporate strategy:

“By 2030, our goal is to significantly reduce the carbon footprint per vehicle (i.e., total carbon emissions divided by the number of units produced) compared to the 2019 reference year, specifically by 80 per cent in production, 50 per cent in the use phase, and over 20 per cent in the supply chain.”

Richter further notes that in 2023, with emissions around 102.1 grams per kilometre, BMW surpassed the EU fleet target limit of approximately 126 grams per kilometre by about ten grams, based on internal company calculations.

“We focus on the EU fleet targets and have surpassed emissions goals in 2022 and 2021,” she adds.

Meanwhile, brands like Hyundai, Kia, and Volkswagen also have plans to introduce low-cost electric cars in the coming years.

What are the market expectations for EVs in 2025?

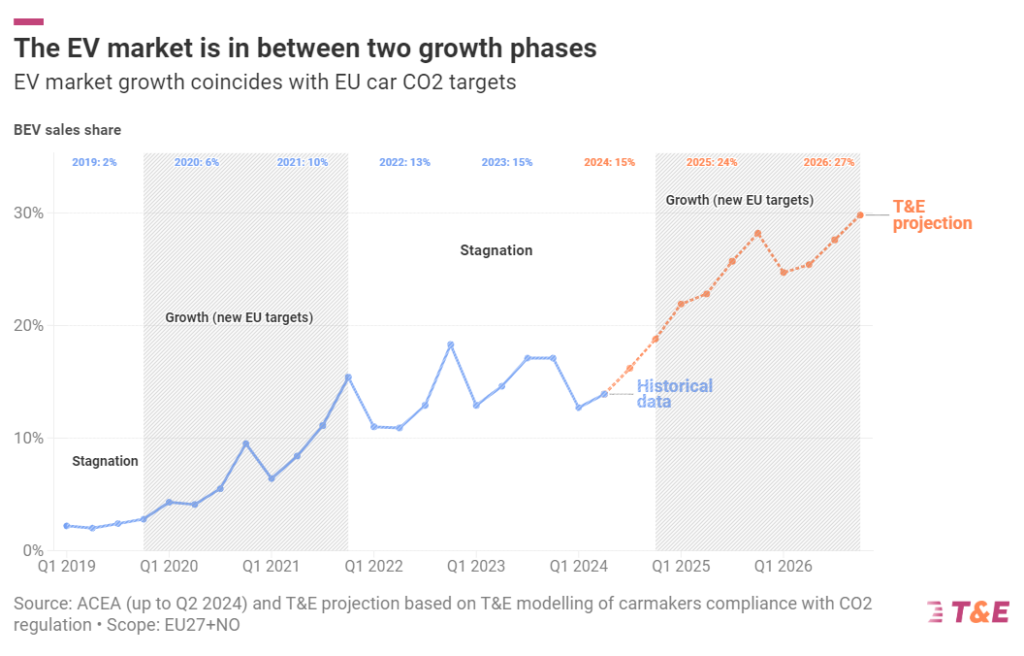

In recent years, the evolution of the zero-emission car market has been marked by phases of growth and stagnation, influenced by the EU’s CO₂ emission regulations and the strategies of car manufacturers.

Between 2022 and 2024, the growth of EVs was slower than expected, largely due to manufacturers prioritizing the profitability of internal combustion models and premium large vehicles, resulting in higher prices for electric cars and, consequently, lower adoption.

This stagnation is not surprising to analysts, who had anticipated in 2020 that manufacturers would meet emission reduction targets only when absolutely necessary.

In fact, the EU regulations set targets every five years, with the next milestones in 2025 and 2030. Historically, manufacturers have achieved these targets at the last minute.

For the time being, the proportion of BEVs in the European car market saw a minor decline to 13.3 per cent during the first half of 2024, down from 13.8 per cent in the same period of 2023 and 15.4 per cent for the entire year of 2023.

However, a new phase of growth is expected from 2025 onwards.

T&E’s source concludes: “Manufacturers prioritized short-term profits by selling higher-margin BEVs, but EU CO₂ regulations will force them to adjust their strategy and offer more affordable options to meet the new 2025 targets.“

Nonetheless, some manufacturers have already requested more flexibility in implementing these regulations, arguing that the imposed targets might be too stringent, a stance aimed at easing pressure on their margins and continuing to prioritize profits.