The Alternative Fuels Infrastructure Regulation (AFIR), which comes into effect on April 13, 2024, establishes that electric vehicle (EV) or hydrogen users must be able to pay easily at charging or refueling points using payment cards or contactless devices without needing a subscription.

Additionally, prices must be fully transparent.

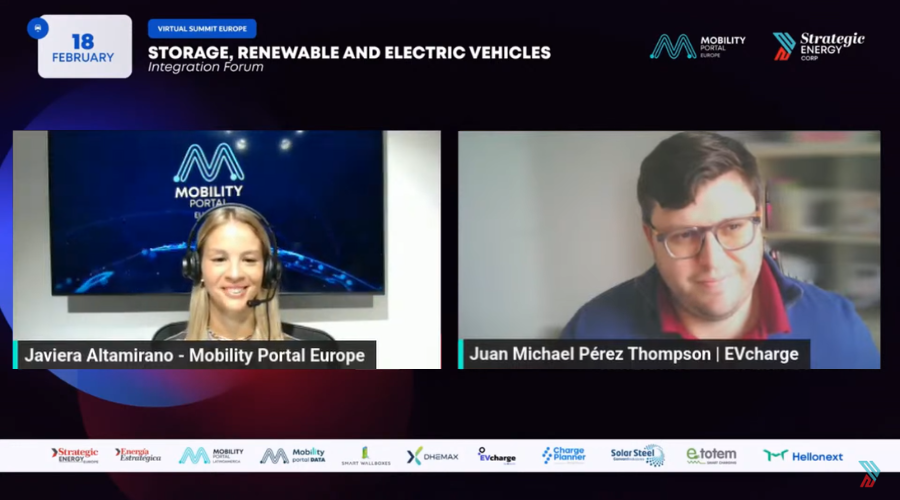

To learn more about how the implementation of these solutions is progressing, Mobility Portal Europe speaks with Juanma Pérez, Sales Manager at EVcharge, the electric mobility management platform.

“This regulation involves adapting chargers that are already installed, which poses both an economic and technical challenge,” explains Pérez during the virtual event “Voice of eMobility Leaders.”

This is why EVcharge created its own neutral point-of-sale (POS) system, which can be adapted to both new and old stations.

“It not only helps in terms of CapEx and OpEx, but it is also very easy to implement in an adaptation,” comments the Sales Manager.

In fact, if a company wants to install payment systems at a station, it must install one at each charger.

In contrast, with EVcharge’s system, only one needs to be installed, or at most two, in the case of a large station.

“With just one system, you can connect all the chargers you want, even if they are from different brands and power levels. The important thing is that they are in the same location,” he explains.

And that’s not all. It also provides a simple user experience.

The customer simply connects the charger, goes to the POS system, selects the connector, chooses the amount, and pays with their card or phone.

What role does software play in charger deployment?

Software allows information to be collected, processed, and analyzed so that the appropriate strategy can be executed.

For this reason, Pérez defines it as “the backbone of modern charging networks.”

“For example, from EVcharge, we can address all the daily tasks we handle in the EV charging infrastructure, such as management, payment systems, maintenance, and other aspects,” highlights the Sales Manager.

In this way, companies can make smart decisions.

“The ability to collect all that information enables the development of a strategic plan, not only for the next year but also to define where you want to be in ten years,” he acknowledges.

Furthermore, EVcharge’s solution also allows for tracking past errors.

“We collect the information and have live data, which is used by hundreds and thousands of users,” explains Pérez.

What challenges is the sector facing?

According to EVcharge, there are various challenges that affect not only CPOs but also electric mobility service providers and users.

First, Pérez mentions the time it takes to process permits as a difficulty.

“In Spain, getting a charger up and running and obtaining all the necessary permits can take up to a year and a half,” he laments.

Additionally, although network capacity is not a problem for the company, delivering energy to specific locations does pose a challenge.

“Indeed, projects can take up to two years to complete.“

The Sales Manager also acknowledges several challenges regarding the OICP protocol and user experience.

“They don’t know where they can use RFID cards or if their purchase will be billed correctly. They have many doubts,” he explains.

Lastly, Pérez emphasizes that “as electromobility is constantly evolving, keeping up from a maintenance and operational perspective is sometimes difficult.”

However, EVcharge has the solution:

“With data and knowledge, we find smart solutions that address all these problems.”

How to encourage more people to embrace electromobility?

There’s no doubt that chargers on the roads are essential.

However, in several European countries around 65% of cars are parked overnight on the street—because users live in buildings—curbside charging also plays an important role.

“We must not forget urban centers,” says Pérez.

Installing stations in these areas will ensure that future EV drivers will have a place to charge their batteries.

Finally, the Sales Manager highlights convenience and ease of use as two key factors.

“This will encourage people to use the chargers more than the price per kilowatt,” he concludes.

Read more:

-

Tritium reveals: What are CPOs in the UK looking for – and how to deliver it?

The UK sets specific standards for charging infrastructure that CPOs must meet. Kevin Pugh from Tritium explains how the firm adapted to these rules and met CPO requirements.

-

EU launches Clean Transport Corridor to boost electric HGV charging rollout

The Initiative seeks to accelerate the deployment of heavy-duty vehicles recharging infrastructure across key freight corridors. Where will it start?

-

CATL launches EU battery with 750 km range and over 1 million km lifespan

CATL claims this version will last for 12 years or one million kilometres, representing a radical shift in the EV sector.