For over 17 years, Tridens has been driving innovation with billing and charging solutions for electric vehicles (EVs), establishing itself as a key partner for operators in the rapidly growing e-mobility sector.

Now, Landis+Gyr’s decision to close its EV charging business operations in Europe, the Middle East, and Africa (EMEA) has created a strategic opportunity for companies like Tridens, which are looking to attract charge point operators (CPOs) who are being forced to migrate their systems to avoid disruptions.

“Short-term decisions do not build lasting businesses. At Tridens, we take a different approach. We don’t seek quick results, but instead focus on a long-term vision,” says Aleš Pristovnik, CEO of the company.

The truth is that Landis+Gyr’s exit has created uncertainty within the electric charging ecosystem.

This is why CPOs who relied on their platform began looking for alternatives that could ensure operational continuity, scalability, and compliance with international technical standards.

“That’s why we prepared ourselves to help clients migrate to our system,” explains Žiga Lesjak, CMO at Tridens.

It is in this context that Mobility Portal Europe spoke with Lesjak to understand how they are working on this transition process, what solutions they offer, and what their global goals are moving forward.

Tridens EV Charge: A Solution Shaping the Future of EV Charging

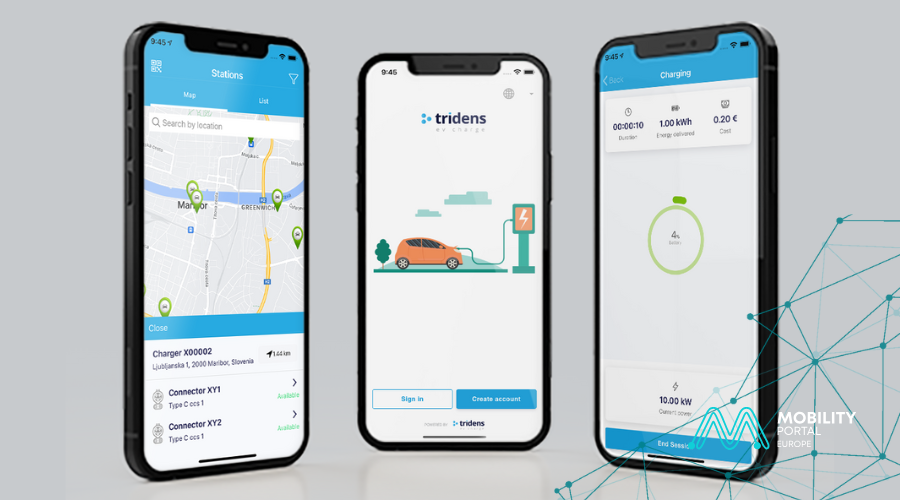

One of the company’s key tools is called Tridens EV Charge.

It is an all-in-one electric vehicle charging software solution for CPOs and e-mobility service providers, which is cloud-based.

This platform connects all elements of the ecosystem to streamline operations and accelerate market entry.

The solution is designed for a diverse range of customers, including EMSPs, CPOs, EVSPs, EV fleets, automotive companies, and manufacturers.

“Our platform is flexible, customisable, complies with international standards, and we are integrating AI to offer smarter solutions. This sets us apart,” explains Lesjak.

Tridens supports all B2C, B2B, and B2X business models, offering a versatile, white-label solution that is hardware-agnostic.

“It supports private, public, and fleet models,” assures the company representative.

Next Steps: Seeking New Clients

Tridens plans to strengthen its global positioning in 2025 by participating in international fairs such as Power2Drive, the International Exhibition for Charging Infrastructure and E-Mobility, which will take place from 7th to 9th May in Munich.

By participating in such events, the company aims to forge strategic partnerships and acquire new clients.

“This year, we want to build our presence,” acknowledges Lesjak.

He continues, “And, of course, we are looking to gain new clients. Retail companies and service stations are our target customers.”

Migration from Shell Sky to Tridens EV Charge

Although Tridens is based in Slovenia, its solutions are available worldwide, including in Europe, North America, Latin America, and the Middle East.

Currently, the company has more than 100 clients globally, including prominent players such as Siemens, BYD, ABB, Shell, and NLX.

It is worth mentioning that Shell Recharge has announced that it will cease operations of its Shell Sky platform, a CPMS for third-party EV chargers in the US and Canada, with the platform shutting down on 30th April 2025.

This decision aligns with Shell’s strategy to expand its own public charging network rather than support third-party networks.

In this context, those using Shell Sky must transition to a new platform before the deadline to ensure uninterrupted service.

Tridens’ platform offers a seamless alternative.

“Tridens EV Charge is compatible with over 400 EV charger models, including ABB, Autel, Tritium, Wallbox, Zerova, and many others,” says Lesjak.

The fact that both Tridens EV Charge and Shell Sky use OCPP ensures a smooth migration for most clients.

READ MORE

-

Atlante y su “modelo híbrido”: generación, almacenamiento y recarga ultrarrápida para un sistema más resiliente

Atlante acelera su despliegue en España y en diálogo con Mobility portal, Inés Mackey, Chief of Staff de Atlante Iberia define las prioridades de la empresa y su apuesta por la interoperabilidad de la mano de Charge League.

-

Spain Auto 2030: a point-by-point look at the plan set to redefine the eMobility landscape

Spain has entered a new phase in its industrial strategy for electric mobility. The Government has unveiled Spain Auto 2030, a roadmap designed to mobilise €30 billion over the next five years, reshaping the centre of gravity of the electric vehicle market through fresh incentives, a centralised management model, targeted investment in charging infrastructure and…

-

EMT Madrid licita 120 nuevos buses eléctricos: inversión de 79,35 millones y entregas entre 2026-2027

Con esta incorporación, Madrid refuerza su estrategia de descarbonización y consolida una de las flotas eléctricas urbanas más grandes de Europa.