The exclusion of N1 vehicles from the new “NaszeAuto” subsidy programme is raising concerns within Poland’s electric mobility ecosystem.

The current scheme, exclusively targeting M1 units and launched on 3 February 2025, establishes a maximum subsidy of 40,000 PLN.

However, the President of the Polish Association for New Mobility (PSNM), Maciej Mazur, warns that without incorporating the N1 category, the allocated fund “will be difficult to exhaust.”

“Our analyses clearly show that the budget allocated to this scheme is virtually impossible to utilise in its entirety,” it affirms in the webinar “Regulations and Operation of Heavy Electric Transport Support Programmes.”

The sector anticipated that the previous programme, “Mój Elektryk,” would remain active to support the acquisition of N1 vehicles.

Nevertheless, the new public policy altered the scope of eligible beneficiaries.

“Instead, we have received the ‘NaszeAuto’ programme, which solely includes the M1 category. Without a doubt, we will advocate for the inclusion of the N1 category in the scheme,” states Mazur.

He further explains: “I believe it is more feasible for this to happen within ‘NaszeAuto’ rather than in the support programme for N2 and N3, accompanied by an evaluation of the budget allocated.”

At present, the subsidies are directed towards individuals and sole proprietors acquiring new, previously unregistered M1 units with a net value below 225,000 PLN.

Beyond the base amount, additional bonuses are considered for scrapping old combustion vehicles and for lower-income applicants, as well as benefits for large families.

PSNM asserts that the programme’s design is restrictive.

Consequently, the organisation proposes a revision of the current framework to expand its coverage to N1 vehicles, at the very least while maintaining the existing groups of beneficiaries.

From an operational perspective, the incentive provides up to 18,750 PLN for individuals, with increases reaching 40,000 PLN if combined with bonuses for scrapping and income levels.

In the case of leasing, support may amount to 30,000 PLN, extendable under similar conditions.

Nonetheless, the programme excludes commercial enterprises, a decision that has drawn criticism from the business sector, as these entities account for the majority of new vehicle registrations.

“The new programme will not lead to market advancement,” the Polish Association for New Mobility warns in a statement.

Furthermore, it explains: “Restricting the number of beneficiaries will negatively impact the efficiency of the grant market in the form announced.”

The structural issue is further exacerbated by the fact that the N1 category constitutes a significant volume within Poland’s electric ecosystem.

These units, commonly employed for light commercial and logistical activities, are necessary for electrifying last-mile delivery.

“Continuing to include the N1 category would undoubtedly make a substantial difference. We deeply regret its unavailability in 2025,” Mazur emphasises.

Poland expands charging infrastructure with 4 billion PLN investment

The National Fund for Environmental Protection and Water Management allocated four billion PLN to develop charging infrastructure for N2 and N3 vehicles.

This funding also aims to expand high-power electrical networks.

The call for applications opened on 31 March and will finance projects located along the TEN-T network, in logistics centres, and at intermodal terminals.

Within this context, Mazur acknowledges: “The implementation of these programmes is a significant step towards accelerating the electrification of heavy transport.”

However, he insists that securing funding for the purchase of N2 and N3 vehicles, scheduled for the second quarter of the year, is equally pressing.

The electric truck programme provides a subsidy covering up to 60% of eligible costs for small enterprises, 50% for medium-sized businesses, and 30% for large corporations, with a ceiling of 750,000 PLN per N3 vehicle.

Although this is a robust scheme, N1 units remain excluded from any of the planned incentives.

According to PSNM, Poland leads heavy transport within the European Union, accounting for 20% of the bloc’s logistical operations, with over 100,000 road transport companies.

However, the number of electric trucks remains low, with only 100 units registered.

At the continental level, 7,516 electric trucks were registered in 2024, representing 2.3% of vehicles exceeding 3.5 tonnes.

READ MORE

-

Strategy for CPOs: how to take EV driver charging experience to the next level

As EV sales rise and public networks grow, the charging experience becomes key. Like petrol stations, EV hubs add services to boost value — that’s why leading OEMs and CPOs partner with 3M.

-

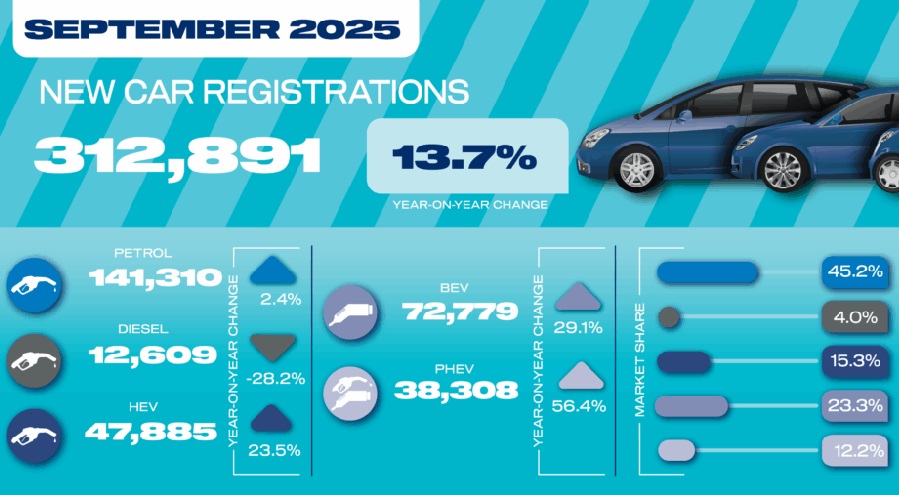

BEVs in the UK hit record monthly high with 72,779 units sold in September

September was the first month in which manufacturer discounts, an expanding range of models, and the introduction of the UK’s Electric Vehicle Grant significantly boosted registrations of BEVs.

-

Electrificación de flotas y rentabilidad: conoce a los protagonistas del nuevo debate eMobility

Bajo registro gratuito, el 15 de octubre (15 h, Madrid) Mobility Portal España reúne a referentes para optimizar TCO y recarga inteligente en flotas a gran escala, con estrategias y casos reales.