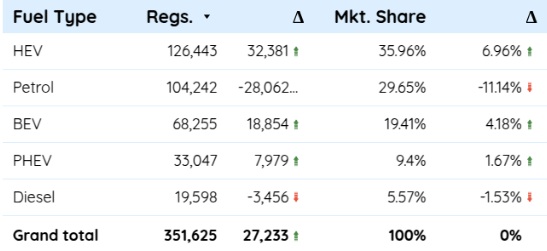

The United Kindom (UK) broke a new record for the number of electric vehicles (EVs) registered in a single month: 68,000, more than 20% higher than the previous record set in September 2024

March saw BEV car registrations grow in line with the other months of this year, by 38% (up by 18,500 units).

This is approximately in line with the kind of growth that will be required to meet ZEV mandate targets.

This was driven by significant growth in EV registrations from manufacturers Volkswagen, whose registrations grew by over 200% in Q1.

BYD also saw significant growth, with Q1 sales increasing 350% to 5,235.

Taking into account their plug-in hybrid registrations, in Q1 they exceeded their total sales over the whole of 2024.

That completed a winning Q1 for EVs, which saw the UK register more BEV cars in three months than Norway did in the whole of 2024.

This came despite a slowdown in E-Mobility market leader Tesla’s sales, which stood still in March, growing only slightly over the whole quarter.

ZEV mandate update

The estimated real ZEV sales target – the headline ZEV mandate target for 2025 is 28%.

But firms generate additional credits by exceeding CO2 emissions targets on their ICE vehicle sales (including hybrids and plug-in hybrids).

New Automotive says, “we calculate the real target – 22.74% – by estimating the number of credits that each manufacturer is expected to generate based on the CO2 ratings of newly registered ICE cars in the year to date, using – like the rest of this bulletin – publicly available information from the DVLA.”

2025 story so far

Amongst the top 10, VW Group (including Audi, Cupra, Skoda, and VW itself) as well as BMW Group (including Mini) are in credit.

New Automotive states, “Now that the March madness in the petrol vehicle market prompted by changes to VED is subsiding, we anticipate more firms will move into credit.”

“We expect Trump’s tariffs to have limited impact on the ZEV mandate.”

The UK barely imports EVs from the US – Teslas are made in Germany and China – and new EVs are price competitive with other fuel types, so the economic damage will be seen through stagnating car sales across all fuel types.

“Tariffs don’t move the economics of driving electric, which continue to favour making the switch,” says the company.

READ MORE

-

E-Mobility milestone at Munich Airport: SBRS powers up new depot with 50 e-bus chargers

With 50 charging points delivering 120 kW each, the new Munich depot already supports 37 electric buses—soon to be scaled up to 72—setting a new benchmark for sustainable airport mobility.

-

Strategic alliance aims to boost the flexibility of smart electric vehicles in Europe

The partnership combines Voltalis’ nearly two decades of expertise aggregating flexible energy assets with Virta’s advanced EV charging platform, spanning over 120,000 charge points and more than 1,000 business customers across 35 countries.

-

ChargeLeague lanza WATT 2025 y llama a “redefinir la experiencia de carga” en Europa

El evento marca el debut oficial de ChargeLeague —nuevo nombre de Spark Alliance— y sienta las bases para una hoja de ruta común hacia la adopción masiva del vehículo eléctrico en Europa.