The development of charging infrastructure does not follow a uniform pattern across Europe.

While in some countries progress goes hand in hand with the adoption of electric vehicles (EVs), in others the market still shows signs of immaturity.

This imbalance presents strategic opportunities for Charge Point Operators (CPOs).

Entering markets where competition is lower and growth is accelerating can offer a key competitive advantage.

In this context, Mobility Portal Europe analyses the latest data from the European Alternative Fuels Observatory (EAFO), updated as of November 2024, to identify the nations with the least public charging infrastructure and the greatest development potential.

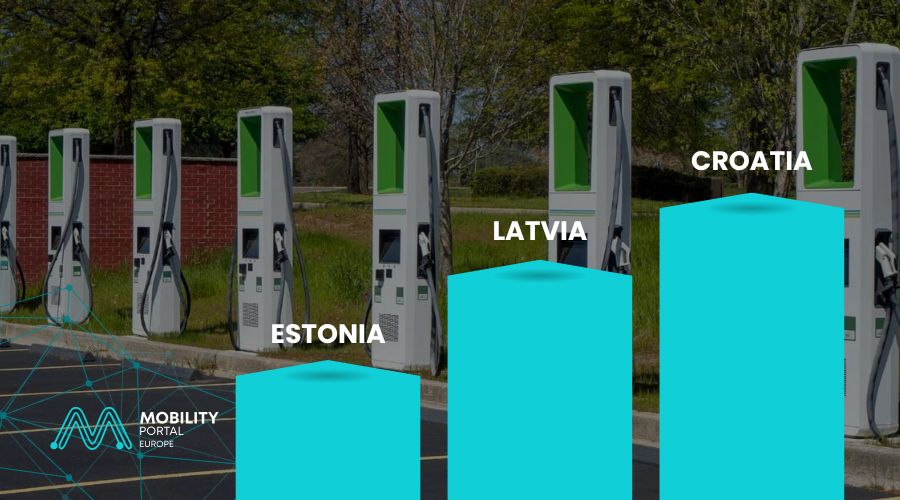

Estonia stands out as the country with the least developed infrastructure in this group, recording just 1,051 stations and a year-on-year growth of 76.94%.

Next is Latvia, which has reached 1,157 charging points and posted an impressive 116.67% increase compared to the previous year, reflecting early-stage momentum in its deployment efforts.

Croatia follows with 1839 public stations and a 71.23% annual growth rate.

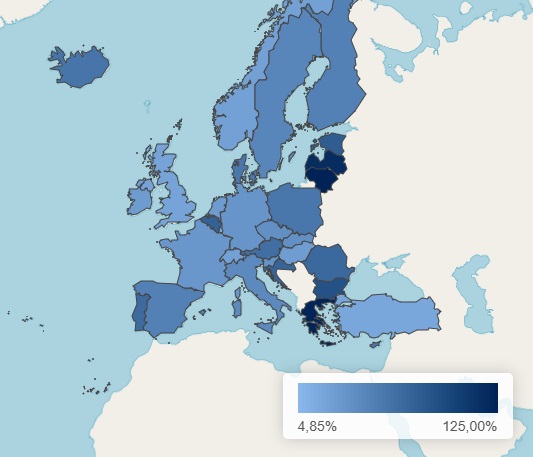

In fourth place is Lithuania with 2,947 chargers. This country registered the highest percentage growth of all: 124.45%.

This positions the Baltic state as a highly attractive market for early investment by CPOs.

Hungary remains on the list with 4,175 public charging stations, although its year-on-year growth rate is comparatively low when set against the countries mentioned earlier — just 25.87%.

Next is Czechia, with 6,359 points, which recorded a growth rate of 36.34%.

Greece is the final country in this group, with a total of 7,049 public chargers and a significant year-on-year growth rate of 122.65%.

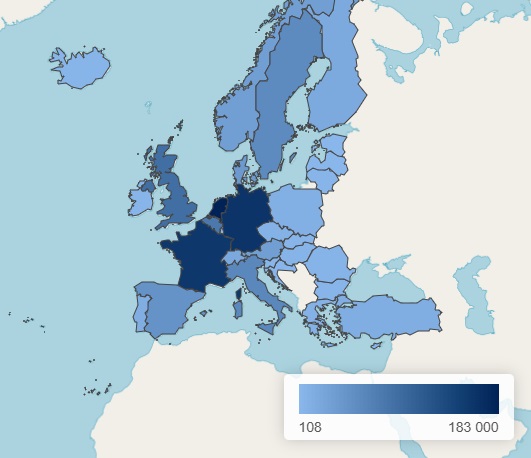

Total number of publicly accessible recharging points – Year-over-year (2024 vs. 2023) growth rate of publicly accessible recharging points.

When evaluating consolidated European markets, Germany stands out with the highest number of public charging points – 159,958 – followed by France (159,958), Belgium (76,819), and Italy (58,189).

The vast number of chargers in these countries is due to a variety of factors, including national targets, the availability of incentives, and government-issued tenders.

For example, Germany aims to reach one million charging points by 2030.

However, a large number of chargers does not guarantee success.

“We’ve observed that supply exceeds demand in the market,” stated the German Federal Association of Independent Petrol Stations (Bundesverband Freier Tankstellen – BFT) to Mobility Portal Europe.

This means that while infrastructure is expanding significantly, utilisation of these charging points remains surprisingly low.

This claim is supported by data showing that the average occupancy rate of charging stations in Germany is just 12.5%, according to the Federal Association of Energy and Water Industries (BDEW).

Usage varies by region, ranging from as low as 3% to as high as 23%, with cities such as Berlin and Munich leading in terms of utilisation.

On the other hand, it is worth noting that year-on-year growth rates in these countries are not particularly high.

The largest increase was recorded in Belgium, with a 73.16% rise.

Italy followed with 41.53%, and Germany with 32.62%.

France came in last on the list, with a year-on-year growth rate of 30.75% in its publicly accessible charging points.

READ MORE

-

UK regulates chargers but users warn: “Rules are not keeping pace with EV purchase targets”

The UK has introduced three public charging regulations and a fourth is coming, but the e-mobility sector warns they are slow to implement and still exclude key user groups.

-

“Abuse of dominant position”: Italy fines Enel X €2 million

The AGCM found that Enel X was charging a wholesale price to competing EMSPs that was so high it made it impossible for them to compete profitably with Enel’s own retail prices offered to end-users on its app.

-

EU pushes to cut tariffs on US-made cars starting 1 August

Washington will take steps to reduce the current 27.5% U.S. tariffs on cars and car parts, a huge burden for European carmakers.