Investors have welcomed the announcement following a 71% drop in the electric vehicle (EV) maker’s net profit for the first quarter of the year, which fell to 409 million dollars.

“I think starting in May, my time spent on DOGE will likely decrease significantly,” Elon Musk, CEO at Tesla, stated during a call with analysts.

He assured that he would still support the US government “to ensure waste and fraud don’t come roaring back,” but said he planned to redirect his focus to Tesla.

The South African-born billionaire mentioned he would devote one or two days a week to governmental matters “as long as President Trump wants,” but stressed his intention to prioritise Tesla’s operations, which are also being hit by new US tariffs.

Tesla’s rally was also boosted by a statement from the Chinese government on Wednesday, expressing willingness to engage in dialogue with the United States over tariffs, while urging Washington to “abandon blackmail and threats” in order to move forward with negotiations to end the trade war between the two powers.

This news lifted major US stock indices, with the Dow Jones up 2.78%, the S&P 500 rising 3.18%, and the Nasdaq climbing 4.27%.

However, Musk’s political activism has shaken investor confidence in Tesla.

The company’s stock is down 37% year-to-date, with a current market capitalisation of $815.8 billion.

Tesla’s automotive revenue stood at $13.97 billion (€12.26 billion) between January and March 2025, a 20% drop compared to the same period last year.

Overall revenue—including energy storage units and other services—fell by 9% to 19.34 billion dollars, while adjusted EBITDA dropped 17% to 2.81 billion dollars.

READ MORE

-

Strategy for CPOs: how to take EV driver charging experience to the next level

As EV sales rise and public networks grow, the charging experience becomes key. Like petrol stations, EV hubs add services to boost value — that’s why leading OEMs and CPOs partner with 3M.

-

West Yorkshire Combined Authority picks firm for £1.4m EV charging infrastructure project

The project will see the deployment of 716 EV chargers across West Yorkshire, comprising a combination of standard, fast, and rapid chargers, delivering the right mix of speeds to address multiple charging applications.

-

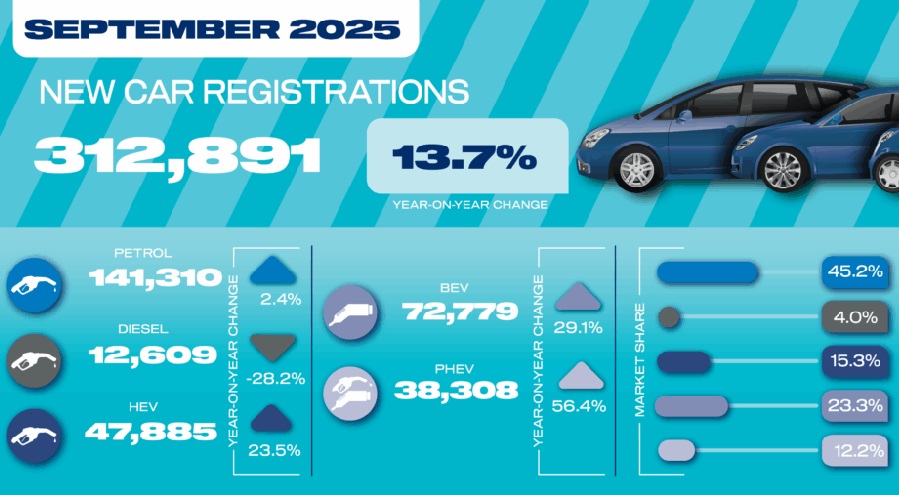

BEVs in the UK hit record monthly high with 72,779 units sold in September

September was the first month in which manufacturer discounts, an expanding range of models, and the introduction of the UK’s Electric Vehicle Grant significantly boosted registrations of BEVs.