The rapid expansion of the electric vehicle (EV) market, along with the growing diversity of brands, models, and charging standards, has put Japan’s CHAdeMO system under pressure—now reduced to a bargaining chip in talks between the US and Japan.

The issue is being debated within the framework of ongoing tariff negotiations between the two countries, as the US seeks to reduce technical barriers hampering its companies.

A lack of interoperability among charging systems is seen as a hurdle to the competitiveness of American EV manufacturers in the Japanese market.

While CHAdeMO still retains some relevance in parts of Asia, its adoption is increasingly limited across North and Latin America.

Why the US is Targeting CHAdeMO

According to a report by Nikkei Asia, Washington argues that CHAdeMO constitutes an “undue obstacle” for key American EV players like Tesla.

Although Donald Trump’s trade offensive did help bring historic rivals such as Japan and China closer, the automotive industries in both countries remain too significant to allow for easy alignment.

Japan’s Ministry of Economy, Trade and Industry currently requires EV charging stations to be CHAdeMO-compliant to qualify for government subsidies.

The Office of the United States Trade Representative stated in a March report that this requirement “discourages foreign carmakers and charging providers from operating in Japan by mandating outdated technology for subsidy eligibility.”

CHAdeMO “will likely be on the agenda” in the tariff negotiations, said Japanese minister Yoji Muto at a press conference this week.

According to the ministry, Japan had around 40,000 EV charging points as of March 2024, with a target of increasing that number to 300,000 by 2030.

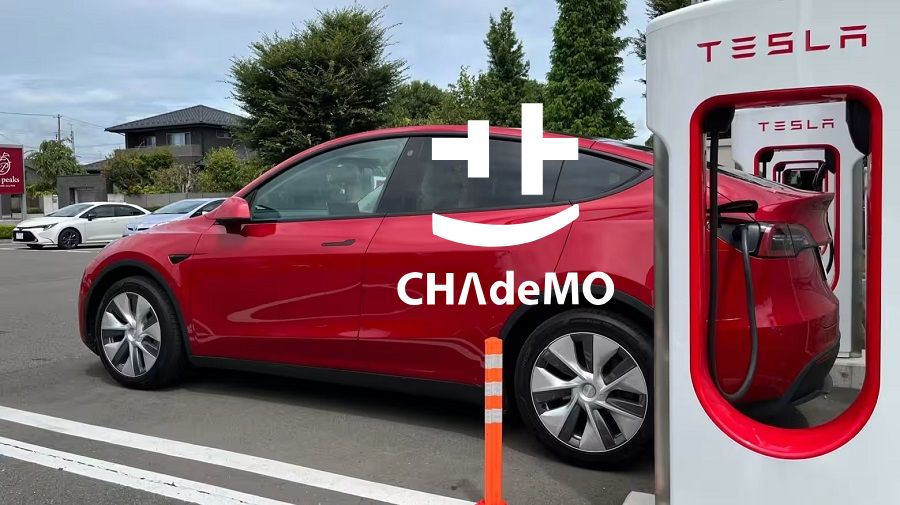

While Teslas can connect to CHAdeMO-compatible stations via a manufacturer-provided adapter, CHAdeMO vehicles cannot use Tesla’s Superchargers—Tesla currently holds around 10% of the market share.

Latin America Chooses Its Charging Standards

In Latin America, the picture is mixed.

Arturo Cravioto of Charging Depot told Mobility Portal Latinoamérica: “I believe the J1772 (Type 1) connector saw the most growth in Mexico and continues to be the most used. In 2024, we also saw significant growth of the GB/T connector (Chinese standard) with BYD’s arrival, but Type 1 remains the most popular.”

Cravioto also highlighted challenges for users: “To charge at public stations across the country, GB/T connectors require an adapter. That’s something I’ve personally criticised about Chinese brands—they don’t come equipped for the American standard.”

From a regulatory perspective, Gustavo Giménez, CEO of eMobilitas, emphasised the need for clearer rules in Mexico.

“In October, the CRE (Energy Regulatory Commission) issued a new decree to push forward regulations for EV chargers and connectors,” he said.

“But that regulation was still broad, as there wasn’t yet a clear definition of which technology Mexico would adopt.”

Giménez also advocates for North American standards to promote interoperability: “We, as experts, and many of our colleagues too, always recommend that Mexico adopt the American standard (CSS1 or J1772).”

“Why? Because we’re in North America, we receive many vehicles from the US, and our power grid is aligned with the North American system.”

In Uruguay—Latin America’s second-highest country in EVs per capita—the public charging network, with roughly 350 points, is largely dominated by the CCS standard.

“At UTE, we particularly try to ensure charge points use CCS2 and we promote that connector type. It’s true that cars can use adapters, but users generally prefer practicality,” representatives told Mobility Portal Latinoamérica.

“As users become more informed, they demand specific connectors when purchasing vehicles, so importers are bringing more CCS2 models.” Currently, only four public stations in Uruguay feature a CHAdeMO charger.

In Brazil—the largest country in the region, with just over 12,000 charging points according to ABVE—the Japanese standard still has a stronger presence, with around 100 CHAdeMO stations per Tupi Mobilidade, although many are currently out of service.

Manuel Montoya, Director of the Nuevo León Industrial Cluster, also shared his view of Mexico’s charging infrastructure with this outlet.

“The other day, I passed by a street where I used to live and saw a sign saying, ‘A Supercharger is being installed here’ (Tesla). You can now see more EVs on the streets. Affordable Chinese models have also arrived,” he commented.

“So, what comes first—the chicken or the egg? I think they go hand in hand. People are buying EVs they can charge at home, and as more such vehicles hit the road, standardisation will start to make sense.”

An Uncertain Future for CHAdeMO?

Once a pioneer in fast charging for EVs, CHAdeMO now faces an uncertain future in a global market that increasingly favours interoperability and standardisation.

Its relevance has sharply declined in recent years. In Japan, the standard still enjoys support from domestic industry. But outside the country, virtually no new electric vehicles use it.

As of 2023–2024, the Nissan Leaf remains the last mass-produced 100% electric model still using a CHAdeMO fast-charging port—though Nissan itself opted for CCS in its newest electric SUV, the Ariya.

In Europe, no new charging stations are being installed with CHAdeMO, signalling a clear retreat.

READ MORE

-

Flexecharge CEO: “The Virtual Power Plant will reach new European countries in 2025 and 2026”

Following the success of launching the world’s first VPP based on high-power public DC chargers, Flexecharge will expand to new countries, partnering with major CPOs.

-

3M launches brand initiative to transform the charging experience across EMEA

The new initiative aims to turn charging stations into visually appealing, functional, and user-friendly spaces through graphic solutions that enhance experience and safety. What’s next for 3M?

-

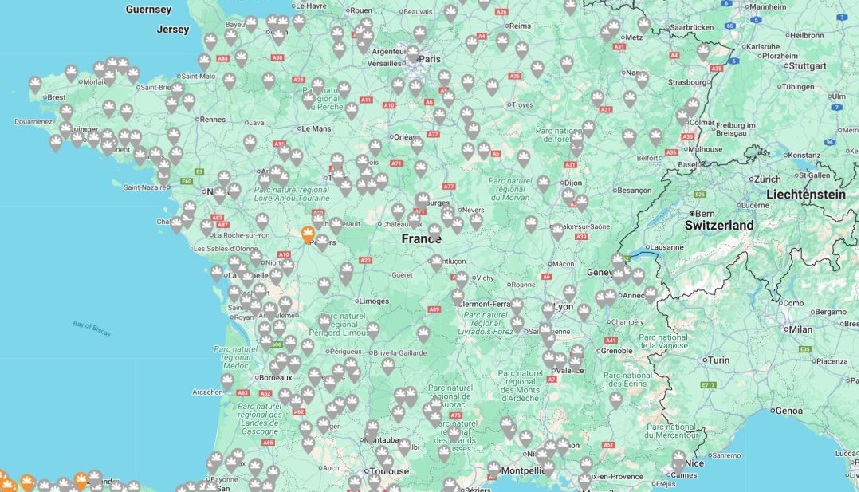

Spanish CPO partners to expand its charging network in France with 2,500 points

This marks a crucial step in accelerating its presence in France, which still lags behind in public charging infrastructure, despite over 175,000 points already in place.