As of 1 June 2025, Spain had reached a total of 46,684 public charging points, according to data from the Business Association for the Development and Promotion of Electric Mobility (AEDIVE).

“We’re now talking about a network that meets the needs of all users. There is high-power public charging across the country, making it possible to travel anywhere by electric vehicle,” said Arturo Pérez de Lucia, president of AEDIVE, during the most recent virtual summit hosted by Mobility Portal España.

The rollout, indeed, is picking up speed.

The focus is not only on DC fast charging, but also on AC deployment in urban and suburban areas, particularly within the service sector.

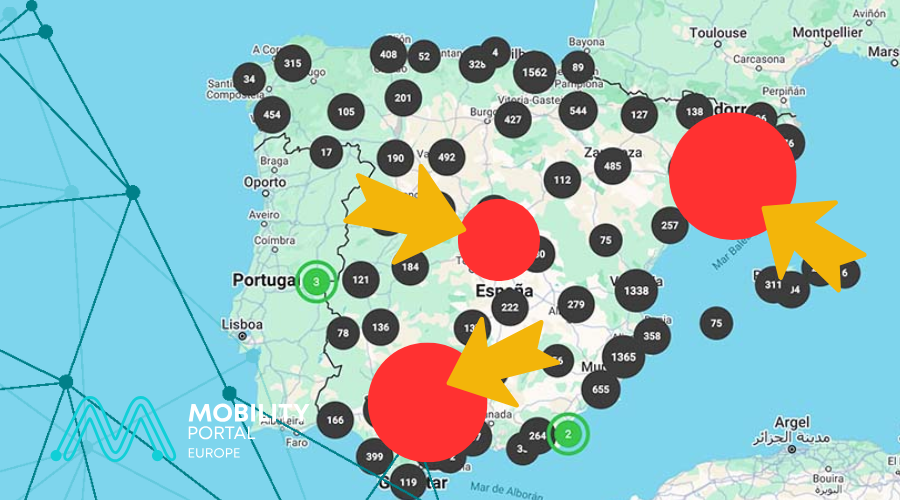

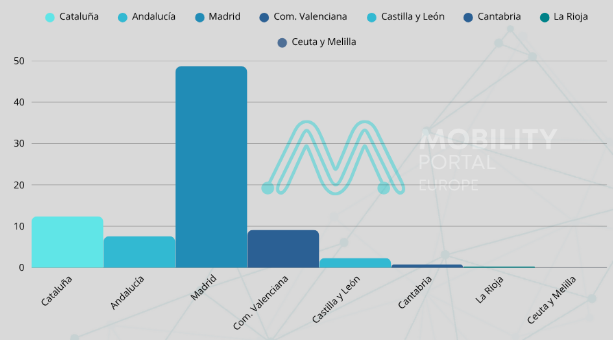

However, the distribution remains uneven: Catalonia (20.4%), Andalusia (14.2%) and Madrid (14%) together host more than half of the national infrastructure.

Yet when comparing these percentages with monthly EV registration figures, key disparities emerge between supply and demand.

The charging point data is cumulative up to the end of May, while the registration figures refer solely to the month of May 2025.

It’s important to clarify that this analysis by Mobility Portal España does not aim to measure historical saturation, but rather to highlight recent imbalances or synergies between availability and demand.

Madrid, for example, leads EV registrations with 11,462 units in May, representing 48.65% of the national total.

However, it only accounts for 14% of the charging points, which translates to 5.8 new cars per charger.

Catalonia presents a more balanced scenario: 12.4% of new EVs versus 20.4% of the infrastructure, with a ratio of 1.13 vehicles per charger.

Meanwhile, Andalusia, with 14.2% of charge points and 7.6% of registrations, records the most relaxed ratio of the three: 0.97 EVs per charger.

This could suggest that the region is well positioned for the future growth of its electric fleet.

Still, AEDIVE acknowledges the nationwide efforts made so far:

“The pace at which charging operators have moved to deploy infrastructure across Spain ensures that today, using an electric vehicle is no longer a challenge.”

Ceuta, Melilla and regions that lag behind

At the other end of the spectrum, Ceuta and Melilla together only have 17 charge points, which represents just 0.04% of the national network.

In May, both territories recorded just nine EV registrations, also 0.04% of the total.

While the matching percentages might suggest a certain equilibrium, in truth they reflect a lack of minimum scale for a self-sustaining ecosystem.

La Rioja is another outlier. Despite hosting 318 charge points (0.68%), it reported just 64 EV registrations (0.27%) that month.

In Cantabria, the contrast is similar: 761 charge points (1.63%) and 180 new vehicles (0.76%).

These cases raise questions about regional planning, incentive schemes, and the socioeconomic profile of potential users.

Despite having active infrastructure, demand still hasn’t materialised at scale.

Two speeds, one goal: avoiding bottlenecks and empty zones

The data confirms that electric mobility progresses at different speeds across Spain.

Some regions show a virtuous correlation between infrastructure and adoption. Others are struggling to align investment with actual use.

Madrid, for instance, could soon face network stress and negative user experiences, due to high demand and limited infrastructure.

Conversely, La Rioja and Cantabria have networks that are underutilised, calling into question the efficiency of investments made.

“The ideal approach is coordinated planning between public authorities and the private sector, taking into account both the growth of the EV fleet and actual usage patterns,” industry sources explain.

Avoiding these two extremes—overloaded zones versus underused ones—is crucial to ensure a functional, accessible and fair energy transition.

How is Spain’s national eMobility landscape evolving?

As mentioned earlier, Spain has surpassed 46,000 public charge points—a key milestone in the country’s EV infrastructure rollout.

As of 1 June 2025, AEDIVE’s latest figures show 46,684 operational chargers, reflecting a 2.9% increase compared to the end of 2024.

At first glance, this may seem like modest growth, but a closer look reveals a more significant shift: the real transformation lies in power and capacity.

While low-power chargers (particularly those below 22 kW) are growing slowly or levelling off, high-power units are driving the real change.

Between January and June 2025:

• Charge points between 50 and 250 kW increased by 60.86%

• Ultra-fast units above 250 kW rose by 38.86%

• Fast chargers between 22 and 50 kW also grew by 22.89% in just five months

This trend points to a clear commitment to infrastructure that supports long-distance travel, faster charging and reduced wait times.

Explore Mobility Portal Data

Mobility Portal Data is a new, exclusive market intelligence platform offering trusted data and key insights to support smarter decision-making across the automotive sector—spanning both combustion and electric vehicles, as well as charging infrastructure.

From in-depth research and trend analysis to organised statistics and real-time updates, everything is just a click away.

With Mobility Portal Data, smart decisions are within reach.