According to the latest AVERE report, France now counts 169,106 publicly accessible charging points. This marks a 27% growth over the past 12 months.

With 249 charging points per 100,000 inhabitants and a 95% immediate access rate, the network is among Europe’s most extensive and accessible.

Thanks to massive deployment efforts, nearly all highway service areas are now equipped with ultra-fast chargers. This transforms traditional fuel service zones into key hubs for electric mobility.

Meanwhile, expansion has shifted towards smaller rest areas to ensure full network continuity across the territory.

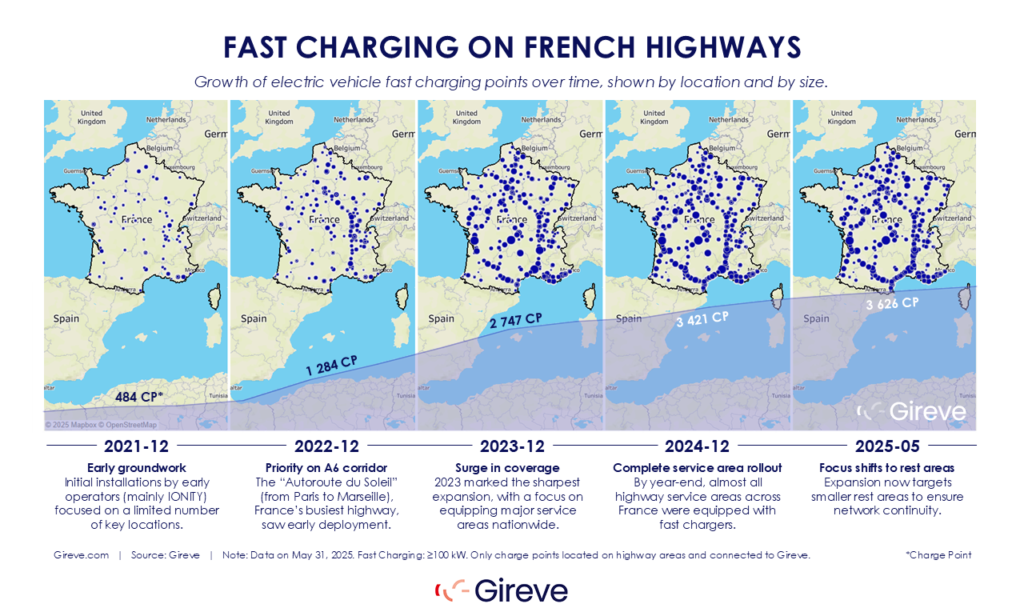

Motorways fast charging timeline in France

The deployment of fast-charging points along French motorways has followed a clear and structured trajectory, as illustrated in the visual above.

At the end of 2021, the network counted 484 charging points. These were mainly installed by early operators such as IONITY, focusing on a limited number of strategic locations.

By December 2022, deployment prioritized the A6 corridor (“Autoroute du Soleil”), one of France’s busiest motorways. This pushed the total to 1,284 devices.

In 2023, the network saw its most rapid expansion. Major service areas across the country were equipped, reaching 2,747 charging points by year-end.

This evolution led to near-complete coverage of all motorway service areas by December 2024, with 3,421 devices in operation.

Since early 2025, attention has shifted towards equipping smaller rest areas. This ensures full continuity of service across the network.

As of May 2025, the total stands at 3,626 charging points.

Highways now represent around 15% of France’s total fast-charging infrastructure.

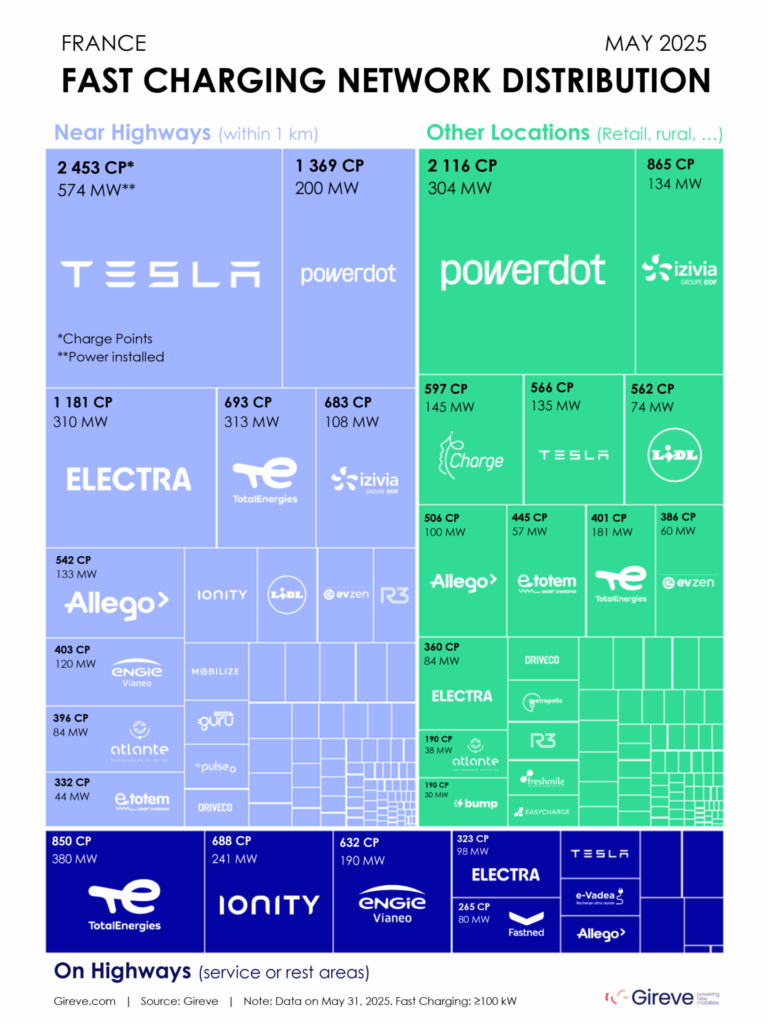

Overview of key market players

On French motorways, TotalEnergies leads the market in both the number of charging points and power installed. Its investment shows a strategy of transition from fossil fuels to electricity.

IONITY and Engie follow closely. Both secured early deployments via tenders and partnerships, especially in the initial expansion phases from 2021 to 2023.

In the “near highway” segment, Tesla remains the market leader. Its longstanding strategy builds near motorway exits, free from public tenders and optimized for direct land acquisition.

This has proven effective in providing reliable, high-speed charging access for its customers.

Outside the motorway and near-highway zones, Powerdot dominates other locations such as retail parks and large urban sites.

Notably, the company also ranks second in the “near highway” category. Its widespread network is designed to capture both local and transient EV demand.

READ MORE

-

MPD: Madrid y Cataluña captan 35% de ventas de vehículos electrificados y agotan fondos MOVES

Un análisis de Mobility Portal Data expone el dominio territorial del mercado eléctrico y el agotamiento de ayudas en las dos principales ciudades de España.

-

Qwello y Remo lideran instalación de 50 puntos de recarga en Córdoba

El contrato contempla un plazo de ejecución de 15 años e incluye no solo la instalación de los equipos, sino también su mantenimiento y explotación.

-

Alphabet alerta: “Una de cada diez empresas conoce las ayudas para la movilidad eléctrica”

La falta de una estrategia clara sigue siendo un obstáculo para la sostenibilidad de la movilidad corporativa, ya que un 43% de las compañías españolas todavía no ha fijado objetivos de reducción de CO2 para sus flotas.