With over 2.5 million electric vehicles (EVs) on German roads, exponential growth is expected, reaching 8.5 million units by 2030.

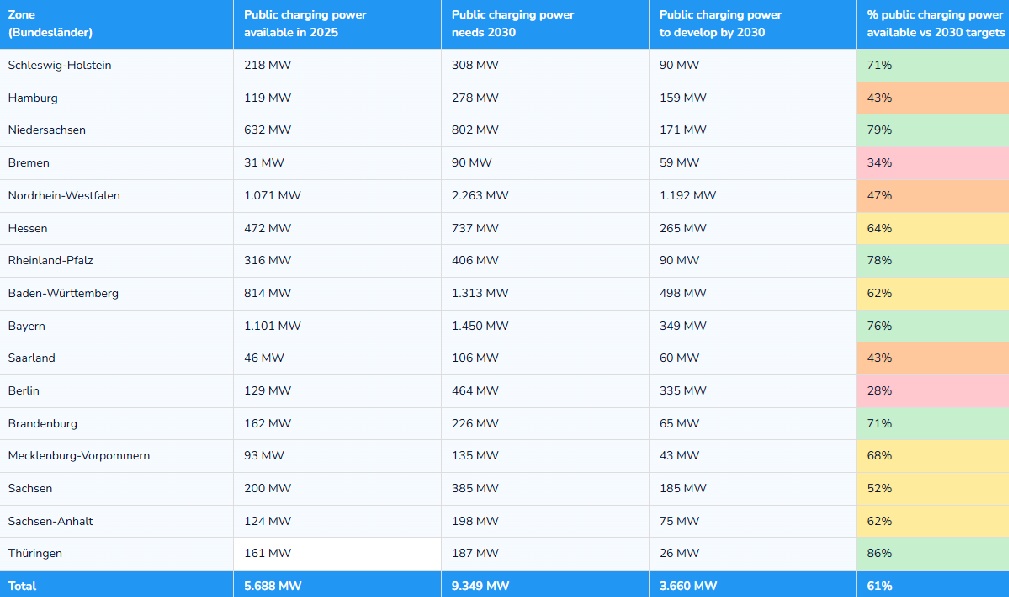

To support this progress, the country must increase its public charging capacity from the current 5.7 GW to 9.3 GW within the next five years.

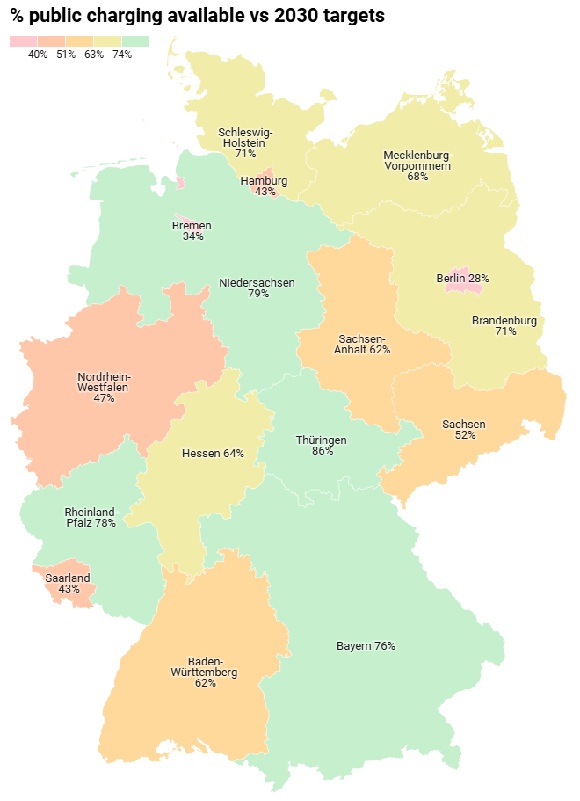

According to the ChargePlanner’s report, Germany currently covers 61% of the charging power required for 2030.

Moreover, available capacity varies significantly across different regions.

In this context, although the charging landscape is evolving rapidly—with a growing number of providers and greater available power—there are still opportunities to refine the network and meet future demand.

Which German regions are closest to meeting the 2030 targets?

Some regions stand out for their remarkable developed capacity.

Thuringia, with 161 MW of public charging power, is the closest to meeting its 2030 targets, already reaching 86% of the goal. It is expected to require 187 MW by then, meaning only an additional 26 MW is needed.

Lower Saxony follows, with 632 MW, covering 79% of its target. To reach the full 802 MW required, it needs to increase its capacity by 171 MW.

In third place is Rhineland-Palatinate, which has already achieved 78% of its goal with 316 MW available. It needs to add 90 MW to meet the projected 406 MW.

Bavaria ranks fourth with 1,001 MW available, reaching 76% of its target. To meet the established 1,450 MW, it must increase by a further 349 MW.

Brandenburg and Schleswig-Holstein are competing for fifth place, both reaching 71% of their goals.

Brandenburg currently has 162 MW available and needs to add 65 MW to meet its 226 MW target, while Schleswig-Holstein has 218 MW and must increase by 90 MW to reach the projected 308 MW.

Although these regions are making strong progress, there is still room to refine the network and optimise pricing—helping to maximise return on investment without unnecessary expansion.

Which regions still have significant development potential?

Berlin is the most lagging region. With 129 MW of public charging power available in 2025, it will need to reach 464 MW by 2030—requiring an increase of 335 MW. Currently, it has achieved only 28% of its target.

Bremen also faces significant challenges. It currently has 31 MW but will need 90 MW by 2030, meaning a 59 MW increase. So far, it has met just 34% of its target.

Saarland and Hamburg, while making progress, remain far from fully meeting their goals.

Saarland currently has 46 MW available, but will need 106 MW by 2030—an increase of 60 MW—achieving only 43% of its target.

Hamburg, meanwhile, has 119 MW and will need to reach 278 MW, requiring a 159 MW boost. Like Saarland, it has achieved 43% of its goal.

Finally, North Rhine-Westphalia has reached 47% of its target, with 1,071 MW currently available. However, it must expand to 2,263 MW by 2030—an increase of 1,192 MW.

About ChargePlanner

The software predicts the usage of new charging points based on up-to-date market data and artificial intelligence.

By leveraging these datasets, their predictive models allow users to test potential locations to identify key hotspots across Europe.

For instance, the software considers factors such as traffic on specific road segments, the number of visitors at nearby points of interest, local residential potential, competitor data, and nearby competitors’ pricing.

Currently, ChargePlanner helps around 20 major charging point operators (CPOs) in Europe make informed investment decisions as they can pinpoint the most profitable locations with maximum car passage, visibility, accessibility, minimal competition and optimise their prices at existing locations.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away.

With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

Atlante y su “modelo híbrido”: generación, almacenamiento y recarga ultrarrápida para un sistema más resiliente

Atlante acelera su despliegue en España y en diálogo con Mobility portal, Inés Mackey, Chief of Staff de Atlante Iberia define las prioridades de la empresa y su apuesta por la interoperabilidad de la mano de Charge League.

-

Spain Auto 2030: a point-by-point look at the plan set to redefine the eMobility landscape

Spain has entered a new phase in its industrial strategy for electric mobility. The Government has unveiled Spain Auto 2030, a roadmap designed to mobilise €30 billion over the next five years, reshaping the centre of gravity of the electric vehicle market through fresh incentives, a centralised management model, targeted investment in charging infrastructure and…

-

EMT Madrid licita 120 nuevos buses eléctricos: inversión de 79,35 millones y entregas entre 2026-2027

Con esta incorporación, Madrid refuerza su estrategia de descarbonización y consolida una de las flotas eléctricas urbanas más grandes de Europa.