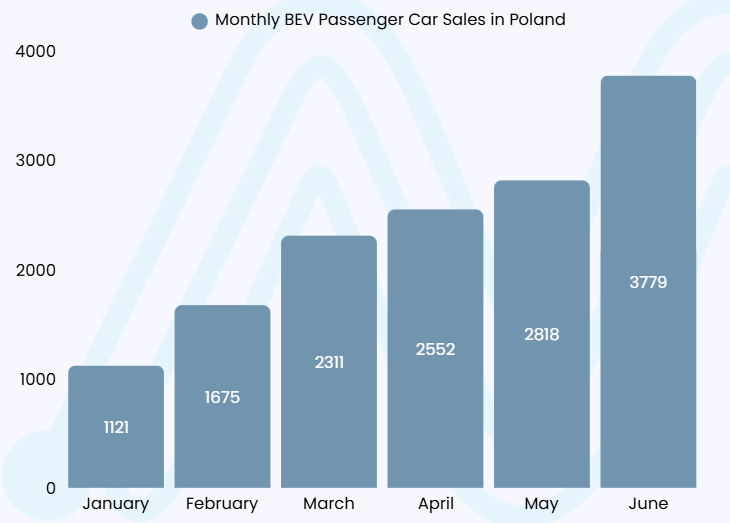

Poland’s automotive market closed June with historic figures: 3,779 fully electric passenger cars were added to the vehicle fleet, representing a 79% increase compared to the same period last year and a new record market share of 7.6%.

The data analysed by Mobility Portal Europe and provided by the Polish Automotive Industry Association (PZPM) reflect a sustained acceleration in the adoption of clean technologies, driven by government incentives, a wider range of available models, and the consolidation of Asian brands in the local market.

“Thanks to the NaszEauto programme and the very strong electric vehicle (BEV) offering, we estimate closing the year with over 25,000 units sold,” says Jakub Faryś, President of PZPM.

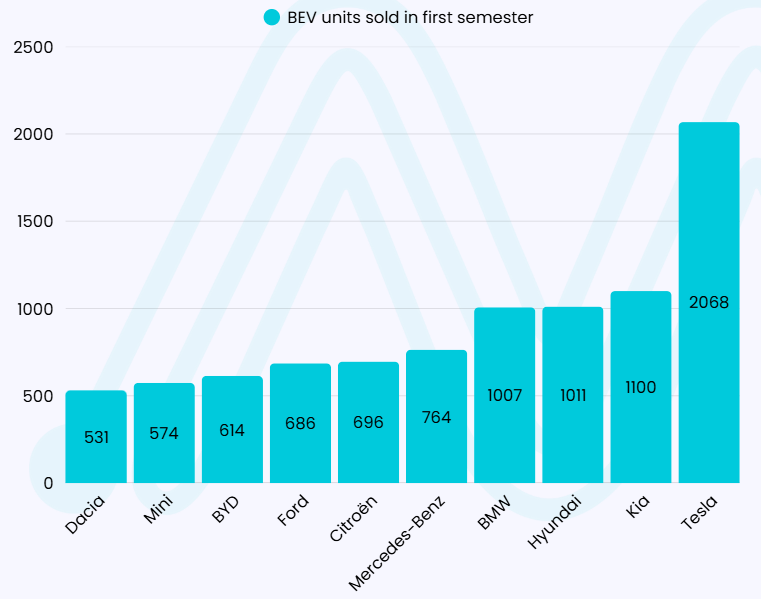

Tesla leads the model rankings with the Model Y and Model 3, topping the half-year chart with 1,204 and 851 units, respectively.

Despite holding the top spots, both models show a year-on-year decline in commercial performance.

The Citroën ë-C3 ranks third with 538 units registered, followed by the Dacia Spring (531) and the Kia EV6 (476).

Among manufacturers, BYD shows the most significant surge: from 21 units in the first half of 2024 to 614 in the same period this year, marking a 2,823% increase.

Double-Digit Growth in the First Half

Between January and June, Poland recorded 14,256 battery electric cars, a 61% year-on-year increase.

This pace positions the country among the most dynamic within the European bloc.

The penetration of Chinese brands has been key, according to PZPM.

New players such as BYD and MG expanded the availability of affordable models, while traditional manufacturers intensified their commercial strategies to meet the European Union’s emissions reduction targets.

The Rise of Plug-in Hybrids

Plug-in hybrid vehicles (PHEVs) also posted strong figures.

In June alone, 2,652 units were registered—an 85% increase compared to the same month in 2024.

In the first half of the year, total PHEV registrations reached 13,500 units, with an 80% increase.

Notable models include the Toyota C-HR, Volvo XC60 and BYD Seal U, underscoring the popularity of electrified SUVs.

Conventional hybrids (HEV and MHEV) continue to lead.

Nearly 139,000 units were registered during the half-year, although there are signs of a slight deceleration in their adoption rate.

Growing Emerging Segments

The electric two-wheeler sector continues its upward trend in Poland.

In June, 405 electric motorcycles and mopeds were registered—up 19% year-on-year—bringing the half-year total to around 1,700 units.

Hydrogen vehicles are beginning to gain ground.

June ended with seven fuel cell electric vehicles (FCEVs) buses registered and a cumulative half-year total of 121 vehicles across buses and passenger cars.

As for zero-emission commercial vehicles, 178 units were added in June, reflecting a growth of nearly 20%. However, the half-year balance shows a slight drop of 3%, with 826 units registered.

The heavy-duty truck segment remains lagging, with just 55 registrations so far this year—a decline of over 40%. The recent implementation of a subsidy programme for N2 and N3 category units could help reverse this trend in the coming months.

What Lies Ahead for the Second Half?

Poland’s electric mobility ecosystem is establishing itself as one of the most active in Central Europe.

This growth is taking place alongside political signals aimed at deregulating and revitalising the sector.

Since returning to office, Prime Minister Donald Tusk has promoted measures to streamline administrative processes and attract investment, including in charging infrastructure and sustainable transport.

Although proposals such as the UDER 53 package have not yet been approved, they point in a clear direction: removing regulatory barriers to accelerate the development of clean technologies.

In this context, initiatives like NaszEauto and dedicated funding for heavy transport are expected to continue delivering positive outcomes throughout the remainder of the year.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away. With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

Possible bankruptcy? JLR cyberattack halts production and threatens UK EV sector

The cyber incident forced JLR to halt production for almost two months, a decision that resulted in costs of £1.9 billion. However, experts warn that the reported losses “may represent only a fraction of the total damage.”

-

France installs world’s first motorway capable of recharging EVs while they drive

The pilot project, called Charge as you drive, covers 1.5 kilometres of the motorway. Beneath the asphalt are coils that transmit energy to vehicles fitted with a special device to receive it.

-

Asociaciones europeas respaldan a Francia y España en la revisión del reglamento de CO₂

El claro reconocimiento por parte de los Gobiernos francés y español de que “el futuro del automóvil europeo será eléctrico”, pocas semanas después de declaraciones similares de la presidenta de la Comisión Europea, llega en un momento clave.