France continues to push forward with transport electrification.

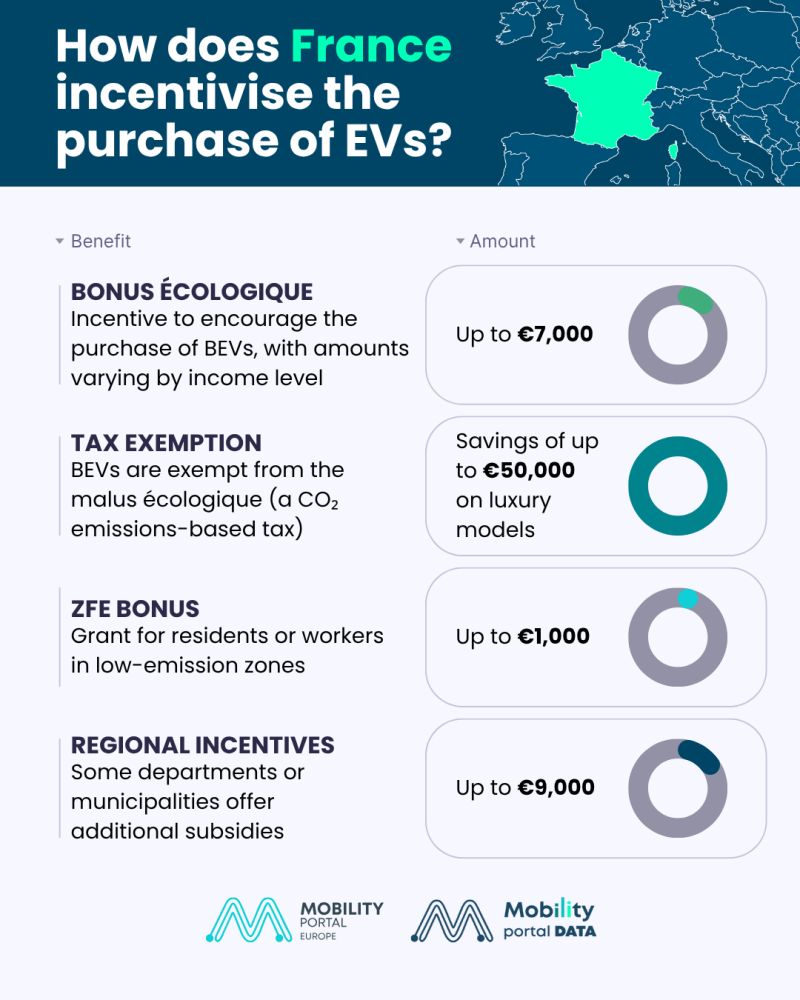

In a recent statement, the Government confirmed that the Bonus Écologique will remain in place, albeit with major restructuring.

Although the fund allocated to the ecological bonus — set by the 2025 Finance Act — has been depleted, the scheme is reinforced through Energy Saving Certificates (Certificats d’Économie d’Énergie, or CEE), a system already in use at various French dealerships.

This reform allocates up to 4,200 euros to households in the first five income deciles, while those with higher earnings can access a 3,100 euros grant.

Despite the restructuring, vehicles ordered before 1 July 2025 remain eligible for the bonus, provided delivery is completed before 30 September 2025.

“Since 2020, the Government has supported the acquisition of 1.3 million electric vehicles via the ecological bonus, totalling 5.6 billion euros,” the statement reads.

Regional incentives boost eMobility

France does not limit its incentives to the national level: several regional schemes are also in place to support electric vehicle (BEV) adoption.

Key regions offering financial support include Île-de-France, where subsidies can reach up to 9,000 euros depending on vehicle type and applicant income.

In Normandy, grants of up to 2,500 euros are available for BEVs priced below 40,000 euros.

Meanwhile, Auvergne-Rhône-Alpes allocates up to 5,000 euros for SMEs and local communities.

In Occitanie, incentives cover up to 30% of the cost of a used BEV, capped at 4,000 euros.

Lastly, the PACA region offers a 50% subsidy for renewable energy systems and BEV-related infrastructure, reinforcing the shift toward sustainable transport.

Social Leasing relaunched

Another key update is the relaunch of Leasing Social, scheduled for September 2025, targeting low-income households — particularly those with a reference tax income (revenu fiscal de référence, RFR) of up to 15,400 euros.

The programme will allow families to lease electric cars for three years or more, with monthly payments capped at 150 euros and a government contribution of 6,000 euros or 16% of the vehicle’s total cost.

This initiative aims to facilitate the transition for low-income groups and promote wider adoption of cleaner technologies.

Exemption from the malus écologique and other tax benefits

The malus écologique — a tax based on CO₂ emissions from combustion-engine cars — has been entirely removed for BEVs.

This is one of the main attractions for buyers, as it represents significant savings, especially for high-end models where the tax can reach 50,000 euros.

Moreover, fully electric vehicles remain exempt from the annual circulation tax in most regions, further strengthening the economic case for electrification.

What about incentives for businesses?

Companies in France also benefit from various measures aimed at transitioning their fleets.

The Benefit in Kind (BIK) tax relief — which reduces tax on company cars — will be maintained at 50% until 31 December 2025, with an annual cap of €1,800.

This benefit also applies to home EV chargers provided by employers, under the same financial limit.

Additionally, companies may access the Green Investment Tax Credit (Crédit d’Impôt à l’Investissement Vert, C3IV), which enables them to recover between 20% and 40% of their investment in electrification projects, depending on the region.

Charging infrastructure: the role of CEEs and public charge points

In France, the roll-out of charging infrastructure is partly funded through Energy Saving Certificates (CEE), which support the installation of chargers both in private homes and public areas.

The CEE scheme allows users to receive financial assistance for EV charger installation, helping expand the infrastructure needed for sustainable electric mobility.

Furthermore, although the standard VAT rate of 20% applies to the purchase of BEVs, reduced VAT rates are available for charger installations.

VAT is reduced to 5.5% for dwellings over two years old, 10% for older buildings, and remains at 20% for new constructions. For businesses, VAT on the purchase of professional BEVs and on electricity used for commercial purposes is deductible.

The French Government has allocated €268 million for the period 2024–2027 to deploy public charging points, with a particular focus on fast and ultra-fast chargers.

This effort aligns with the national goal of reaching 400,000 public charging points by 2030 — a key milestone to meet growing EV demand.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away.

With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

Top 5 EV charging infrastructure projects that moved the needle in the UK last month

The UK is progressing with various charge point installation projects, backed by both private investment and public funds. Which companies led infrastructure expansion last month?

-

Allego and HORNBACH to build 160+ fast chargers at 20 DIY stores in the Netherlands

From this project, 20 fast-charging hubs will be built. Considering grid congestion, Allego is combining charging stations with battery storage and smart load balancing.

-

Edison Next equips DHL Express sites in Italy with over 100 charging points

Edison Next was responsible for the design, supply, installation and commissioning of the infrastructure and will manage both routine and extraordinary maintenance throughout the 3-year contract period.