Founded in 2007, VISPIRON has grown by diversifying its operations into sectors such as electric mobility and renewable energy. Today, all of its business units operate in an integrated manner under the same corporate group, enabling efficient coordination across different technological areas.

In the charging sector, VISPIRON acts as a charging point operator (CPO) as a service, with stations currently installed in Germany.

However, Tizian Luciani, Business Development, reveals to Mobility Portal Europe that the company is planning to expand across the continent.

“We are currently positioning well in the German market. Southern Europe is an attractive market for us,” Luciani states.

The company’s preferred locations for infrastructure deployment include high-traffic motorways and large car parks in commercial zones.

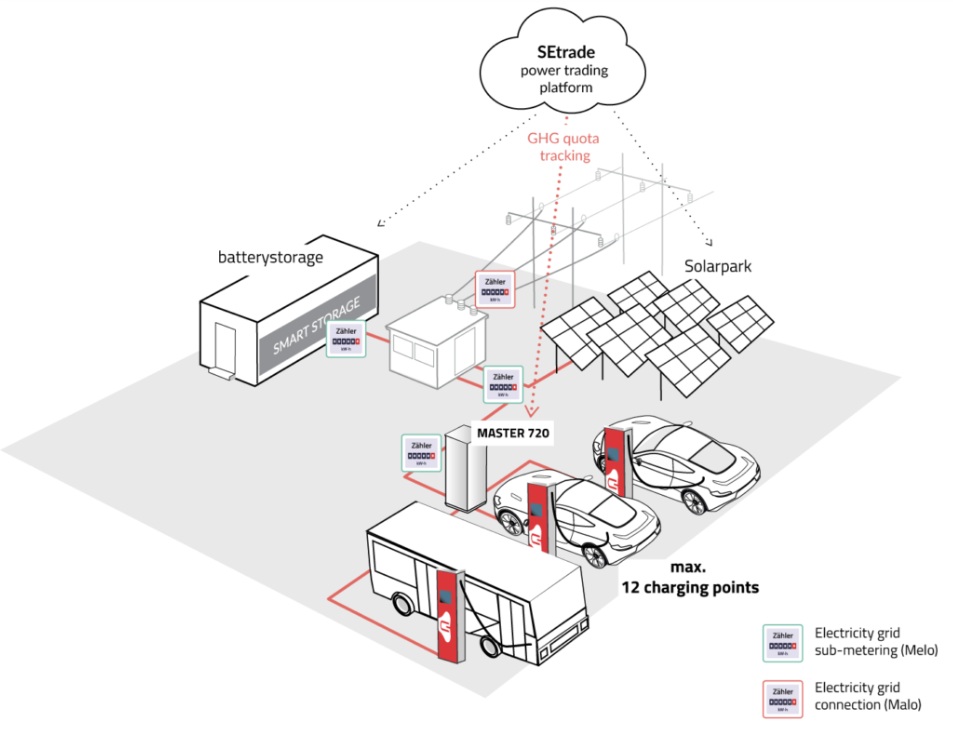

But VISPIRON’s offering goes beyond operating chargers: it integrates them with photovoltaic (PV) systems and battery storage solutions.

“We connect these systems through an intelligent control panel and offer this product to the market,” he explains.

VISPIRON identifies sector coupling as a key trend

Asked about the main trends shaping e-mobility in Germany, Luciani emphasises the importance of energy convergence: “What is setting the pace in the market is sector integration.”

Since 2017, the company has been promoting this vision through its ENERGY World ecosystem, which integrates energy generation, consumption, storage, charge management, energy trading and station operation under an open system architecture.

The model relies on the collaboration of the group’s specialised subsidiaries: VISPIRON ENERGY, VISPIRON EPC, SEtrade, CHARGE-V and VISPIRON ECO INVESTMENT.

Today, sector coupling is no longer a future vision but a present-day reality.

The company’s combined-cycle plant links solar energy, batteries and fast charging infrastructure in a single system, managed and marketed via intelligent control.

The platform enables real-time optimisation of performance and energy consumption, with an integrated, sustainable and cost-effective approach.

“There are many individual innovations and technological advances. But for an energy system to be truly valuable, it must be designed with sector integration in mind,” says Luciani.

According to the executive, most clients are now seeking integrated solutions based on this concept of energy convergence.

“We are pioneers in offering this in Europe,” he affirms.

Fast charging technology with an intelligent edge

The progression of the group´s different business units now provides a smart fast charging system designed to enable sustainable business models through the integration of e-mobility and the energy industry.

Its stations comply with legal metrology standards and allow the simultaneous use of up to 12 charging points.

The product range includes power outputs from 40 kW to 320 kW per direct current (DC) charging point, meeting a wide variety of operational requirements.

In addition, the payment system is simple and versatile, supporting debit and credit cards, RFID and mobile app usage.

The German market: structural challenges and new opportunities

In his assessment of the local context, Luciani points out that one of the main challenges for CPOs in Germany is the volatility of electricity prices.

“As prices are so flexible, there’s a fear of negative electricity rates, which are not a reliable basis for financing,” he notes.

This volatility complicates the planning of sustainable return-on-investment models. Nevertheless, VISPIRON’s intelligent systems help mitigate this risk.

“We usually work with a payback period of five to nine years. Thanks to our smart systems, we can ensure stable pricing and amortisation. That’s a variable you can rely on,” Luciani emphasises.

Regarding the rollout of charging infrastructure in Germany, Luciani admits that progress could be quicker. However, the level of advancement depends on the use case.

While unidirectional charging is developing at a steady pace, the deployment of bidirectional technologies still hinges on specific technical conditions.

“If we look at bidirectional chargers, their rollout depends, for instance, on the implementation of smart meters,” he explains.

Currently, the penetration of such devices in Germany is estimated at around 5-10% —a figure significantly lower than in other parts of Europe:

“In Southern Europe, like Italy, they have 90% or more,” he compares.

READ MORE

-

chargecloud Expands Marketplace with AI-Based Support: Cooperation with Lemonflow Technologies

The integration brings 24/7 AI-powered user support, fully embedded into the chargecloud ecosystem, aiming to enhance operational efficiency and service quality for CPOs across Europe.

-

EV transition in Europe slows, but momentum remains after EU climbdown

EU policy flexibility may ease short-term pressure on automakers, yet rising EV sales, infrastructure needs and long-term investment signal that electrification remains the industry’s core trajectory.

-

EnBW and Alpitronic strengthen long-term partnership to scale high-power charging across Germany

The agreement covers fast-charging hardware, joint development of future functionalities and a multi-year maintenance framework to support EnBW’s expanding HPC network.