The electrification of Chile’s freight transport is no longer exclusive to mining.

According to Mobility Portal Latinoamérica, logistics, distribution and retail account for 50 % of companies using electric or hybrid trucks—surpassing the mining sector in both numbers and diversity.

This shift toward zero-emission heavy‑duty technology has become widespread across urban distribution, inter‑urban transport, and retail operations.

Where once mining—on account of electric buses and heavy machinery—was the poster child for electromobility, today the lion’s share of electric truck use comes from logistics operators, supermarkets, e‑commerce firms, and FMCG manufacturers.

Logistics and retail, the new leaders of the electric transition

Leading the charge are companies like Sotraser, Chilexpress, DHL Global Forwarding, Transportes Casablanca, Transportes Yáñez, Walmart Chile, and Sodimac.

They have deployed—or announced—the adoption of electric trucks in various configurations across urban distribution, inter‑regional logistics, and last‑mile delivery.

One illustrative example is Sotraser: among Chile’s premier logistics operators, it has integrated over 50 Foton eAuman 2554 heavy electric trucks and, in partnership with Walmart and Maersk, developed the country’s first “electro‑logistics terminal”, capable of charging multiple trucks at once.

It is one of the largest logistics electrification projects in South America.

Walmart Chile, meanwhile, is building a regenerative supply chain. The company currently operates more than 45 electric trucks from its Santiago distribution centre to its stores, aiming for net‑zero emissions from its own fleet by 2040.

Chilexpress has electrified over 120 light delivery vans, a clear sign of rising technological adoption in last‑mile logistics. DHL has also added JMC electric trucks for urban operations.

Sodimac, for its part, uses electric trucks to deliver home‑improvement products to both stores and customers, and its Lo Espejo logistics centre already has its own charging infrastructure.

FMCG companies putting their fleet commitments in motion

Mass‑consumption companies are joining the shift. CCU already operates six electric trucks and has set a goal for 50 % of its fleet to be electric by 2030.

PepsiCo Chile recently acquired its first 100 % electric Scania tractor unit, complementing its natural‑gas fleet for beverage transport.

Both companies participate in the Public‑Private Electromobility Agreement, promoted by Chile’s Ministry of Energy and Energy Sustainability Agency, where corporate pledges are key to accelerating the change.

Mining’s current role in fleet electrification

While mining was early in trialling high‑tonnage electric trucks, adoption remains limited to a few players.

SQM—with Enel X and Yutong—unveiled Chile’s first 100 % electric truck for large‑scale mining: a 28‑ton model operational in the Antofagasta region. It also leads a hybrid retrofit programme with Movener and Transportes Nazar, which converts diesel units with electric‑assist kits to yield up to 20 % fuel savings.

CMP (Compañía Minera del Pacífico) introduced a 55‑ton Yutong electric truck in 2023 for tailings transport and plans to expand its fleet at its Huasco Pellets Plant.

Sector breakdown of adoption

Of the 12 Chilean companies that have adopted electric or hybrid trucks (Mobility Portal Latinoamérica analysis):

- Logistics / Distribution / Retail: 6 companies (50 %)

- FMCG / Food & Beverages: 2 companies (16.7 %)

- Mining: 2 companies (16.7 %)

- Construction: 1 company (8.3 %) – Melón with the country’s first electric mixer

- Passenger and courier transport: 1 company (8.3 %) – Transvip, with a mixed‑fleet solution for urban logistics

This shows that heavy‑duty electromobility in Chile is no longer limited to pilot projects or mining—it’s being driven by sectors integral to the country’s daily supply chains.

Approved electric models and homologation in Chile

There’s a growing portfolio of electric trucks homologated in Chile, including:

- Foton eAuman 2554

- Volvo FH and FM Electric

- Scania BEV series

- JMC Conquer EV

- Yutong E‑Truck (mining)

- Sany electric mixer (construction)

The gradual entry of new brands, together with expanding charging infrastructure, paves the way for a transition that until recently seemed distant.

Electric trucks in Chile are gaining ground—and the leadership has shifted from desert-bound mining sites to urban logistics centres, inter‑city routes, and daily distribution networks. The city—rather than the desert—has become the new epicentre of heavy‑duty electromobility. The figures confirm it.

READ MORE

-

Strategy for CPOs: how to take EV driver charging experience to the next level

As EV sales rise and public networks grow, the charging experience becomes key. Like petrol stations, EV hubs add services to boost value — that’s why leading OEMs and CPOs partner with 3M.

-

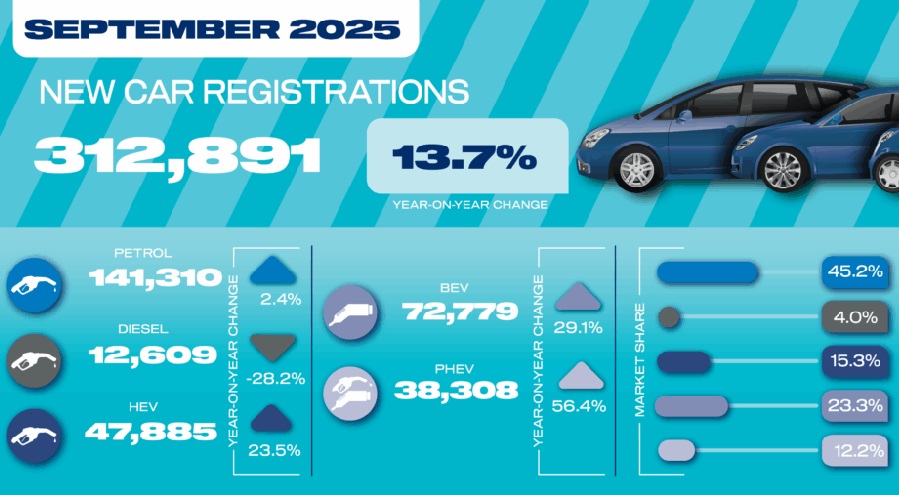

BEVs in the UK hit record monthly high with 72,779 units sold in September

September was the first month in which manufacturer discounts, an expanding range of models, and the introduction of the UK’s Electric Vehicle Grant significantly boosted registrations of BEVs.

-

Electrificación de flotas y rentabilidad: conoce a los protagonistas del nuevo debate eMobility

Bajo registro gratuito, el 15 de octubre (15 h, Madrid) Mobility Portal España reúne a referentes para optimizar TCO y recarga inteligente en flotas a gran escala, con estrategias y casos reales.