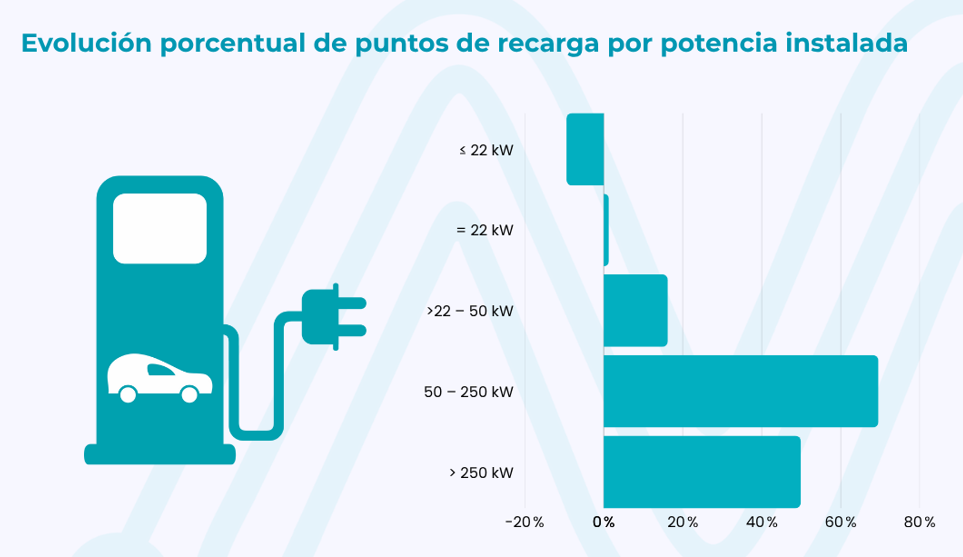

The deployment of ultra-fast charging points in Spain could be marking a turning point.

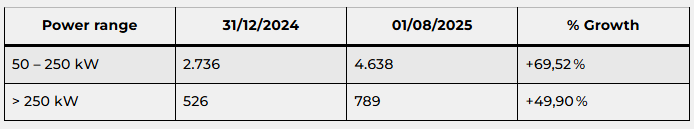

According to the latest data from the Business Association for the Development and Promotion of Electric Mobility (AEDIVE), the number of public chargers over 250 kW has grown from 526 to 789 between December 2024 and August 2025, representing a 49.90% increase in just seven months.

This figure is especially significant when considering the jump also made by high-power chargers (between 50 and 250 kW), which have grown by 69.52% over the same period, confirming a clear trend: more power, less waiting.

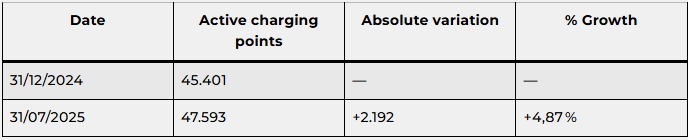

Almost 5% more public charging points in just seven months

The public charging network in Spain continues to grow.

As of 31 July 2025, there are 47,593 operational charging points, according to AEDIVE data.

This represents a 4.87% increase compared to the end of 2024, when there were 45,401 active points (a figure recalculated under a new methodology).

This growth has occurred despite AEDIVE’s methodological change, which now only counts points that are active in real-time.

This adds rigour to the data and may lead to downward adjustments if a point is out of service or under maintenance.

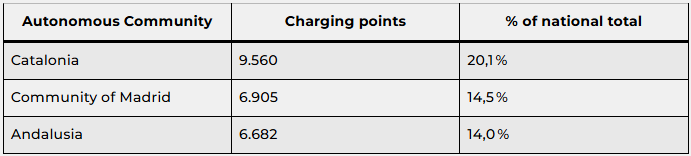

Catalonia, Madrid, and Andalusia account for almost 50% of public charging points in Spain

Meanwhile, the public charging infrastructure in Spain remains highly concentrated in three regions: Catalonia, Madrid, and Andalusia. Together, they hold 48.6% of all operational points in the country.

According to AEDIVE, as of 31 July 2025, the national total amounts to 47,593 active points, of which:

- Catalonia leads with 9,560 points (20.1%)

- The Community of Madrid regains second place with 6,905 points (14.5%)

- Andalusia is in third place with 6,682 points (14.0%)

These three regions lead not only in volume but also in the pace of installation and deployment of high-power infrastructure, especially in urban areas and high-traffic interurban roads.

In contrast, regions like Extremadura (1.1%), Cantabria (1.5%), and La Rioja (0.6%) have a significantly lower level of implementation, highlighting an opportunity for future development.

READ MORE

-

chargecloud Expands Marketplace with AI-Based Support: Cooperation with Lemonflow Technologies

The integration brings 24/7 AI-powered user support, fully embedded into the chargecloud ecosystem, aiming to enhance operational efficiency and service quality for CPOs across Europe.

-

EV transition in Europe slows, but momentum remains after EU climbdown

EU policy flexibility may ease short-term pressure on automakers, yet rising EV sales, infrastructure needs and long-term investment signal that electrification remains the industry’s core trajectory.

-

EnBW and Alpitronic strengthen long-term partnership to scale high-power charging across Germany

The agreement covers fast-charging hardware, joint development of future functionalities and a multi-year maintenance framework to support EnBW’s expanding HPC network.