At a time when electric mobility in Spain finds itself caught between high expectations and complex realities, TERA Batteries has taken a step that blends strategic vision with business pragmatism: becoming an official partner of Contemporary Amperex Technology Co. Limited (CATL).

The agreement will allow the Spanish company to oversee advanced diagnostics, maintenance, and reconditioning of CATL batteries at a local level.

According to projections, this move will boost TERA’s production capacity by 150% and increase annual turnover by more than 200%, solidifying its position in the European market.

But for David Santiago, CEO of TERA Batteries, growth is not just about scale — it’s about strategy:

“There are two key variables: one is investment control, and the other is adaptability. It’s not just about making a three-year strategic plan and leaving it at that.”

“You do need long-term goals, yes, but they must be monitored almost daily based on what the company needs at any given time. Balancing short-, medium-, and long-term planning is essential,” he adds.

Based in Alicante, TERA specialises in the reconditioning and reuse of electric vehicle batteries, as well as in the development of energy storage systems using recovered modules.

Its value proposition is clear: maximise the lifespan of each battery and reduce reliance on virgin raw materials by integrating technological innovation with the principles of the circular economy.

An oversized market

The CEO’s perspective reflects a clear reality in the Spanish market. In recent years, both public and private forecasts have leaned on optimism that hasn’t always translated into results.

2025 was expected to mark the breakthrough year for EV registrations. However, setbacks such as the slowdown of the MOVES Plan, regulatory delays, and inflationary pressures have hindered progress.

According to Mobility Portal Data, if the current pace continues, Spain will close 2025 with around 224,000 electrified vehicle registrations — just 15.7% of the 2030 target set by the PNIEC (National Integrated Energy and Climate Plan), which calls for 5.5 million EVs on the road.

To reach that goal, between 2026 and 2030, the country would need to sell approximately 956,000 electrified vehicles annually — that’s over 79,000 per month, far above the current pace.

This mismatch has led many companies, both domestic and international, to scale back operations, alter strategies, or prioritise markets where returns materialise faster.

In this context, TERA’s decision to diversify its activity beyond automotive battery repair into energy storage is no coincidence.

“We saw that this segment could become mainstream in 7–10 years, but we needed to shorten that timeline to generate revenue. Energy storage fit perfectly with our know-how and allowed us to start earning sooner than expected,” Santiago notes.

Spain: Europe’s second largest vehicle manufacturer

Despite the challenges, the CEO believes Spain holds a strategic position that must not be overlooked.

“Spain cannot miss the electrification train. We have the knowledge, experience, investment capacity, and qualified personnel to lead in Europe,” he says.

He reminds us that Spain is the second-largest car manufacturer in the European Union and ranks among the top ten globally.

Moreover, the ecosystem is no longer limited to historic industrial hubs — new innovation clusters are emerging with companies in charging, software, and hardware.

Santiago highlights that both European and Spanish regulations are pushing for efficiency and sustainability.

The European Battery Regulation, due to come into effect in 2025, will require full traceability through a digital passport. Meanwhile, several strategic projects in lithium, cobalt, and nickel extraction and recycling are already receiving preferential funding.

For TERA, these policies are “positive”, but not sufficient on their own:

“An incentive won’t make a project viable if the market doesn’t support it. You have to crunch the numbers carefully and ensure market conditions are right,” he warns.

Between geopolitics and business flexibility

The CEO emphasises that in a sector so intertwined with the automotive and energy transitions, geopolitics plays a decisive role.

Shifts in incentives, trade tensions, or changes in demand can completely reshape the roadmap.

“Flexibility and agility in responding to market behaviour are key. We’ve been doing that since 2022, because geopolitics has a huge impact on this sector,” he concludes.

With CATL’s backing and a strategy grounded in technology, diversification, and adaptability, TERA Batteries is not only strengthening its footprint in Spain, but also positioning itself as a European benchmark in sustainable battery management.

All of this contributes to the continent’s energy transition — with a dose of realism that, in today’s landscape, might be just as valuable as innovation.

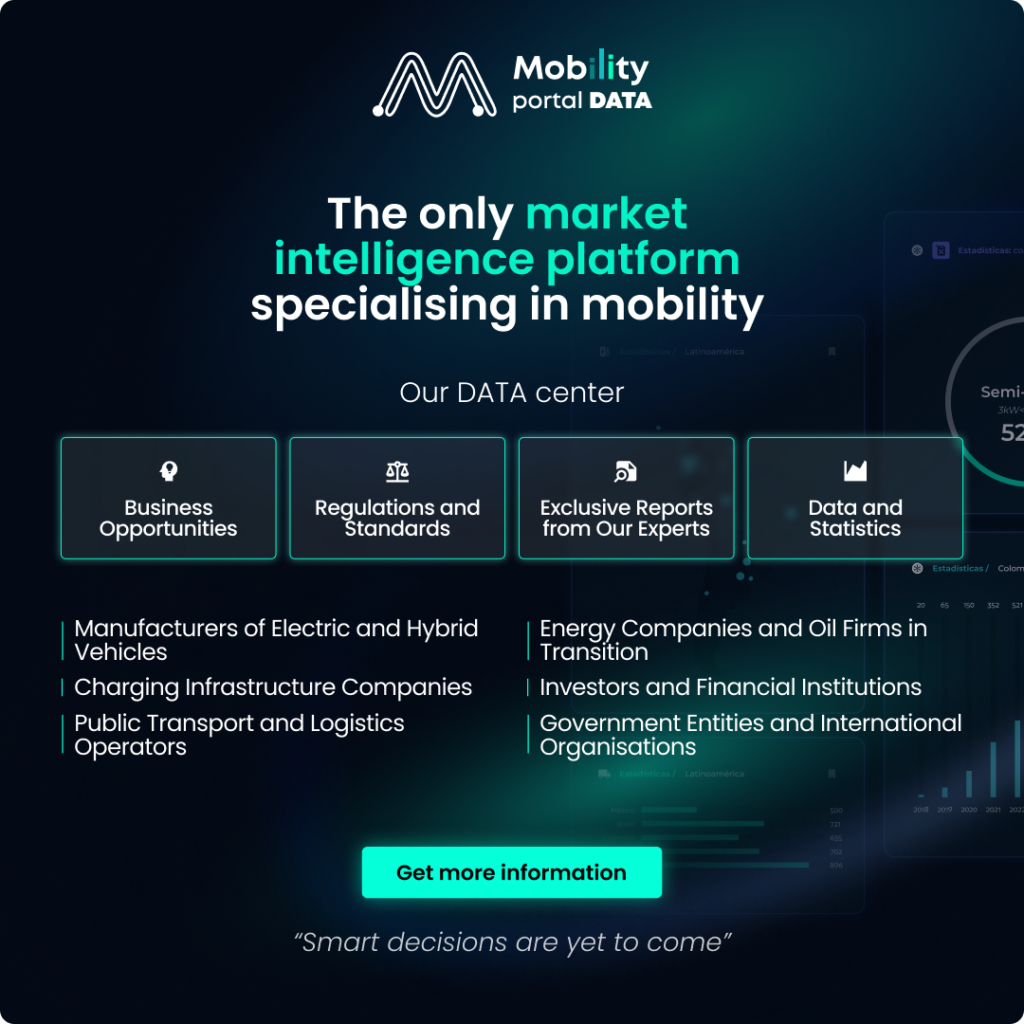

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, an exclusive new market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector, covering both combustion and electric vehicles as well as charging infrastructure.

Research, trend analysis, and well-organised statistics presented with clarity and precision, alongside real-time information — all just a click away. With Mobility Portal Data, better decisions are always within reach.

READ MORE

-

“Spain cannot miss the eMobility train”: TERA Batteries partners with CATL on battery management

The Spanish company becomes the official service provider for the world’s largest battery manufacturer. Its CEO, David Santiago, tells Mobility Portal how to combine innovation, flexibility, and realism in a market with oversized targets.

-

Scotland announces over £3m for EV charging infrastructure

Since 2011, the Scottish Government has provided over £65 million in public charging. Scotland now has one of the most comprehensive public charging networks in the UK.

-

Milence announces new charging hub in Italy

This new Milence hub will support one of Europe’s key freight corridors, linking southern Spain to Hungary and beyond.