France continues to make significant strides towards electric mobility. The country currently hosts 1,458,691 battery electric vehicles (BEVs), and for this trend to grow sustainably, charging infrastructure must keep pace.

According to the European Alternative Fuels Observatory (EAFO), there are 175,873 public points available in the country. Of these, 140,312 operate with alternating current (AC) and 35,561 with direct current (DC), the latter enabling fast and ultra-fast charging.

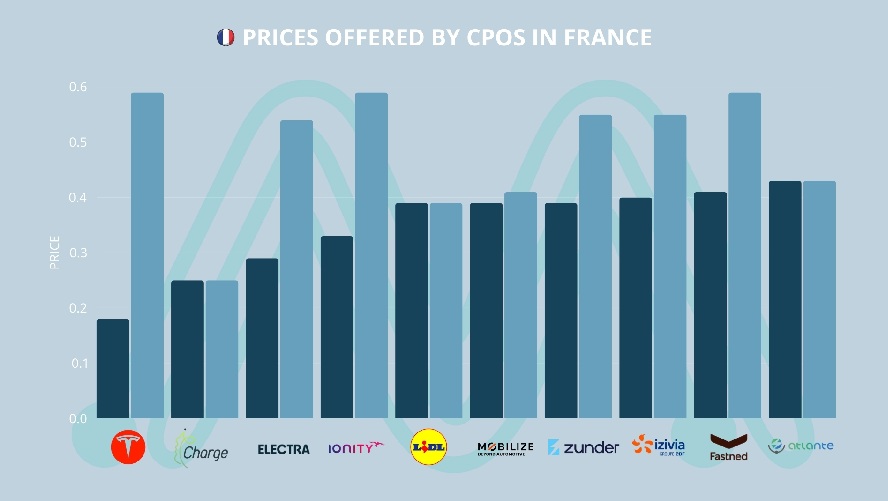

Each charge point operator (CPO) applies its own pricing model, with billing methods that vary between cost per kilowatt-hour (kWh), per minute, or through subscription-based plans.

It is worth mentioning that the subscription trend, adopted by operators such as Electra and IONITY, significantly reduces the price per kWh and overall costs for frequent users.

So, which CPOs are currently offering the most competitive rates?

Mobility Portal presents the following analysis.

Tesla

Tesla ranks as the CPO with the most affordable charging rates in France (€0.18/kWh), although prices vary depending on time, location and whether the vehicle is a Tesla or another brand.

In Roissy-en-France, Tesla owners pay between €0.18/kWh (from 00:00 to 04:00) and €0.42/kWh (from 10:00 to 23:00). In contrast, non-Tesla EVs are charged between €0.25/kWh and €0.59/kWh for the same time windows.

In Calais, Tesla drivers pay €0.24/kWh between 04:00 and 08:00, and €0.35/kWh between 16:00 and 21:00. Non-Tesla units are billed €0.33/kWh and €0.49/kWh, respectively.

Meanwhile, in Paris – Bercy, Tesla vehicles are charged between €0.25/kWh and €0.29/kWh, while other cars pay between €0.35/kWh and €0.41/kWh.

IECharge

IECharge presents itself as the CPO offering “the best price for high-power charging” in France.

The company applies a flat rate of €0.25/kWh for charging sessions at power levels of up to 320 kilowatts (kW).

Electra

Electra has implemented a flexible tariff structure tailored to the user’s subscription level.

The standard rate, accessible via the mobile app, is €0.54/kWh. However, those subscribing to the Electra+ plan can benefit from a reduced rate of €0.39/kWh for a monthly fee of €4.99.

The premium subscription, priced at €19.99 per month, lowers the rate further to €0.29/kWh, positioning it as the most cost-effective option within the company’s offerings.

IONITY

IONITY provides four different charging plans depending on user profile and level of commitment.

The IONITY Power plan, aimed at frequent users, offers a reduced rate of €0.33/kWh, with a monthly subscription fee of €11.99.

For occasional users, the IONITY Motion plan offers charging at €0.39/kWh with a subscription of €5.99 per month.

Meanwhile, IONITY Go charges €0.55/kWh without requiring a subscription. Users can access this rate via the app.

Lastly, IONITY Direct is a pay-as-you-go option with no registration or app download required. The session is paid on-site via contactless payment, at a rate of €0.59/kWh, making it the most expensive of the four.

Lidl

Supermarket chain Lidl has also entered the EV charging space.

AC charging is offered at €0.29/kWh, while DC fast charging costs €0.39/kWh. The rate is calculated exclusively based on energy consumption.

However, the company notes that third-party mobility cards may incur an extra fee imposed by the card issuer.

Mobilize Fast Charge

Mobilize offers a promotional launch rate of €0.41/kWh for the first two months after opening a new station, applicable to users paying with credit card.

In addition, Renault Group customers holding a Mobilize Charge Pass benefit from a preferential rate of €0.39/kWh for one year. This promotional price is valid starting from March 2025.

Since early 2023, Mobilize has opened 25 charging stations in France, with plans to reach around 100 by the end of the year.

Zunder

Zunder’s rates vary based on charging power and user subscription.

For non-subscribers, charging up to 50 kW is priced at €0.42/kWh, and over 50 kW at €0.55/kWh.

Subscribers, who pay a monthly fee of €4.99, benefit from reduced rates: €0.39/kWh for charging up to 50 kW and €0.40/kWh for sessions above that threshold.

Izivia Fast

Izivia’s standard tariff ranges from €0.40 to €0.55/kWh for rapid charging (up to 150 kW), available in urban centres and commercial zones.

Users can pay using the Pass Izivia, other interoperable mobility cards, or directly with contactless bank cards.

Fastned

Fastned’s standard tariff is €0.59/kWh, with no hidden fees.

However, its Gold membership offers a 30% discount, lowering the cost to €0.41/kWh.

The subscription costs €11.99/month and is cost-effective for drivers using over 67 kWh monthly (equivalent to approximately two full charges).

Activation is managed directly via the Fastned mobile app.

Atlante

Atlante offers a flat rate of €0.43/kWh for both rapid and ultra-rapid charging across its French network.

This tariff is available to subscribers of the Atlante Go plan, launched in April 2025 at a promotional rate of €3.99/month (previously €6.99), valid for 12 months.

The structure represents up to 27% savings compared to standard market rates.

Bonus Track: what do other CPOs offer in France?

While the main operators analysed in the top 10 offer the most competitive rates, there is a wider network of other CPOs active in the country.

TotalEnergies applies variable tariffs depending on the station type, charger power and time of day. The base rate starts at €0.44/kWh and can go up to €0.59/kWh for ultra-rapid charging stations.

However, subscribers of the METPARK parking service (€7/month) enjoy reduced prices: €0.40/kWh during the day and €0.35/kWh at night for 7 kW chargers, €0.47/kWh for 50 kW rapid charging and €0.56/kWh for 200 kW ultra-rapid charging.

As for E-Vadea, charging at stations below 100 kW is priced at €0.48/kWh, while those of 100 kW and above cost €0.62/kWh.

For its part, Allego has set the following prices as of 1 January 2025: ultra-fast charging costs €0.590/kWh, fast charging €0.490/kWh, and standard charging is priced at €0.390/kWh.

EVZen uses a clear pricing structure based on power levels: €0.39/kWh for accelerated charging (up to 22 kW) and €0.49/kWh for rapid and ultra-rapid charging (50 to 240 kW). An annual subscription of €12 offers a 5% discount on every session, along with preferential access to partner networks.

E-totem currently charges €0.39/kWh for AC charging and €0.49/kWh for DC, according to industry sources.

Driveco adopts a decentralised pricing model, with each station setting its own tariffs—some even offering free charging.

Official references indicate €0.30/kWh for semi-rapid charging (22 kW), €0.49/kWh for rapid (50 kW) and €0.54/kWh for ultra-rapid (150 kW). These rates, while published in 2023, are presumed current as no updates have been issued.

When it comes to Powerdot, the CPO applies a consistent rate policy across different power levels.

For slow charging, the final rate is €0.42/kWh, based on a base price of €0.35 plus €0.07 in VAT. Fast charging and high-power charging (above 100 or 150 kW) are both priced at €0.53/kWh, comprising €0.44 base plus €0.09 VAT.

By maintaining the same price across all high-power tiers, Powerdot differentiates itself from CPOs that penalise faster charging with higher rates.

Charging at Engie Vianeo stations costs between €0.54 and €0.63 per kWh. Prices are only displayed on-site via totems and cannot be accessed in advance. It is worth noting that some 300 kW chargers offered a promotional rate of €0.351/kWh in July 2025, available through the mobile app.

R3, part of the DBT Group, maintains a fixed rate of €0.55/kWh for rapid charging and €0.35/kWh for standard charging, with no additional fees. This pricing was confirmed in a July 2025 press release.

Dream Energy applies a flat rate of €0.59/kWh across its network of DC chargers (160 to 300 kW). Compatible with CCS, CHAdeMO and Type 2 connectors, these stations can charge most EVs in under 20 minutes.

DISCOVER MOBILITY PORTAL DATA

Explore Mobility Portal Data, an exclusive new market intelligence platform offering reliable data and key insights to support smart decision-making across the automotive sector – encompassing both combustion and electric vehicles as well as charging infrastructure.

Research, trend analysis and well-organised statistics, presented clearly and accurately, together with up-to-date information – all just a click away.

With Mobility Portal Data, the best decisions are just around the corner.