Poland’s electric vehicle (EV) market is gaining strong momentum. Projections indicate that the fleet could increase from 115,000 electric units to as many as 1.9 million by the end of the decade.

Despite this rapid growth, the charging infrastructure is not keeping pace.

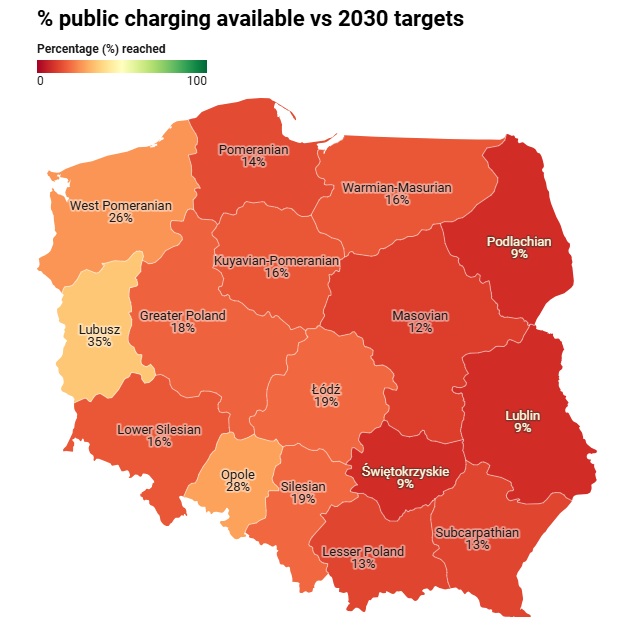

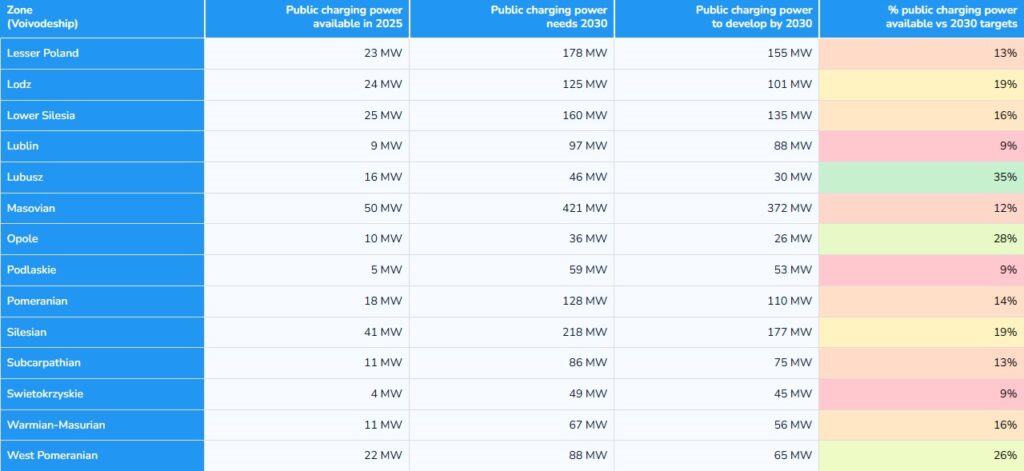

Currently, only 15.6 per cent of the required public charging capacity is in place.

The total installed capacity stands at 318 megawatts (MW), which falls far short of the 2,040 MW projected as necessary within the next five years.

This figure puts Poland at a disadvantage compared to other European countries, according to a recent report by ChargePlanner on the state of the market.

The silver lining is that municipalities have started to issue tenders to accelerate deployment.

At the same time, the targets set by the European Union’s Alternative Fuels Infrastructure Regulation (AFIR) are pushing national and regional stakeholders to move more swiftly.

Nonetheless, as the investment potential varies greatly between regions, it is crucial to understand the local needs in order to make well-informed strategic decisions.

Best-performing Polish regions

In the western and southern parts of the country, some regions are showing encouraging signs of progress.

Lubusz (Lubuskie) leads the ranking, with 16 MW of installed public charging capacity, reaching 35 per cent of its 2030 target. The region is expected to require 46 MW in total, meaning an additional 30 MW will be needed.

It is followed by Opole (Opolskie), which currently has ten MW, covering 28 per cent of its goal. In order to meet the required 36 MW, it must add a further 26 MW.

West Pomeranian ranks third, with 22 MW currently available, representing 26 per cent of its 2030 objective. To achieve the projected 110 MW, it will need to incorporate 88 MW more.

While these regions are relatively better positioned, none have yet reached even half of their required capacity.

10 regions with the greatest charging infrastructure deficit

The most critical shortfalls are concentrated in the eastern regions.

Podlaskie, Lubelskie and Świętokrzyskie all share a similarly critical scenario: each has reached just nine per cent of the capacity they will need by 2030.

Podlaskie currently has five MW, but will need to reach 59 MW, leaving a shortfall of 54 MW.

Świętokrzyskie operates with four MW and must reach 49 MW, requiring an additional 45 MW.

Lubelskie, meanwhile, has nine MW available, far from the 97 MW required, which means it must expand by 88 MW.

Another region of concern is Masovian (Mazowieckie), which, despite having 50 MW in place, is still far from its 421 MW target. The region must increase its capacity by 371 MW, having met only 12 per cent of its objective to date.

Other regions show mixed results, still falling significantly short of their 2030 benchmarks.

Lesser Poland (Małopolskie), for example, currently has 23 MW installed, but needs 178 MW in total. With a 155 MW shortfall, it has achieved only 13 per cent of its goal.

Subcarpathian (Podkarpackie) faces a similar challenge, with 11 MW currently in place and a 2030 target of 86 MW. This leaves a gap of 75 MW, and a 13 per cent achievement rate.

Pomeranian (Pomorskie) has installed 18 MW and must reach 128 MW, implying a deficit of 110 MW. The region has so far achieved 14 per cent of its target.

Finally, three regions share similar levels of progress, having reached 16 per cent of their respective goals.

Warmian-Masurian (Warmińsko-Mazurskie) has 11 MW and must reach 67 MW, requiring an additional 56 MW.

Kuyavian-Pomeranian (Kujawsko-Pomorskie) operates with 17 MW, but needs 104 MW, which leaves an 87 MW shortfall.

Lower Silesia (Dolnośląskie) has installed 25 MW to date, but will need 160 MW by 2030, meaning 135 MW must still be added.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away.

With Mobility Portal Data, good decisions are on the horizon.