The market for battery electric vehicles (BEVs) in the Netherlands maintained its upward trajectory in October 2025, with a total of 13,968 units registered, compared to 10,965 in the same month of the previous year.

This represents a year-on-year increase of 27 per cent, according to data from RAI Vereniging and BOVAG.

As a result, BEVs reached a 40.2 per cent share of total registrations, up from 34.1 per cent in October 2024.

Although higher shares have been recorded in previous year-end periods — such as in December 2020, when BEVs peaked at 69 per cent — this increase occurred during a regular month, indicating that electric mobility is now structurally embedded in the Dutch automotive market.

In addition to fully electric vehicles, hybrids accounted for the largest share of new registrations in October 2025, with a total of 16,198 units, representing 46.6 per cent of the market.

Petrol-powered vehicles recorded 4,209 registrations, equivalent to a 12.1 per cent share.

Meanwhile, diesel and LPG vehicles held a marginal presence in the Dutch market, with 188 and 161 units respectively, each representing 0.5 per cent of total registrations.

One of the key drivers of this growth is the upcoming change in company car taxation, effective from January 2026.

The benefit-in-kind (“bijtelling”) rate for electric lease vehicles will increase from 17 to 22 per cent, aligning it with petrol vehicles. This has led to a surge in registrations ahead of the policy shift.

In addition, the expansion of charging infrastructure, the wider availability of affordable models and accelerated fleet electrification are contributing factors to the market’s development.

Which fully electric models led the Dutch market in October?

According to registration data for October 2025, the Škoda Elroq emerged as the best-selling battery electric vehicle in the Netherlands, with 1,772 units registered, accounting for 12.7 per cent of the BEV segment.

It was followed by the Kia EV3, which recorded 708 registrations (5.1 per cent), and the Tesla Model Y, with 617 units (4.4 per cent).

The Volkswagen ID.3 and ID.4 also featured among the top five, with 509 and 503 units respectively, each capturing 3.6 per cent of the fully electric market.

These results reflect a continued preference for compact and mid-sized electric crossovers, as Dutch consumers prioritise driving range, practicality and cost efficiency when selecting electric models.

Outlook for 2026

RAI Vereniging and BOVAG forecast around 361,000 new passenger car registrations in 2026, slightly below the projected 367,000 units for 2025.

While the increase in the “bijtelling” rate may cause a temporary slowdown in demand, BEV adoption is expected to maintain a positive trajectory, supported by corporate sustainability targets, new model launches and enhanced affordability.

READ MORE

-

Siemens: “No hay que ver la movilidad eléctrica como una carga adicional, es una aliada del sistema eléctrico”

El responsable de eMobility Iberia de Siemens explica cómo la carga flexible, el V2G y los modelos peer-to-peer pueden contribuir a estabilizar la red y crear nuevos modelos de negocio.

-

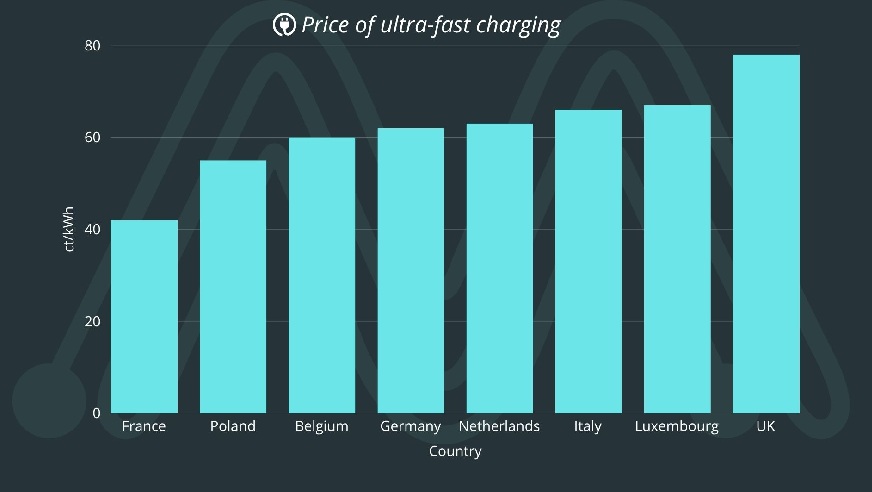

MPD: Which european countries have the highest and lowest ultra-fast charging tariffs?

EV charging rates vary across Europe depending on local energy sources and market conditions. For example, while France offers ultra-fast charging at €0.42/kWh, Italy reaches €0.66/kWh. How does each country rank?

-

UK University Powers Up Its Campus with 142 New EV Charging Points

The rollout is part of a 1.3 million-pound investment by Zest that will see the CPO provide and manage charging facilities at the University over the next 15 years.