According to the German Federal Motor Transport Authority (KBA), car registrations in Germany saw a notable 7.8% increase in October, reaching a total of 250,133 new vehicles.

Of these, 65.6% (+5.9%) were registered by commercial users, while 34.4% (+11.8%) were purchased by private individuals.

For the first ten months of 2025, total car sales in Germany increased slightly by 0.5%, reaching 2.36 million vehicles.

Over 80,000 electrified vehicles delivered in October

The German market saw a significant surge in the delivery of electrified vehicles (both electric and plug-in hybrid).

October alone saw over 80,000 electrified cars registered, a major milestone in the country’s shift towards cleaner mobility.

- 30,946 plug-in hybrid vehicles (PHEVs) were registered, marking a 60% increase compared to the previous year, with a market share of 12.4%.

- 52,425 fully electric battery vehicles (BEVs) were sold, representing a market share of 21%, and showing an impressive growth of 47.7%.

Additionally, 70,652 hybrid vehicles (HEVs) were registered, accounting for 28.2% of the market, reflecting a 19.5% increase compared to the same month last year.

Meanwhile, 932 LPG-powered cars were sold, a decline of 10.4% from the previous year, making up only 0.5% of the market.

In contrast, 64,706 gasoline-powered vehicles were registered, down by 12.9% year-on-year, holding a market share of 25.9%, while 30,462 diesel vehicles were sold, reflecting a 15.8% decrease in registrations with a 12.2% market share.

Hybrid models remain the most popular in Germany

As of October, hybrid vehicles (non-plug-in) have maintained their dominance in the German market, with 673,922 units sold and a market share of 28.6%.

Gasoline models, in comparison, accounted for 654,657 units sold, holding 27.7% of the market.

Together, the total number of electrified vehicles (including both PHEVs and BEVs) has almost reached one-third of all vehicle sales in Germany, with 683,333 units sold and a combined market share of 29.1%.

This includes 248,706 PHEVs (up 63.4% from last year) and 434,627 BEVs (up 39.4%).

Meanwhile, diesel sales continue to decline sharply, dropping 18.6% year-to-date, with 338,463 units sold.

The LPG market also contracted by 14.8%, with 11,656 units sold.

Volkswagen leads the German market

Volkswagen remains the best-selling brand in Germany, having delivered 468,902 units in the first ten months of 2025, reflecting a 4.5% increase from the previous year.

The brand also topped the October rankings with 48,274 sales, marking a 9.9% year-on-year increase, significantly outpacing competitors like Mercedes (24,225 units, +4.3%) and BMW (23,563 units, +24.3%).

As of October, one in five cars sold in Germany was a Volkswagen.

The brand’s performance outstripped that of Mercedes, which registered 215,323 units (+2.1%), BMW with 205,163 units (+8.7%), Škoda at 187,944 units (+8.8%), and Audi rounding out the top five with 165,066 units (-2.1%).

READ MORE

-

Siemens: “No hay que ver la movilidad eléctrica como una carga adicional, es una aliada del sistema eléctrico”

El responsable de eMobility Iberia de Siemens explica cómo la carga flexible, el V2G y los modelos peer-to-peer pueden contribuir a estabilizar la red y crear nuevos modelos de negocio.

-

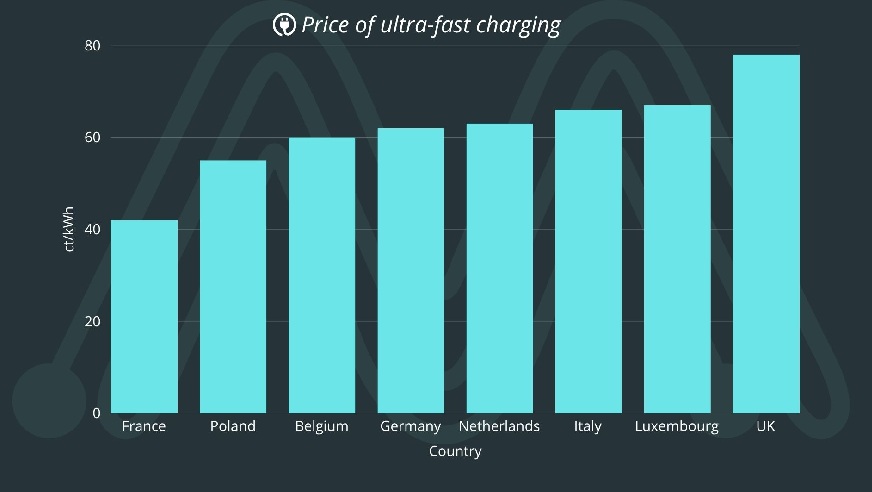

MPD: Which european countries have the highest and lowest ultra-fast charging tariffs?

EV charging rates vary across Europe depending on local energy sources and market conditions. For example, while France offers ultra-fast charging at €0.42/kWh, Italy reaches €0.66/kWh. How does each country rank?

-

UK University Powers Up Its Campus with 142 New EV Charging Points

The rollout is part of a 1.3 million-pound investment by Zest that will see the CPO provide and manage charging facilities at the University over the next 15 years.