Starting from January 2024, electric vehicles traded between the European Union (EU) and the United Kingdom could face taxation, a development that has raised concerns in the electromobility sector.

However, there is a possibility of preventing the implementation of these tariffs.

As explained by the European Automobile Manufacturers’ Association (ACEA), the only way to avoid the application of these taxes is to source all battery components and some critical battery materials within both the EU and the UK.

Nevertheless, ACEA considers this to be “practically impossible to achieve today.”

They urgently call upon the European Commission to take immediate action and circumvent the implementation of these measures.

Luca de Meo, President of ACEA and Chief Executive Officer at the Renault Group, suggests, “There is a very simple and straightforward solution: extend the current phased-in period for battery rules by three years.”

“We urge the Commission to do the right thing,” he adds.

While massive investments are being made in European battery supply chains, more time is needed to develop the necessary scale to meet the origin rules.

If the taxation is not avoided, a 10% tariff will be imposed on EU electric vehicle exports to the United Kingdom, its largest trading partner.

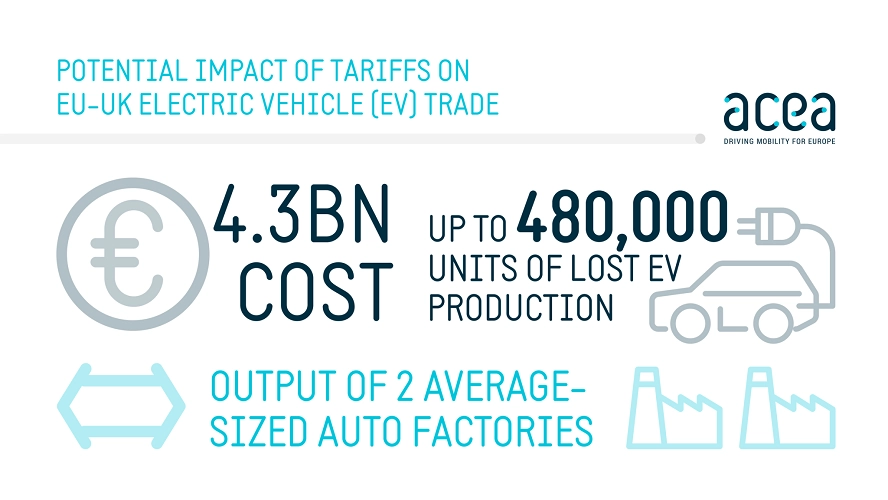

This could cost EU car manufacturers €4.3 billion over the next three years, potentially reducing electric vehicle production by approximately 480,000 units, equivalent to the output of two medium-sized car factories.

“Driving up consumer prices of European electric vehicles, at the very time when we need to fight for market share in the face of fierce international competition, is not the right move – neither from a business nor an environmental perspective,” stated de Meo.

“Europe should be supporting its industry in the net-zero transition as other regions do – not hindering it,” added de Meo.

It’s worth noting that the European automotive industry faces a threat from China due to the influx of a large number of electric vehicles from the Asian giant.

Chinese models are known for being cheaper, thanks to significant state subsidies.

That’s why the President of the European Commission, Ursula von der Leyen, announced the commencement of an investigation into this matter, as these subsidies result in “artificially low” prices.

Another industry leader who provided their stance on how to avoid the imposition of taxes on zero-emission cars was Mike Hawes, Chief Executive Officer at the Society of Motor Manufacturers and Traders (SMMT).

In this regard, Hawes stated, “This could be easily avoided by simply delaying the introduction of over-demanding rules of origin requirements.“

“We urge the EU and UK to agree a pragmatic solution and quickly because raising the cost of EVs will not only constrain the transition but will limit consumer choice and, ultimately, compromise the competitiveness of an industry on which so many livelihoods depend,” he added.

Read more: Ford: “We need the policy focus trained on bolstering the EV market in the short term”

UK, the largest trading partner of the EU

A recently published document by ACEA reveals that the United Kingdom is the largest market for EU vehicle exports. It is followed by the United States (second) and China (third).

This fact sheet examines the trade flows of vehicles between the EU and China, including the EV market.

Regarding the marketing of new cars, in 2022, 500,006 units manufactured in China were exported to the EU, with a value of 9.3 billion euros.

Of these, 313,723 were battery electric vehicles (62.7%).

On the other hand, in 2022, 391,586 cars manufactured in the EU were exported to China, with a value of 24.2 billion euros.

Of these, only 17,345 were battery electric vehicles (4.4%).