Currently, France is positioned as one of the European leaders in the transition to electromobility, reflecting a strong commitment to reducing emissions and promoting sustainable energy.

Below, is a detailed analysis by Mobility Portal Europe on the current state of eMobility market, addressing various key aspects that the country has implemented to foster this transition.

Sustainable vehicles constitute 20.9% of the market

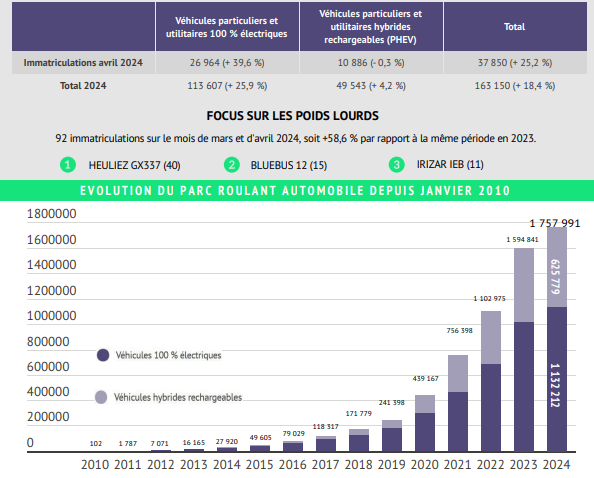

In April this year, 37,850 registrations of electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) were recorded, reaching a market share of 20.9 per cent.

Although the number seems significant, it represents a 29 per cent decrease compared to March.

However, it is important to contextualize this observation with two factors.

Initially, the first quarter of 2023 had already shown a similar trend, with three consecutive months of increase followed by a 35 per cent drop.

Additionally, it is worth noting that the registrations for the same period this year are 25.2 per cent higher.

This growth has been driven mainly by private EVs, while plug-ins have decreased by 0.3 per cent and utility cars by 3.6 per cent.

For this reason, on 6 May 2024, a new strategic contract for the automotive sector was signed between the State and the industry, setting new sales targets.

These targets include quadrupling battery sales for electric cars (800,000) and sextupling sales of light commercial electric units with batteries and fuel cells (100,000) by 2027.

Moreover, there has been a notable increase in the registrations of heavy-duty electric vehicles (HDEVs), with 92 units registered in two months, representing a growth of 58.6 per cent compared to the same period last year.

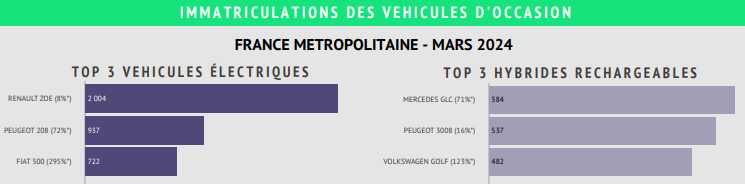

On the other hand, the second-hand electric car market in Metropolitan France showed notable growth, with three models standing out significantly.

The Renault Zoe leads the market with 2,004 units registered, representing an 8 per cent increase compared to April last year.

In second place, the Peugeot 208 recorded 937 registrations, a substantial increase of 72 per cent compared to the same period last year.

Finally, the Fiat 500 showed the highest growth among the top three, with 722 units registered and a striking increase of 295 per cent compared to April 2023.

In the case of HDEVs, the Mercedes GLC leads the ranking with 584 cars registered, representing a 71 per cent increase compared to the same period last year.

In second place, the Peugeot 3008 recorded 537 registrations, marking a 16 per cent increase compared to the same period in 2023.

Lastly, the Volkswagen Golf showed the highest growth among the top three, with 482 units registered and an increase of 123 per cent compared to April 2023.

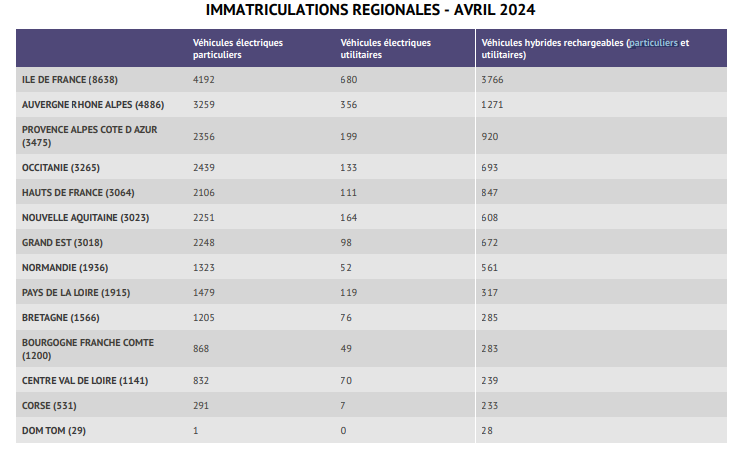

On the other side, as the nation embraces sustainable transportation solutions, certain regions emerge as pioneers in this transformative journey.

Among these, Ile de France, Auvergne Rhone Alpes, and Provence Alpes Cote d’Azur notably lead the charge, boasting substantial concentrations of electric vehicles.

Within these regions, specific statistics highlight the extent of EV adoption and the evolving preferences of consumers towards cleaner and greener modes of transportation.

Ile de France emerges as the leading region in France for electric vehicle adoption, boasting a total of 8,638 EVs concentrated within its boundaries.

Among these, 4,192 are particular electric vehicles, 680 are utility electric vehicles, and 3,766 are plug-in hybrids (PHEVs).

Following closely behind is Auvergne Rhone Alpes, with 4,886 electric automobiles in total.

This location accounts for 3,259 particular electric vehicles, 356 utility electric vehicles, and 1,271 PHEVs.

Provence Alpes Cote d’Azur secures the third position with 3,475 electric cars, comprising 2,356 particulars, 199 utility units, and 920 plug-ins.

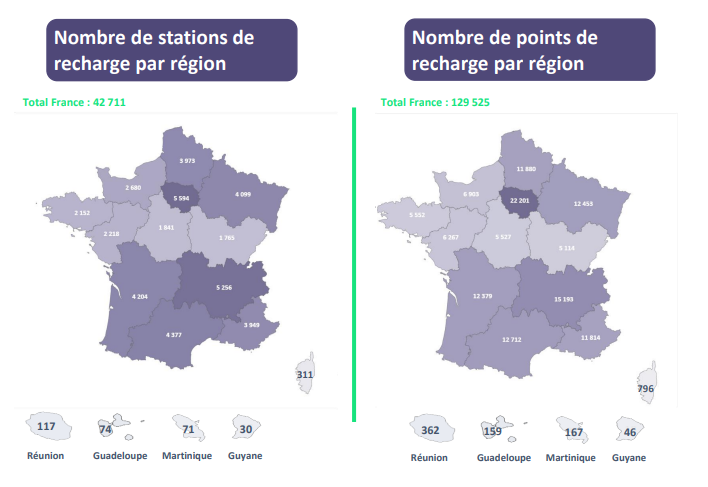

France has 129,525 public charging points

The fourth month of 2024 ended with nearly 130,000 public charging points open in France.

Specifically, as of 30 April, there were 129,525 chargers available in the French public network.

The second quarter began smoothly, with the installation of 2,238 new units, representing an increase of 1.76 per cent.

Additionally, to date, the country has a total of 42,711 charging stations.

Furthermore, with the recent agreement between the sector and the State on 6 May 2024, the established charging targets were reviewed.

The initial goal is to reach 400,000 public charging points by 2030, and the current deployment rate suggests this target is achievable.

The second objective is to install 25,000 points of at least 50 kilowatts on major roads by 2027.

Currently, there are already nearly 19,000 fast terminals installed at various charging stations.

Beyond the numbers, it is crucial to remember that the true purpose of these deployments is to meet the needs of current and future users, both in terms of quantity and quality.

It is worth mentioning that, according to Avere-France, during the mentioned period, the average price of a charging session in B2B was 33 cents per euro for alternating current (AC) charging points and 38 cents per euro for direct current (DC) charging points.

Read more: EdEn warns of a lack of space to install charging stations: What solutions are proposed?

Home charging in buildings and collective residential areas

Electric mobility in collective residences is becoming an increasingly tangible reality.

Charging in these areas is divided into three main types: individual charging points, shared charging points, and common infrastructure.

There are various options for co-owners or landlords, ranging from private solutions offered by charging operators to a public solution managed by the Distribution Network Administrator (Enedis, in most of the territory) or a Local Distribution Company (EDL).

This approach involves the installation of a public electrical distribution network, to which charging stations can then be connected according to each resident’s needs.

The first common barometer of Avere-France indicates that many collective residences have already adopted this approach, showing a growing trend.

The growth of individual terminals has been notable, with an increase of 17.2 per cent between the first quarter of 2024 and the last quarter of 2023.

At the end of March this year, France had 15,996 individual devices in collective residential areas, compared to 13,643 registered at the end of December 2023.

This increase only includes charging points installed by a private operator of AFOR.

Additionally, the Advenir programme has financed the installation of 19,101 individual charging units as of 31 March 2024.

Regarding collective infrastructure, almost 12 per cent of buildings have already adopted this model.

In fact, at that time, 28,673 buildings had approved the installation of collective infrastructure, compared to 26,942 in the last quarter of 2023, representing an increase of 6.4 per cent.

However, the number actually installed was 8,383, a growth of 15.7 per cent compared to the 7,248 registered at the end of 2023.

What incentives does France provide?

In the land of the Revolution, as mentioned in the European Alternative Fuels Observatory, the benefits of the registration tax include a 50 per cent exemption for fully electric vehicles and plug-in hybrids.

Moreover, in most regions, vehicle registration is also completely free.

In the business sector, the regulations of the Official Bulletin of Social Security dated 8 December 2022 in France extended for two years, until 31 December 2024, the assessment of the Benefit in Kind (BIK) for companies that provide an electric vehicle and a charging station to their employees.

For the calculation of social contribution, the electricity tariffs paid by the employer for charging the vehicle will not be considered, and the benefit will be assessed after a 50 per cent reduction, with an annual limit of 1,800 euros.

Regarding purchase subsidies, the French state’s “eco-bonus” offers financial aid to those who purchase or lease a low-emission vehicle, whether new or second-hand.

For example, electric cars with CO2 emissions below 20 g/kilometre and a value of less than 47,000 euros can receive a subsidy of 3,000 euros, or up to 4,000 euros for light commercial vehicles.

For individuals, if the driver’s income is below 14,100 euros annually, the maximum subsidy increases to 7,000 euros, with additional incentives of up to 3,000 euros in Low Emission Zones.

To access these subsidies in France, certain requirements must be met: being a resident in the country, purchasing or leasing a new or used vehicle (in which case the aid is 1,000 euros), and the vehicle must be fully electric or a hybrid with less than 50 g/kilometre of CO2.

Additionally, the owner cannot sell the vehicle before 12 months.

Other financial benefits include free parking for up to two hours in certain municipalities for electric vehicles with a green card.

Moreover, the installation of EV charging stations in private homes in France enjoys a reduced VAT rate of 5.5 per cent.

For buildings over two years old, the VAT is ten per cent, and for newer buildings, it is 20 per cent.

Since 1 January 2021, there is a tax credit covering 75 per cent of the purchase and installation costs of charging stations, up to a maximum of 300 euros.

This work must be carried out by a qualified company and reflected in the invoice with technical details and the price of the equipment.

Finally, the Advenir subsidy also funds the charging infrastructure for electric vehicles for individuals in collective buildings, owners, companies, communities, and public entities in France.