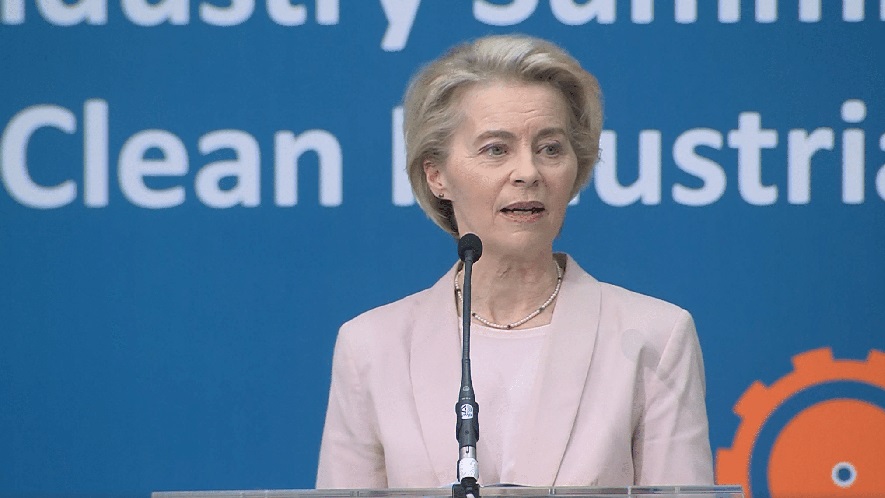

The presidents of Europe’s major car manufacturers and suppliers have sent a letter this Wednesday to Ursula von der Leyen, President of the European Commission, warning that “the EU risks losing its way in the automotive transition” if deadlines for completing the shift to electrification are not extended and additional support measures to stimulate demand are not approved.

The industry has once again issued a call to Brussels, arguing that the transformation of the sector towards electrification is becoming “unfeasible”, urging policymakers to “align strategies with the current market, geopolitical, and economic realities”, without putting the entire sector at risk.

“Europe’s transformation plan for the automotive industry must go beyond idealism and take into account today’s industrial and geopolitical realities. Meeting the strict 2030 and 2035 CO₂ targets for cars and vans is no longer realistic in the current global context,” stated Ola Källenius and Matthias Zink, presidents of the European Automobile Manufacturers Association (ACEA) and the European Association of Automotive Suppliers (CLEPA), respectively.

Källenius and Zink stressed that Europe “does not offer the conditions needed to enable the transition”, and called for “more ambitious, coherent, and long-term incentives” on the demand side, including lower energy costs for charging, purchase subsidies, and tax relief.

The two industry leaders—who also serve as executives at Mercedes-Benz and Schaeffler, respectively—are calling for a review of the CO₂ reduction timeline for road transport in order to safeguard industrial competitiveness, social cohesion, and strategic resilience.

“Successful decarbonisation requires more than just targets for new vehicles; it must also address emissions from the existing fleet (e.g. by accelerating fleet renewal), expand fiscal and purchase incentives (including for company cars and vans), and introduce targeted measures for lorries and buses to level the total cost of ownership,” they argued.

The ACEA and CLEPA representatives also highlighted Europe’s near-total dependence on Asia for battery value chains, as well as tariffs imposed by the United States, which burden the industry in a key market for many brands.

“We want this transition to succeed, but we are frustrated by the lack of a holistic and pragmatic political plan for the transformation of the automotive industry. We are being asked to transform with our hands tied behind our backs,” they stated.

In their letter to President von der Leyen, they also pointed to the low market share of electric models in Europe: just 15% for passenger cars, 9% for vans, and 3.5% for trucks.

According to Källenius and Zink, Europe must commit to “much more ambitious, long-term and consistent demand-side incentives”, while also speeding up procedures through “simpler and more agile bureaucracy” that doesn’t leave customers hesitant to switch to alternative powertrains.

Finally, the industry representatives turned attention to the upcoming meeting scheduled for 12 September, where the future of the European automotive sector will be discussed.

“This is the EU’s last chance to align its policies with current geopolitical, economic, and market realities—or risk jeopardising one of its most successful and globally competitive industries,” they concluded.

READ MORE

-

Amp Assist busca ser el ‘outsourcing’ de los CPOs: eficiencia 24/7 con IA y menos costes operativos

Patrick Roelke, André Duarte y Manuel Fernandes, fundadores de Amp Assist, presentan en exclusiva a Mobility Portal Europe su propuesta BPO para operadores y fabricantes: inteligencia artificial, soporte multicanal 24/7 y reducción de costes en la recarga eléctrica.

-

Three startups redefining eMobility charging: how can AI improve the user experience?

Chargia, Quantum, and Amp Assist are applying AI to fix faults, automate support, and enhance the charging experience. A new wave of startups is proving that the future of eMobility is also being programmed.

-

Car Industry to Von der Leyen: “Electrification goals no longer feasible without more support”

The car industry warns that meeting the strict 2030 and 2035 CO₂ targets for cars and vans is no longer realistic in the current global context. What are they asking for?