Between March and May 2025, Chile’s public charging network for electric vehicles grew by 55.3%.

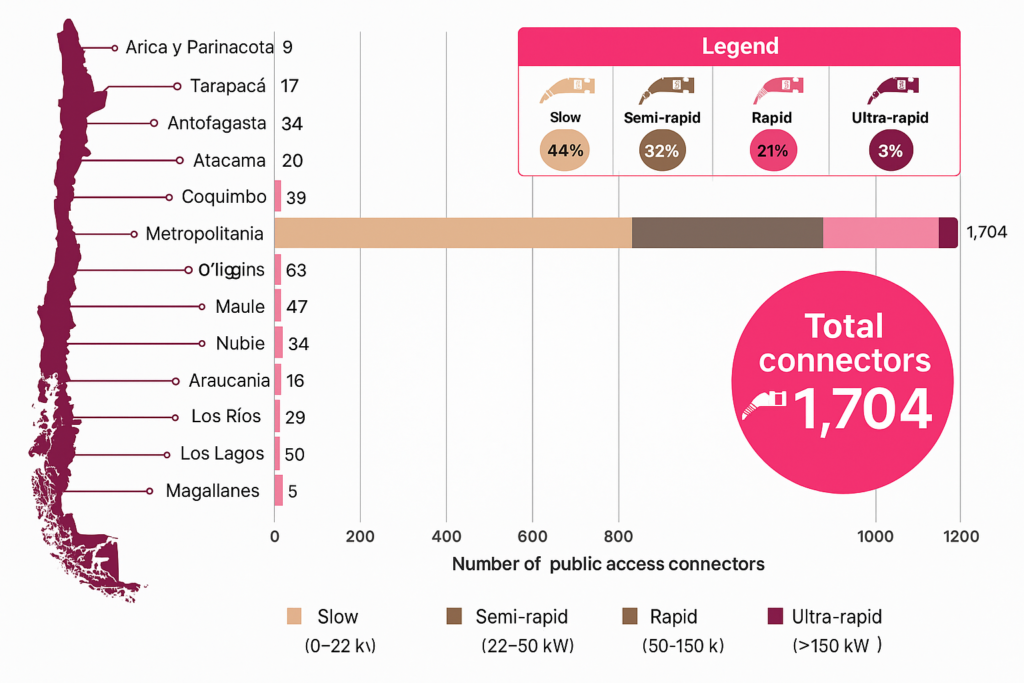

According to the latest report from the Charging Infrastructure Observatory (Observatorio de Infraestructura de Carga, IC), compiled by the Centre for Sustainable Mobility (Centro para la Movilidad Sostenible, CMS), the country went from having 1,097 to 1,704 operational connectors.

This increase of 607 points marks an unprecedented step forward for the local e-mobility ecosystem.

However, the data also show that development has not been evenly distributed across the territory.

More chargers, but in the same areas

The Metropolitan Region accounts for 1,185 of the total connectors—that is, 69.5% of the national network.

Valparaíso, with 89 connectors, and O’Higgins, with 63, complete the top three, though far behind Santiago’s figures.

Regions such as Aysén and Magallanes have only seven and five units, respectively.

The territorial disparity is clear: 211 of the country’s 346 municipalities—61%—still lack access to public charging, which limits the effective expansion of electric mobility.

Another persistent structural challenge is the low availability of rapid charging.

Of the national total, 44% corresponds to slow chargers (0–22 kW) and 32% to semi-rapid chargers (22–50 kW).

In other words, three out of every four connectors do not exceed 50 kW of power.

Rapid charging (50–150 kW) represents 21% of the total, while ultra-rapid charging accounts for just 3%.

This composition limits the possibility of efficient charging, particularly for users who rely exclusively on public infrastructure or for fleets requiring greater operational agility.

Charging network lags behind outside Santiago

The CMS report notes that 12 of Chile’s 16 regions have fewer than 50 public connectors.

Some, such as Ñuble (34), La Araucanía (46) and Antofagasta (34), show partial progress, but remain well below projected demand. In terms of rapid charging outside the Metropolitan Region, the situation is more critical: only six regions have more than 10 units.

This directly impacts interurban connectivity, which is key to a successful transition in long-distance transport, tourism, logistics and regional services.

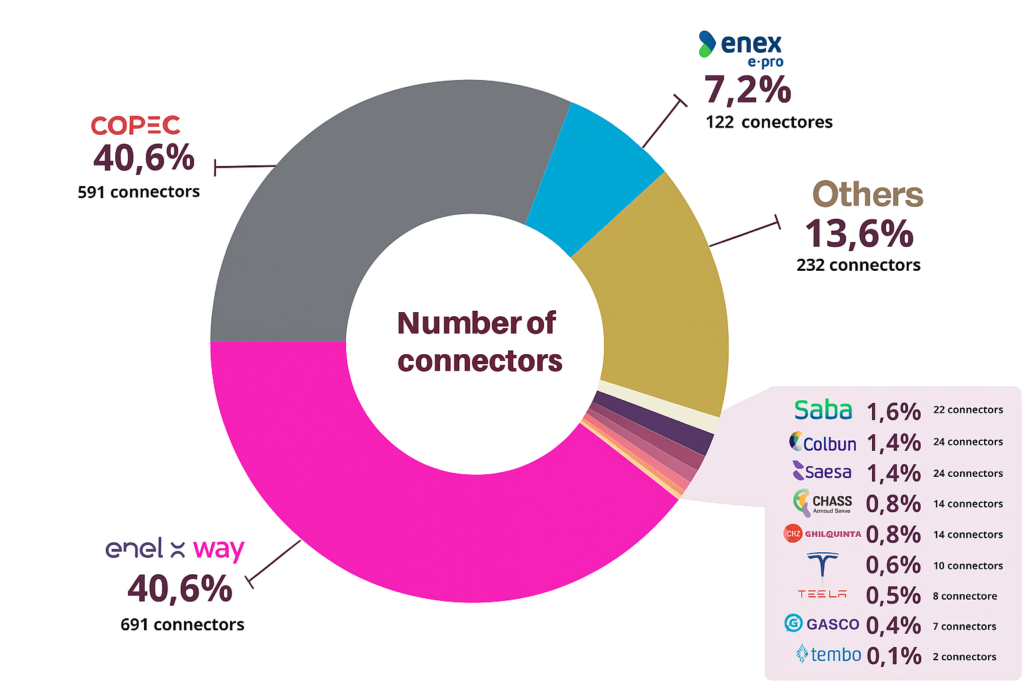

A market dominated by a few operators

Infrastructure development is also marked by strong market concentration.

Enel X Way and Copec Voltex control more than 70% of public connectors nationwide. In the rapid charging segment, this dominance rises to 96% when Enex Pro and smaller players are included.

Enel X Way operates 691 connectors (40.6%), while Copec Voltex accounts for 525 (30.8%).

The remainder of the market is fragmented among operators with less than 2% market share, according to the latest data from the Superintendence of Electricity and Fuels (Superintendencia de Electricidad y Combustibles, SEC).

Alongside the expansion of the network, May saw the introduction of a new tariff policy: time-differentiated pricing.

Enel X Way increased its rapid charging tariff from CLP $340 to $395 per kWh during peak hours (17:00–22:59), an increase of 16.2%.

Other operators applied more moderate adjustments, such as EVX Smart Charging, which raised its rates by 3.9%.

However, the introduction of time-based pricing puts pressure on infrastructure usage during peak periods, especially for users without access to home charging.

Lack of standardisation and a fragmented user experience

Chile’s public charging ecosystem continues to operate without a unified technical standard. Each operator defines its own access requirements, interfaces, power levels and payment systems.

This has led to a fragmented and poorly interoperable user experience, resulting in recurrent difficulties locating, using and paying for charging services.

The Superintendence of Electricity and Fuels is expected to make progress on establishing a common technical regulation, but no formal roadmap has yet been published.

Industry associations such as ANAC and AChVE stress that without this regulatory foundation, it will not be possible to ensure a truly interoperable and efficient network.

Investments led by the private sector

At present, infrastructure deployment depends almost entirely on private capital.

Over the past year, companies such as Copec Voltex, Enel X Way and Tessa have announced investments totalling over CLP $12 billion, although the majority of projects are concentrated in high-density urban areas.

The government expects the newly announced Green Infrastructure Fund to begin directing resources towards areas with low coverage, but neither the mechanism nor the implementation timeline has yet been defined.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away. With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

Can a “super ministry” accelerate electric mobility in Poland?

While registrations of zero-emission vehicles are breaking records in the country, industry leaders warn of the political challenges accompanying the progress of eMobility: “New regulations should be prepared at the beginning of autumn.” Could a state restructuring be the answer?

-

Spark Alliance: the largest and most trusted charging network is now live

Created by 4 of Europe’s leading CPOs, the Spark Alliance is setting the bar for what EV charging should be: fast, seamless, and flawlessly connected. What does it consist of?

-

Europe has 1,100 public E-Truck chargers but distribution remains uneven

In a new white paper, Milence delivers a clear, data-driven answer: while today’s infrastructure can support the current fleet, rapid and strategic expansion is essential to enable widespread adoption by 2030. How can this trend be accelerated?