ChargePlanner is a Software as a Service (SaaS) solution that, leveraging up-to-date market data and artificial intelligence, helps predict the usage of future sites and define their optimal setup, determining the potential for slow, fast, and ultra-fast charging separately.

Months ago, Dieter Debels, Founder & CEO at RetailSonar, told Mobility Portal Europe that while the company already offers this solution for electric car charging, they would be launching it for trucks.

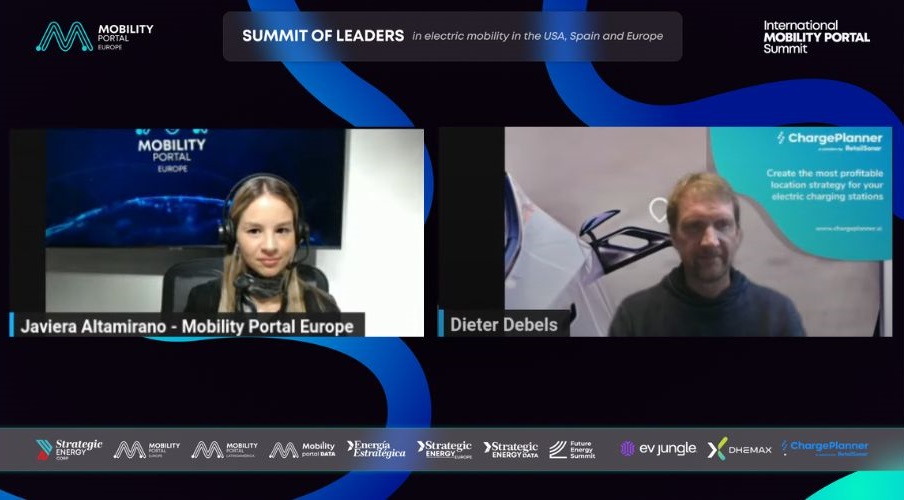

In this regard, during the “Summit of Leaders in Electric Mobility in the USA, Spain, and Europe,” Debels reveals more details about this initiative.

At the event, the CEO indicates that within less than two months, this solution for electric trucks will be available for some of ChargePlanner’s clients in France and Belgium.

“We have our first deliveries scheduled for early December for charging point operators (CPOs) who are investing in megawatt infrastructure,” Debels announces.

He also confirms, “It is clear that a big market is opening up for truck chargers and that the future of sustainable mobility will be electric, rather than hydrogen.”

It is worth mentioning that the company plans to offer this solution in other European countries next year.

“What’s interesting is that today we are monitoring the current stops of truck drivers at parking lots and logistic centres, as well as traffic on the roads,” he explains.

“We have access to data from 20% of truck drivers in Europe,” he adds.

It is important to note that the solution will be of the same quality as for light vehicles.

The software allows for the prediction of new charging point usage based on up-to-date market data and artificial intelligence.

From these data sets, predictive models are built that can be tested in each potential location to identify critical spots across Europe.

For instance, the software takes into account traffic on each road segment, visitor counts at nearby points of interest, local residential potential, competition data, and also the pricing of nearby competitors.

Currently, ChargePlanner is helping around 20 large CPOs in Europe make informed investment decisions to roll out charging infrastructure and optimise local pricing by location.

The software is now available in nine countries, including Spain, Portugal, France, Germany, UK, The Netherlands and Belgium.

“We are looking to expand the application across Europe in the coming months,” the CEO confirms.

“We are one step ahead in this emerging market thanks to the technological history of RetailSonar behind us, which automatically helps us expand,” he adds.

It is worth noting that expansion into other countries is primarily happening through active sales channels in European offices—in France, Germany, the Netherlands, and Belgium—but also by following clients like TotalEnergies and PowerDot, who are expanding across the continent.

“The most challenging part for us is activating local CPOs in countries where we don’t have direct sales channels, such as in Spain and Portugal. We are seeking a solution to this,” Debels says.

ChargePlanner helps implement the ‘ideal’ strategy for CPOs

This year, the European Union (EU) introduced certain requirements for CPOs: prices must be ad-hoc and transparent, and credit card payments must be accepted.

“This will push electric vehicle drivers to become more price-sensitive, as they will be able to easily compare prices and pay less,” explains Debels.

He continues, “CPOs need to consider their pricing strategy depending on locations, increasing costs where possible or lowering them when it can have a significant impact on customer usage.”

In summary, they must adopt the right pricing strategies to balance price sensitivity with profitability in order to remain competitive.

To start designing the ideal strategy, operators can leverage data and technology to stay competitive in response to changing needs, with the help of ChargePlanner.

Need for publicly accessible data

Debels acknowledges that the capacity limitations of electrical grids are one of the main “long-term” issues that must be resolved to further drive the charging infrastructure sector.

“They can be addressed by investing in infrastructure and smart charging technologies,” he explains.

“In the short term, it would also help if CPOs were not in the dark about where they currently have connection possibilities. Making electrical grid data publicly accessible would help,” he adds.

For example, in France and Flanders, electrical grid operators are promoting the availability of information.

However, in many other regions, this is not happening, either because the data does not yet exist in digital form, or because companies are reluctant to reveal their weaknesses.

“We hope the EU can help push this forward because if that data becomes available, CPOs will be able to make strategic moves: if they make the right decisions and have profitable chargers, fewer subsidies will be needed to grow the business,” the CEO assures.

“This is one of the biggest infrastructure challenges of the past decades. We will only overcome it if we collaborate between governments, electrical grid operators, CPOs, and the technology sector,” he concludes.