In Costa Rica, electric vehicles stopped being a novelty some time ago. According to the Costa Rican Association for Electric Mobility (ASOMOVE), over 9,647 EVs were sold in 2024, reaching a 12% market share in the light vehicle segment.

Behind announcements of new brands and models, however, a pressing question is gaining traction among individual users, businesses, and mobility platforms: which EV offers the lowest Total Cost of Ownership?

All signs point to the newly launched BYD Seagull leading the way.

“It’s widely used on ride-hailing platforms because they rack up a high number of kilometres,” explains Eric Orlich, President of ASOMOVE, in an interview with Mobility Portal Latin America.

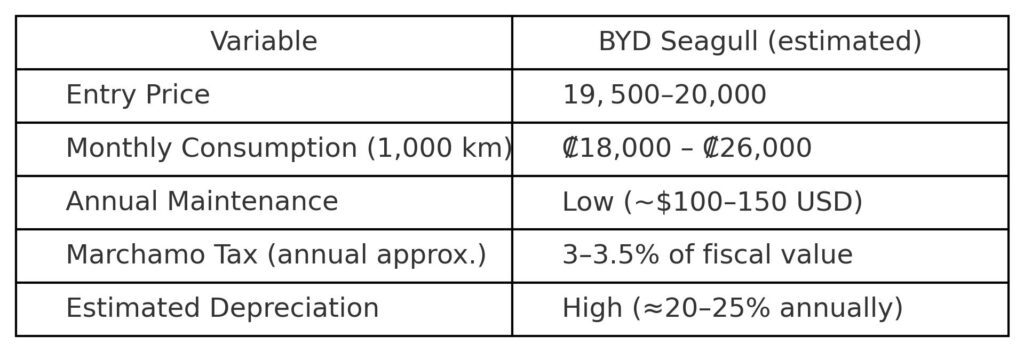

Priced between $19,500 and $20,000, the Seagull is positioned as the most affordable electric model on the Costa Rican market.

Its technical specifications (55 kW motor, up to 405 km range, Blade battery of 30 or 38 kWh, and DC fast charging) are tailored for high-usage urban environments, boosting its popularity among app drivers using platforms like Uber and DiDi.

Maintenance: minimal, almost non-existent

One of the most influential factors in TCO is preventative and corrective maintenance. Here, like most BEVs, the Seagull has a clear advantage over internal combustion models — and even hybrids.

With no gearbox, exhaust system, or fuel injectors, BEVs eliminate many common wear-and-tear parts.

In typical private use, annual maintenance costs are just 10% of those for a combustion vehicle — and even lower in optimal conditions.

How much does it cost to charge a Seagull in Costa Rica?

In terms of energy consumption, the Seagull averages 10 to 13 kWh per 100 km. For private urban use of around 1,000 km per month, this equates to 100 to 130 kWh. With residential electricity rates ranging between ₡180 and ₡200 per kWh, this translates to ₡18,000 to ₡26,000 per month (roughly $34 to $50 USD).

“A typical private car in Costa Rica covers about 1,000 kilometres per month. A ride-hailing vehicle — where BYDs are commonly used — can do 300 kilometres a day. Naturally, that impacts energy use in kilowatt-hours,” the expert notes.

For high-mileage ride-hailing use, monthly consumption can exceed 900 kWh, with proportionally higher electricity costs — though still significantly cheaper than fossil fuels.

Depreciation and resale value

Another key component of the TCO equation is depreciation. EVs — particularly in the entry-level segment — tend to lose value more quickly due to the rapid pace of technological advancement in the sector.

“Depreciation has typically been high, because each year new models arrive offering more features for the same price,” he explains. “Or prices drop because battery costs fall.”

This can impact resale value, posing one of the main challenges for the segment.

However, this trend may begin to shift as a formal second-hand electric vehicle market develops in Costa Rica.

Why Is the seagull leading in TCO?

At Mobility Portal Latin America, we’ve analysed the five key variables that make up the Total Cost of Ownership of an electric vehicle in Costa Rica:

Despite its accelerated depreciation and still-high road tax, the Seagull makes up for it with extremely low running costs, making it ideal for high-mileage urban use.

Compared to more expensive models such as the Dolphin, the JAC E10X or the Changan Lumin, its Total Cost of Ownership (TCO) ends up being more favourable over a 3- to 5-year horizon—especially when current tax benefits are taken into account.

It is worth noting that Costa Rica enforces Law No. 9518, which exempts electric vehicles from several taxes (VAT, excise, import duties) and from the road tax for a five-year, gradually decreasing period. This enhances the competitiveness of the BEV segment versus internal combustion vehicles.

READ MORE

-

UK updates eligibility criteria for the Electric Car Grant

The UK Government sets new technical and environmental requirements that manufacturers must meet for their electric vehicles to qualify for grants of up to £3,750.

-

Deftpower raises €12.5M to boost European growth and enhance its AI-powered charging tech

Deftpower aims to make EV charging cheaper, cleaner, and smarter for drivers and CPOs, while easing pressure on Europe’s congested power grids.

-

Ekoenergetyka: Investing in EV charging at car parks is more crucial now than ever before

Public car parks are no longer just simple transit points. With the addition of chargers, they are becoming strategic hubs for electric mobility. What is Ekoenergetyka’s strategy?