The European automotive industry could return to producing 16.8 million cars per year — matching its post-2008 crisis peak — if the European Union (EU) sticks to its 2035 clean vehicle target and strengthens industrial and demand-side policies, according to a new study.

According to the report published by the environmental group T&E, this would mean that jobs across the automotive value chain would remain at current levels.

The report models the impact of maintaining the EU’s zero-emissions target for 2035 and implementing new industrial policies to boost domestic EV production — such as electrification targets for corporate fleets and support for EU-made cars and batteries.

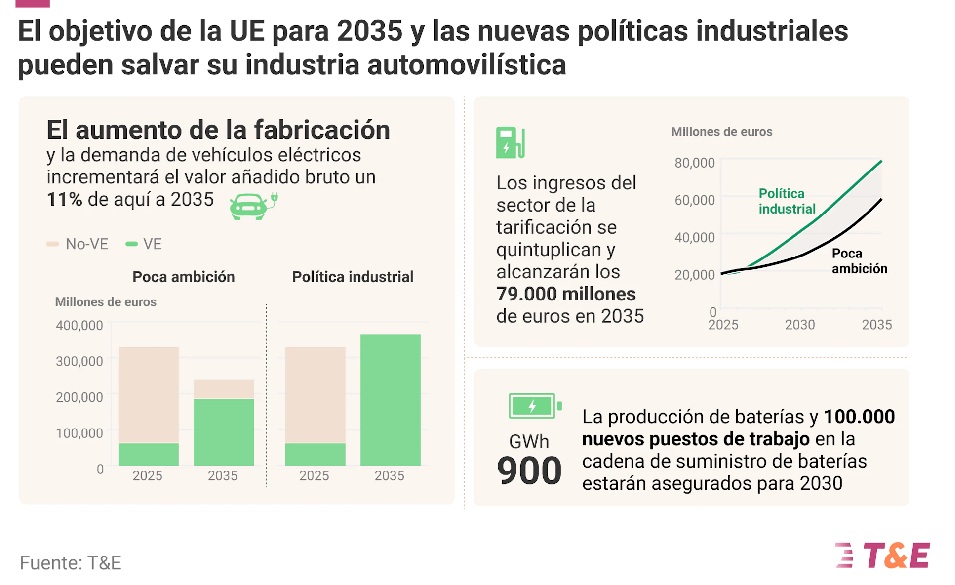

Under this scenario, the contribution of the automotive value chain to the European economy would increase by 11% by 2035 compared to today.

Batteries and Charging

Job losses in vehicle manufacturing could be offset by the creation of over 100,000 new jobs in battery production by 2030, and 120,000 in the charging sector by 2035, according to the study.

The EU could produce up to 900 GWh of batteries annually (up from 187 GWh today) by 2030 if it maintains its zero-emissions goal and enacts supportive industrial strategies.

The economic output of the charging sector could grow almost fivefold to reach 79 billion euros by 2035.

However, according to the report, if the zero-emissions target is weakened — as EU lawmakers are currently being pressured to do — and comprehensive industrial policies are not put in place, the contribution of Europe’s automotive value chain to the economy could fall by 90 billion euros by 2035.

In this scenario, up to one million jobs could be lost compared to current levels.

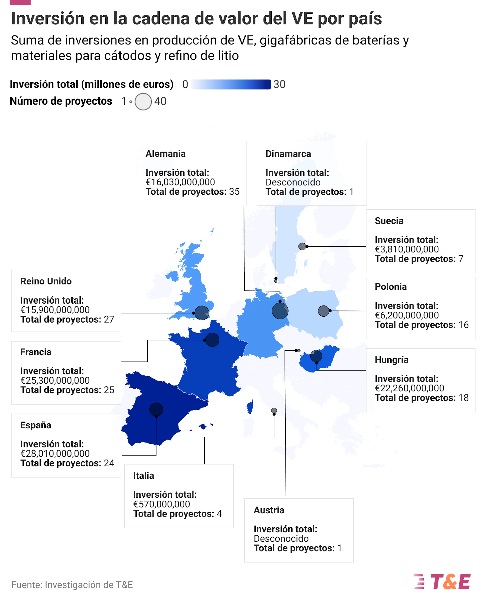

Up to two-thirds of planned battery investments in the EU could also be lost, while the charging sector could miss out on 120 billion euros in projected revenues over the next ten years.

Laura Vélez de Mendizábal, electromobility expert at T&E Spain, says: “This is a decisive moment for the European automotive industry, as the global competition to lead in electric car, battery and charger production is intense.”

“Europe’s success depends on the path EU policymakers choose today. Sticking to the 2035 zero-emissions target, alongside adopting strong industrial and demand-side policies, is the EU’s best chance to return to higher car production, preserve employment levels, and grow the economic value of its automotive industry,” she adds.

According to T&E, the EU must prioritise industrial leadership in electric vehicles across all its climate and industrial policies if it wants to preserve the economic contribution and employment levels of the car sector, while maximising new investments and job creation in the battery and charging industries.

This includes:

- Maintain the 2030–2035 CO₂ targets for cars in the upcoming review of the regulation, accompanied by EU-wide measures to support demand.

- Introduce support for EV battery production both at EU level and through national funding sources, along with incentives to purchase components and materials made in the EU.

- Implement the EU Alternative Fuels Infrastructure Regulation, electricity market reforms, and grid action plans to accelerate the rollout of chargers, grid connections, and permitting processes.

- Integrate social conditionality to ensure quality jobs and strengthen provisions on technology transfer and skills in foreign direct investment.

Three industry associations have reviewed the report and support its high-level message on the economic and employment potential of Europe’s electric vehicle transition.

They agree that this transition requires both stable targets and stronger industrial and demand-side policies, though they do not endorse all aspects of the report.

Chris Heron, Secretary General of E-Mobility Europe, states: “Europe still has hundreds of thousands of new jobs to seize in its transition to electric vehicles — but only if it acts with courage and political determination. The global race for EV leadership is already underway, and we cannot afford to let other regions pull ahead.”

“Europe needs to hold firm on its 2035 target to guide investment into EVs, batteries, materials, and charging. But it also needs a tangible step forward in its industrial and demand-side policies to show businesses it truly means business,” he adds.

Ilka von Dalwigk, Secretary General of RECHARGE, indicates: “This study echoes what industry leaders have long been warning: Europe risks losing one of the most strategic sectors of the green transition.“

“The EU’s questioning of the 2035 target and its failure to implement effective support systems for battery production are putting one of the most important clean tech industries at risk. The study confirms that if we move swiftly, we can secure hundreds of gigawatt-hours of locally produced clean batteries.”

Lucie Mattera, Secretary General of ChargeUp Europe, says: “The energy transition is a driver of Europe’s competitiveness, powering innovation, investment and new opportunities. The charging infrastructure sector plays a key role in this transformation and is on track to deliver long-term value and a range of quality jobs across the continent.”

She continues: “To fully unlock this potential, stable and predictable regulatory conditions — such as the 2035 target — are essential.”

READ MORE

-

Krizansky (E-Mobility Europe): “Many CPOs are unwilling to offer competitive roaming prices”

The European Union has surpassed 1 million charging points. However, this progress must be matched by improvements that enhance user experience. Which key areas need attention?

-

UTA Enred expands: clients can now access 925,000+ charging points across more countries

UTA Edenred expands UTA eCharge to Switzerland, the UK, Denmark, Sweden, Norway, and Finland, meeting all the needs of electric vehicle fleets.

-

Kehua’s 40kW SiC Module certified for compliance with key international standards

This charging module from Shenzhen Kehua has successfully obtained international certifications, including CE, CB and UL, which ensure compliance with major global market standards.