Based on the latest registration data published by IDEAUTO, Mobility Portal España conducted a detailed analysis of the year-on-year performance of leading eMobility brands, with a focus on the BEV segment.

The study compares volumes from January to May 2024 with the same period in 2025.

Figures reveal significant disparities: while Tesla is retreating, brands such as Citroën, BYD and Kia have seen growth of over 400%, driven by new product launches and stronger price competitiveness.

Tesla and the decline of eMobility leadership

With 3,640 units registered in the first five months of the year, Tesla remains the BEV volume leader in Spain, despite a year-on-year decline of 10.5%.

Its two flagship models, the Model 3 and Model Y, accounted for the majority of registrations. However, the lack of technological updates and increased market competition have eroded its relative share.

Kia: steady strategy with the EV3 as a growth engine

Kia posted growth of 179.4%, rising from 890 to 2,486 BEV units.

The launch of the EV3, a compact SUV with a range of over 500 km and an entry price of around €37,000, proved decisive.

It joins the existing line-up alongside the EV6 and other well-established models.

Citroën: surge from low volumes with the ë-C3

The French brand multiplied its eMobility registrations sevenfold, driven by the new ë-C3, an urban model offering 320 km of range (WLTP) and starting at €23,800.

Produced in Europe, the model targets the entry-level BEV segment and was responsible for the jump from 180 to 1,266 units.

BYD: consistent expansion with a diversified line-up

BYD increased BEV registrations from 285 to 1,451 between January and May, marking a 409% rise. Its main model, the Seal U, features the Blade battery and offers up to 500 km of range.

In May, the brand added the Seal U DM-i Comfort, a plug-in hybrid version delivering up to 125 km electric range and a total range exceeding 1,100 km.

The range also includes the urban Dolphin, targeting private buyers, as well as fleet- and business-oriented models, underpinning a diversified market strategy.

Renault: repositioning with the R5 and Megane E-Tech

Renault doubled its eMobility volume thanks to the comeback of the R5 as a compact BEV and the growing success of the Megane E-Tech.

Both models contributed to a 141.3% increase compared to 2024. The brand benefits from local manufacturing and access to national incentives.

How is Spain’s eMobility market progressing?

Between January and May 2025, a total of 76,688 electrified vehicles (BEV + PHEV) were registered in Spain, reaching a cumulative market share of 14.98%.

This overall growth masks notable disparities by brand origin: while some European manufacturers show tactical gains, Asian brands are rapidly expanding their share, backed by renewed product lines and a more agile response to consumer demand.

READ MORE

-

Strategy for CPOs: how to take EV driver charging experience to the next level

As EV sales rise and public networks grow, the charging experience becomes key. Like petrol stations, EV hubs add services to boost value — that’s why leading OEMs and CPOs partner with 3M.

-

West Yorkshire Combined Authority picks firm for £1.4m EV charging infrastructure project

The project will see the deployment of 716 EV chargers across West Yorkshire, comprising a combination of standard, fast, and rapid chargers, delivering the right mix of speeds to address multiple charging applications.

-

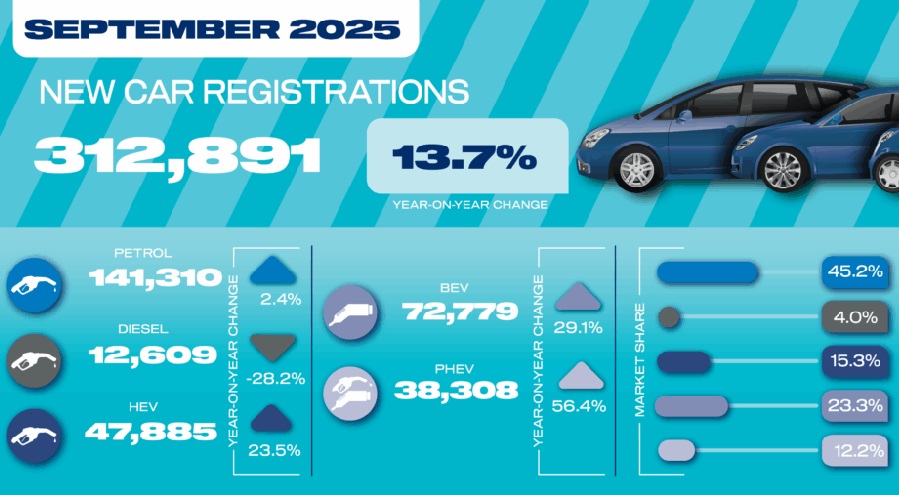

BEVs in the UK hit record monthly high with 72,779 units sold in September

September was the first month in which manufacturer discounts, an expanding range of models, and the introduction of the UK’s Electric Vehicle Grant significantly boosted registrations of BEVs.