The European Commission is investigating whether the plant that BYD plans to build in Hungary has received subsidies from the Chinese government, according to a report published on Thursday by the British newspaper Financial Times, citing two sources familiar with the matter.

The newspaper notes that this move targets the “increasingly deep” economic ties between the Hungarian government under Prime Minister Viktor Orbán and China.

According to the report, the European Commission is in the early stages of an investigation into foreign subsidies at the BYD plant.

This could “further escalate trade tensions with Beijing.”

Therefore, if Brussels discovers that the Chinese car manufacturer has benefited from “unfair” state aid, it could force BYD to sell some of its assets, reduce its capacity, repay the subsidy, and potentially face a fine for non-compliance.

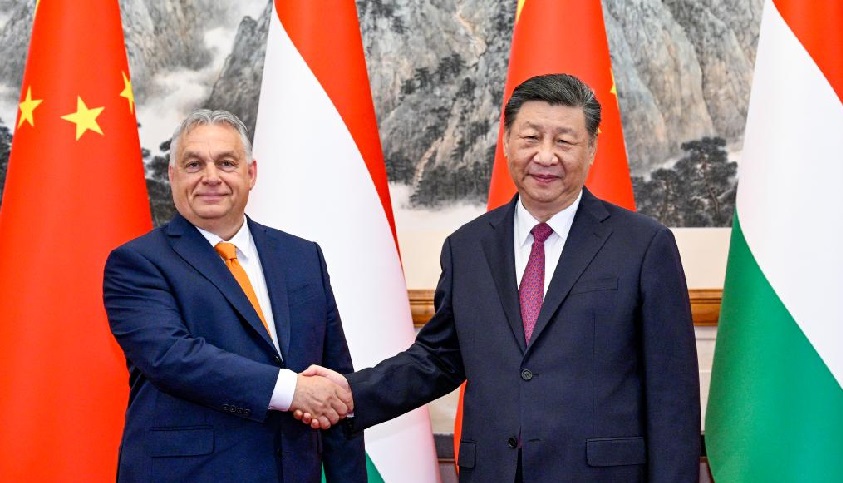

The newspaper also recalls that Orbán hosted President Xi Jinping in Budapest last year and has managed to attract a quarter of all Chinese investment that has come to Europe in recent years.

In this regard, it highlights that Hungary expects an investment from BYD in the Szeged region, in the south of the country, of four billion euros, which could create up to 10,000 jobs.

EU officials stated that the factory was built with Chinese labour and primarily uses imported parts, including batteries, which generate little economic value for the bloc.

The Hungarian Minister for Europe told Financial Times that Hungary was not informed about the investigation.

“It’s not surprising, and it is well known that any investment made in Hungary quickly appears on the Commission’s radar, and the Commission closely monitors every decision on state aid made in Hungary,” he commented.

In October last year, the European Commission determined that both BYD and other Chinese car manufacturers had received subsidies, following a trade investigation that led to the imposition of tariffs on imports.

The European Commission’s investigation concluded that BYD had received such subsidies and imposed a 17% tariff on the imports of its vehicles to Europe.

READ MORE

-

“Installing on the cheap ends up being costly”: Smart Wallboxes issues warning amid eMobility installation boom

Elis Álvarez, CEO of Smart Wallboxes, warns of the risks of cutting costs at a time of record EV sales and rapid expansion of charging points across Spain.

-

European manufacturers welcome EU’s “bold” proposals for the automotive sector

European manufacturers welcomed the fact that, while not all differences have yet been resolved and not all answers to the challenges are known, the range of solutions has expanded, with “concrete” proposals across all areas.

-

Porsche tests inductive charging in Germany: When will it launch across Europe?

Porsche will be the first car manufacturer to bring an 11 kW charging system with a ‟one-box” base plate for battery-electric vehicles to markets.