Chinese manufacturers also continue to benefit from the current regulatory framework. Plug-in hybrid vehicles imported from China are not subject to tariffs, and several Chinese brands still sell internal combustion engine models in European markets where EV adoption remains limited, such as Poland.

Prior to Tuesday’s announcement, consultancy AlixPartners had forecast that fully electric vehicles would account for just 62% of Europe’s new car sales by 2035, citing doubts over whether the EU’s original combustion engine ban could be fully enforced. According to partner Nick Parker, the latest policy shift is unlikely to materially change that outlook.

A slower transition to full electrification could, however, give markets more time to deploy charging infrastructure, one of the structural bottlenecks behind the uneven uptake of electric vehicles across Europe.

Industry data show that EU battery-electric car sales rose 25.7% year-on-year through October, reaching 16.4% of total vehicle sales. Yet EVs still represent a marginal share of the market in southern and eastern Europe, highlighting persistent regional disparities.

Carmakers invested billions in electrification

The policy adjustment represents a setback for automakers and suppliers that have invested tens of billions of euros in electric vehicle development and factory expansion, based on EU legislation that only entered into force in 2023.

At the same time, greater technological flexibility could encourage new partnerships focused on affordable EVs, such as the recently announced collaboration between Ford and Renault to develop small electric models for the European market.

Just one day before the EU’s announcement, Ford disclosed a $19.5 billion writedown and plans to cancel several electric vehicle programmes.

“This will ultimately drive more cooperation and platform-sharing across the industry,” said Joe Stevenson, CEO of UK-based startup Anaphite, which is developing dry-coating technology for battery electrodes aimed at reducing EV costs.

Industry calls for regulatory certainty

Ahead of the policy shift, Ford CEO Jim Farley publicly urged Brussels to provide regulatory clarity, warning that frequent changes undermine long-term investment planning. As recently as March, the European Commission had already given automakers “breathing space” by allowing compliance with 2025 emissions targets to be spread over three years, followed by further adjustments nine months later.

“That’s not how you plan long-term capital investment,” Farley said. “We need certainty.”

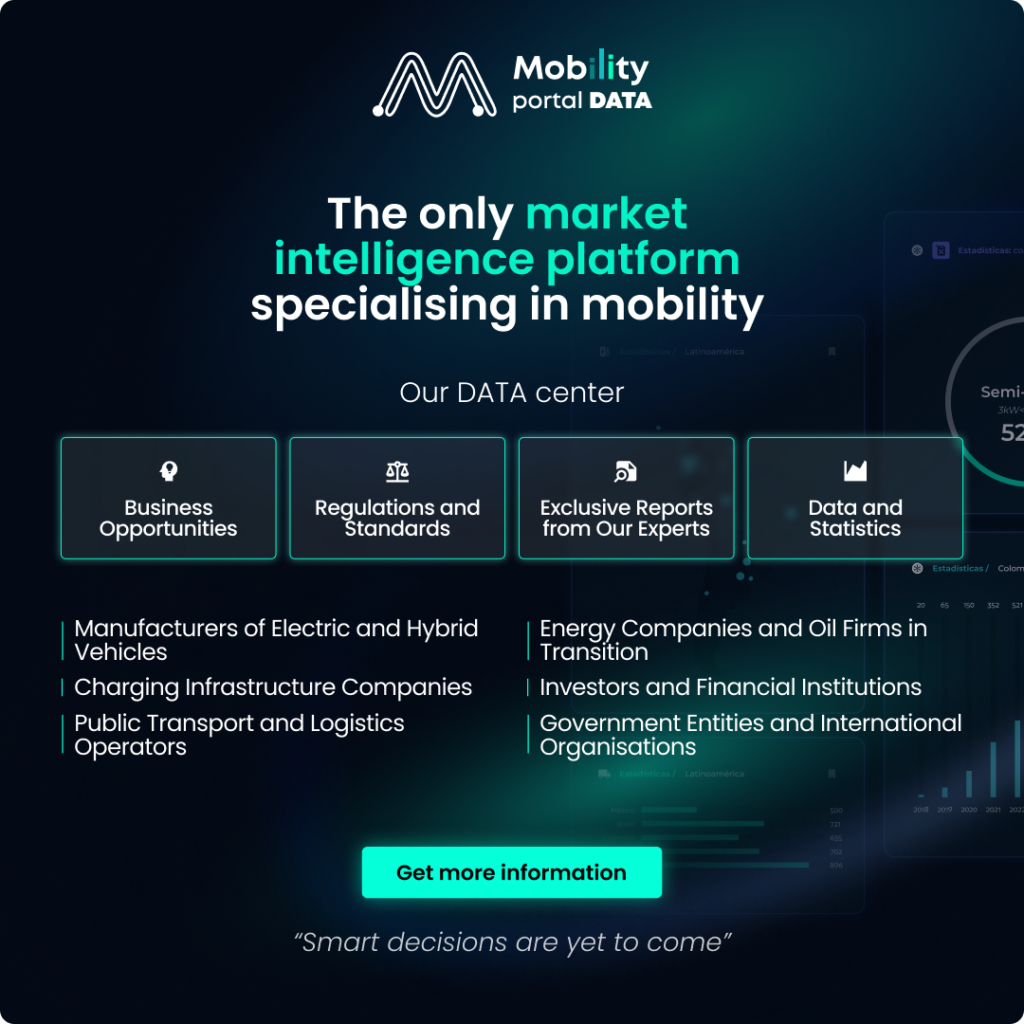

Discover Mobility Portal Data

Discover Mobility Portal Data, a new, exclusive market-intelligence platform offering reliable datasets and essential reports to support informed decision-making across the automotive sector—from combustion and electric vehicles to charging infrastructure.

Research, trend analysis and well-organised statistics, presented with clarity and precision, together with up-to-date insights—all just one click away. With Mobility Portal Data, better decisions are within reach.

READ MORE

-

chargecloud Expands Marketplace with AI-Based Support: Cooperation with Lemonflow Technologies

The integration brings 24/7 AI-powered user support, fully embedded into the chargecloud ecosystem, aiming to enhance operational efficiency and service quality for CPOs across Europe.

-

EV transition in Europe slows, but momentum remains after EU climbdown

EU policy flexibility may ease short-term pressure on automakers, yet rising EV sales, infrastructure needs and long-term investment signal that electrification remains the industry’s core trajectory.

-

EnBW and Alpitronic strengthen long-term partnership to scale high-power charging across Germany

The agreement covers fast-charging hardware, joint development of future functionalities and a multi-year maintenance framework to support EnBW’s expanding HPC network.