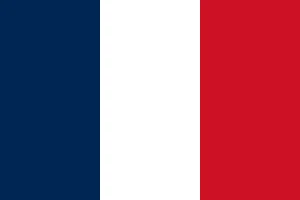

With 93% of LCVs still diesel-powered and an average age of 10 years, France’s fleet faces a dual challenge: environmental and public health.

One in two vans is over 15 years old, and in dense urban areas like Paris, vans make up 17% of traffic but more than 25% of air pollutants.

These figures, part of Mobility Portal Europe’s analysis based on the “Briefing VUL” report (March 2025), highlight a critical gap: while France dominates in fleet size, it lags behind in the decarbonisation of the professional transport sector.

A growing electric offer, but limited fiscal suppor

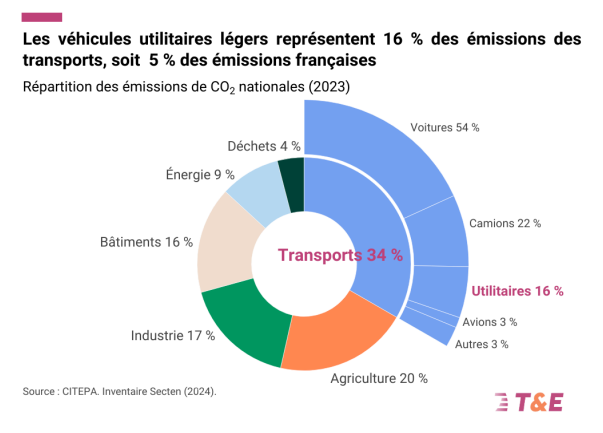

France has started to cut emissions in new LCVs—dropping from 181 to 166 gCO₂/km in 2024, an 8% improvement from 2023. However, a further 7% cut is needed to hit the 2025 target of 154 gCO₂/km, and a 40% reduction is required by 2030 (down to 91 gCO₂/km).

There are 43 electric van models available—compared to 49 combustion models—and the zero-emission offer is expected to outnumber thermal by 2026.

But 2025 also marked the end of the purchase bonus for electric LCVs, replaced by a more complex Energy Savings Certificate (CEE) scheme. Unlike electric cars, LCVs don’t benefit from tailored tax incentives, making it harder to achieve a favourable total cost of ownership.

Companies at the centre, with uneven capacities

Businesses own 52% of the LCV fleet and account for 90% of new registrations. Yet, 49% of commercial fleets are operated by small firms with fewer than 20 employees, many of them in construction, retail or delivery. These firms often face significant financial and operational obstacles when switching to electric.

In the construction sector alone, 25% of all business LCVs are concentrated, and 80% of those are operated by companies with fewer than 50 staff.

In delivery, the picture is mixed—many operators are self-employed or work for large retailers, making the transition even more complex.

Meanwhile, low-emission zones (ZFE) are beginning to show results. In cities like Paris and Montpellier, LCVs are newer and less polluting than the national average, proving the effectiveness of local restrictions. By 2025, 40 French metropolitan areas must implement such zones.

An industrial opportunity for France

Over 60% of LCVs sold in France in 2024 were from domestic brands—Renault (31%), Peugeot (18%) and Citroën (13%)—and 38% were assembled in France, far more than the 15% seen in passenger cars.

This makes LCVs a strategic lever for reindustrialisation and job creation. French brands already dominate the electric van segment, holding two-thirds of e-LCV sales in 2024.

Projects like Flexis SAS, a joint venture between Renault, Volvo and CMA CGM, aim to reinforce France’s industrial edge by developing a new generation of electric vans.

According to the “Briefing VUL” projections, if battery costs continue to fall, electric vans will be cheaper than diesel models before 2027, even without major autonomy increases.

Nine measures to lead in electrification

Transport & Environment outlines nine key actions to accelerate the shift:

- Stick to the 2035 zero-emission target for new LCVs.

- Support the electrification of large fleets to secure market demand.

- Reform fiscal policy to make e-LCVs economically attractive.

- Provide tailored support to SMEs, simplifying access to incentives.

- Introduce an eco-score for LCVs, promoting efficient EU-made models.

- Establish zero-emission logistics zones (ZZEs) by 2030.

- Tax e-commerce platforms based on delivery volume, funding public transport.

- Include zero-emission vehicle criteria in public tenders.

- Conduct sector-specific studies to address charging and financing barriers.

From volume to leadership

France already leads in size, with a vast market, industrial base and ambitious targets. But true leadership in electrification demands bolder structural decisions and consistent fiscal policies.

As Mobility Portal Europe’s analysis based on the “Briefing VUL” concludes, the country has a unique chance to turn its industrial scale into an environmental advantage. What’s needed now is speed.