Car industry sales in Germany fell by 5% in 2024, after consistent growth over the previous three years, with total revenue amounting to 536 billion euros last year, compared to 564 billion euros in 2023.

In this context, nearly 19,000 jobs were lost. Just over 761,000 people remained employed in the automotive industry by the end of last year, down from 780,000 a year earlier.

Meanwhile, the turnover of suppliers based in Germany dropped by 8% compared to the previous year, from 92.1 billion euros in 2023 to 85.2 billion euros, according to an analysis published by auditing and consulting firm EY.

“The German automotive industry is going through a massive and widespread crisis,” says EY automotive expert, Constantin Gall.

The issues in the country range from weak demand due to the current economic crisis to excessive costs and the expensive coexistence of combustion engines and electric cars, where the push towards electromobility is not yielding the expected results.

Several German manufacturers have recently announced cost-cutting programmes.

In the coming years, thousands of jobs will be cut in Germany at manufacturers such as Mercedes-Benz, Porsche, and Volkswagen.

“This year we will see car manufacturers massively cut costs to increase their resilience. This will inevitably lead to significant job cuts,” Gall commented.

GERMAN EXPORTS TO CHINA FALL BY 17%

The automotive sector faced the collapse of exports to China, which fell by 17% in 2024, with a turnover of 20.3 billion euros, after already dropping by 18% in 2023.

Germany’s largest export volume went to the United States (US), with over 34 billion euros, a 1.8% increase year-on-year.

The third place was occupied by the United Kingdom, with 20.3 billion euros in turnover (-4.4%).

In total, of the top ten export markets, only two— the US and Poland— saw growing values.

Overall, exports of vehicles and their components totalled 262 billion euros— almost half of Germany’s total turnover— down 4.12%, after the German industry reached 272.8 billion euros in 2023.

However, the significant importance of the US sales market could pose particular problems for the German automotive industry with the imposition of tariffs by the Trump administration.

Last year, 13% of Germany’s automotive exports were destined for the US.

Given recent geopolitical developments, EY considers it highly likely that there will be large-scale production relocations to the US or China in the future, which could lead to more layoffs in factories.

“This would significantly accelerate job losses in Germany,” says the expert.

Finally, EY’s analysis emphasises the urgent need for electromobility to have a “clear” roadmap in Europe, as the current duality of combustion engines alongside electrified ones is “severely affecting suppliers by making very costly investments” whose results are yet to materialise.

Read more

-

Can a “super ministry” accelerate electric mobility in Poland?

While registrations of zero-emission vehicles are breaking records in the country, industry leaders warn of the political challenges accompanying the progress of eMobility: “New regulations should be prepared at the beginning of autumn.” Could a state restructuring be the answer?

-

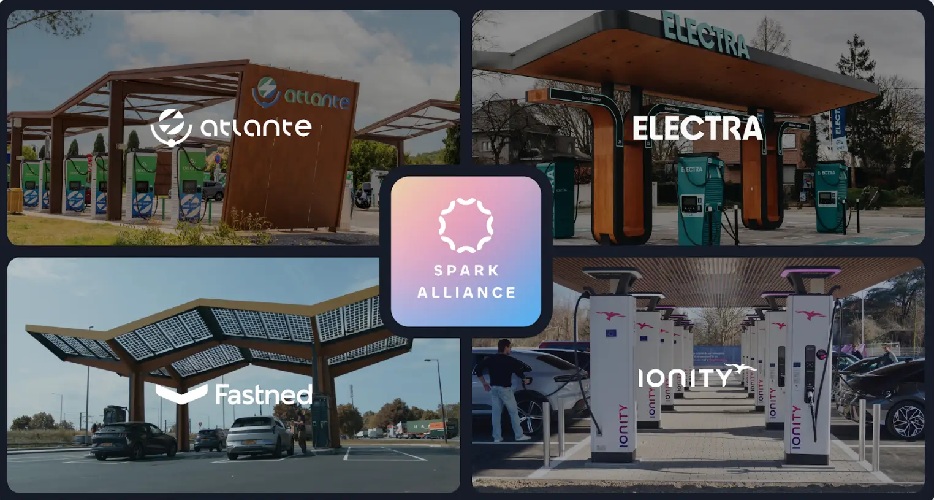

Spark Alliance: the largest and most trusted charging network is now live

Created by 4 of Europe’s leading CPOs, the Spark Alliance is setting the bar for what EV charging should be: fast, seamless, and flawlessly connected. What does it consist of?

-

Europe has 1,100 public E-Truck chargers but distribution remains uneven

In a new white paper, Milence delivers a clear, data-driven answer: while today’s infrastructure can support the current fleet, rapid and strategic expansion is essential to enable widespread adoption by 2030. How can this trend be accelerated?