According to Transport & Environment’s Good Tax Guide, Germany and Poland not only fail to discourage the acquisition of polluting vehicles but, in some cases, even incentivise their purchase.

In Germany, acquiring a luxury SUV such as a BMW X5 or an Audi Q7 can generate a net fiscal benefit of €7,072 for companies over a typical four-year ownership period.

This benefit is driven by:

• Full VAT deduction (19%),

• Complete vehicle depreciation allowances,

• Low ownership taxes based on emissions.

Crucially, Germany applies no acquisition tax based on CO₂ emissions or vehicle weight, measures commonly used in other markets to discourage high-emission models.

The impact is clear.

Germany accounts for 40% of all large SUVs sold to corporate fleets in the European Union, despite representing only 30% of corporate registrations.

In Poland, although companies do not benefit from a negative net tax balance, similar factors apply: no CO₂-based acquisition taxes and favourable flat-rate deductions.

As a result, 16% of all large SUV sales in the EU are concentrated in Poland, which accounts for just 6% of corporate registrations.

In contrast, France enforces a much stricter fiscal framework. A similar SUV incurs a tax cost of €142,912 over four years, driven by high acquisition taxes, exclusion of VAT deductions for combustion vehicles, and restricted depreciation allowances.

Consequently, only 0.3% of large combustion SUVs are sold within the French corporate fleet market.

Weak incentives for electric SUVs

The Good Tax Guide also highlights the limited fiscal support for electric vehicles (EVs) in Europe’s largest automotive markets. In Germany, the fiscal gap favouring an electric SUV over a combustion model stands at just €8,718 over four years.

In Spain and Poland, the gap barely exceeds €3,000, offering little encouragement for companies to shift to electric fleets.

In contrast, countries such as Portugal and Belgium have adopted robust fiscal policies. In Portugal, the fiscal advantage for choosing an electric SUV reaches €30,251, while in Slovenia it stands at €27,001, and in France at €24,395.

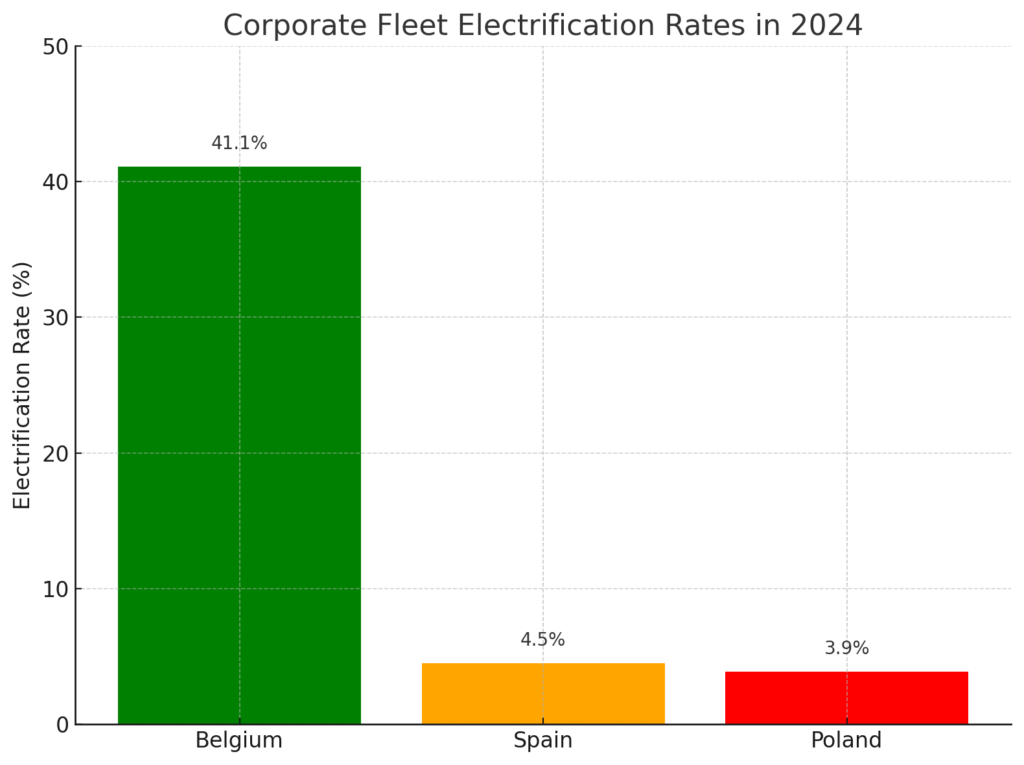

This divergence is reflected in corporate electrification rates: in Belgium, 41.1% of new corporate fleet vehicles were electric in 2024, compared with just 4.5% in Spain and 3.9% in Poland.

Thus, while Germany and Poland operate as tax havens for polluting SUVs, Portugal, Belgium and other countries have positioned themselves as fiscal safe havens for zero-emission vehicles.

Tax fragmentation of SUV in the EU

Transport & Environment’s Good Tax Guide also draws attention to the broader fragmentation in tax policy across Europe.

While some countries adopt holistic approaches that align company car taxation with climate goals, others maintain outdated frameworks that continue to favour internal combustion vehicles — particularly within the corporate segment.

According to the report, only nine EU countries apply an acquisition tax based on CO₂ emissions for company cars, despite evidence that such fiscal tools are effective in changing purchasing behaviour. Moreover, just five countries fully exclude VAT deductions for polluting vehicles.

These inconsistencies create an uneven fiscal landscape across Europe, where fleet emissions are shaped more by national tax codes than environmental ambition.

The guide indicates that harmonising fiscal policies at the EU level — for example, through minimum CO₂-based taxation thresholds or VAT reform — could play a decisive role in accelerating fleet electrification.

Although such measures fall under national competence, the widening gap between frontrunner and laggard states underscores the need for greater alignment to ensure the EU stays on track to meet its 2030 transport decarbonisation targets.

A divided fiscal map for fleet decarbonisation

The analysis collected by Mobility Portal Europe from Transport & Environment’s report shows how differences in fiscal structures shape fleet electrification trends across the continent.

Corporate SUV taxation in Europe varies significantly, with some countries reinforcing high-emission purchasing patterns, and others successfully steering corporate buyers towards cleaner options.

With corporate channels representing around 60% of new vehicle registrations in Europe, the absence of coherent tax reforms in Germany, Poland and other major markets presents a significant barrier to achieving the EU’s 2030 decarbonisation targets.

By communicating the findings of the Good Tax Guide, Mobility Portal Europe reflects how fiscal policy continues to play a central role in either accelerating or hindering the shift to clean corporate mobility.

READ MORE

-

81% of European EV users charge at home—which countries rely most on public charging?

The survey identifies where EV drivers charge most often: home leads. However, in countries such as Germany, a large share relies on public infrastructure. Which countries follow on the list?

-

159,810 electric cars were registered across Europe: which countries led the way?

667,786 new vehicles were registered, with BEVs accounting for a 15.8% market share. When including data from EFTA countries and the UK, a total of 159,810 electric cars were registered across the region.

-

Put through its paces: MAN and ABB conduct landmark MCS test week

Over the course of three days, the testing covered system and device communication, Transport Layer Security (TLS), performance validation, current ripple measurements, and charging session termination and emergency shutdown scenarios.