BEVs remain the strongest growth driver in Europe’s automotive sector, far outperforming the overall market, which grew by just 1.9%. As a result, BEVs now account for 18.3% of all new passenger cars, up from 15.4% in 2024.

With 434,627 BEVs sold (+39%), Germany regains its position as Europe’s largest EV market. Although its market share (18.4%) is close to the EU average, sheer volume places it ahead of the UK and France.

Europe’s top three BEV markets in 2025:

- Germany: 434,627 BEVs (+39%)

- United Kingdom: 386,244 BEVs (+29%), 22.4% share

- France: 250,418 BEVs, 18.9% share

The report underscores a growing divergence between Northern Europe’s mature EV markets and the slower adoption seen in Southern and Eastern Europe.

Leaders in BEV penetration

- Norway: 95.1%

- Denmark: 66.5%

- Sweden: 35.5%

- Netherlands: 35.4%

- Belgium: 33.7%

Markets falling behind

- Italy: 5.2%

- Spain: 8.5%

- Poland: 6.4% (despite +125% growth)

- Czech Republic: 5.6%

- Sharp declines: Croatia –43%, Estonia –33%, Romania –19%

Professor Bratzel: “Europe is in a critical transition phase”

CAM Director Stefan Bratzel warns that the EV rollout is being hindered by mixed political signals:

“Consumer uncertainty remains high, fuelled by ideological debates over technology openness and the possible softening of the 2035 combustion engine phase-out. Uncertainty leads to hesitation, and hesitation slows adoption.”

Although easing the 2035 ban might offer short-term financial relief to manufacturers, Bratzel argues it would be strategically damaging:

“Any slowdown in investment in future technologies would be a Pyrrhic victory for the German automotive industry.”

Industry performance: winners and losers

Across all drivetrains, Europe’s automotive market shows clear contrasts:

Winners:

- Volkswagen Group

- BMW

- Renault Group

- Chinese OEMs (+22.5%), led by BYD (+285%)

Losers:

- Stellantis

- Hyundai/Kia

- Toyota

- Tesla (–50% in Europe)

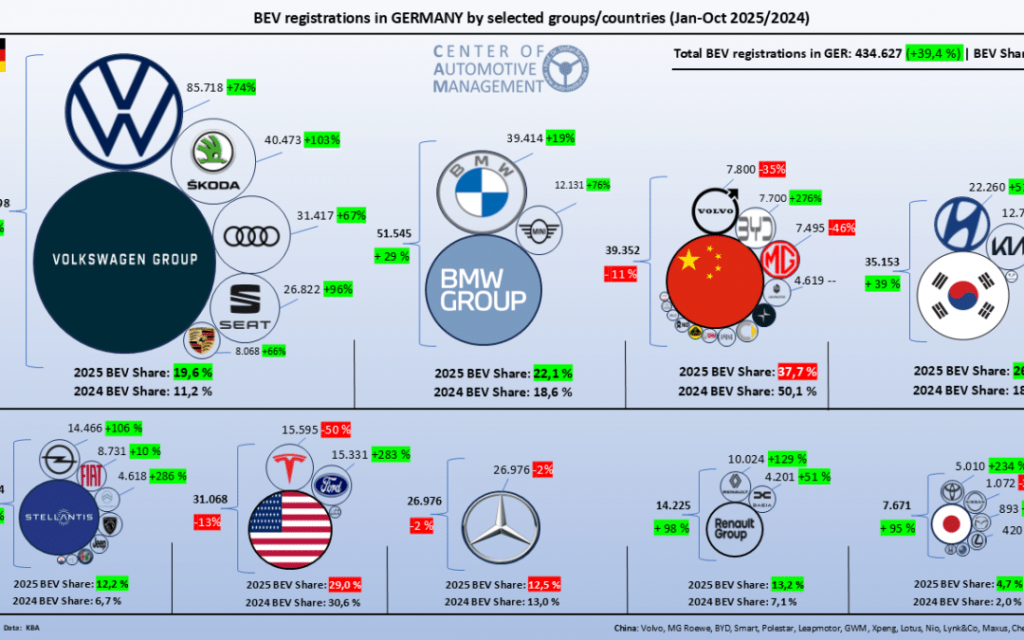

Between January and November, Germany registered 490,368 BEVs, a 41.3% increase.

Key contributors:

- Volkswagen Group: 192,498 BEVs (+81%)

- BMW Group: 51,545 BEVs (+29%)

- Hyundai/Kia: 35,153 BEVs (+39%)

By contrast, Chinese OEMs fell 11%, and Mercedes-Benz remained flat.

Discover Mobility Portal Data

Discover Mobility Portal Data, a new, exclusive market-intelligence platform offering reliable datasets and essential reports to support informed decision-making across the automotive sector—from combustion and electric vehicles to charging infrastructure.

Research, trend analysis and well-organised statistics, presented with clarity and precision, together with up-to-date insights—all just one click away. With Mobility Portal Data, better decisions are within reach.

READ MORE

-

chargecloud Expands Marketplace with AI-Based Support: Cooperation with Lemonflow Technologies

The integration brings 24/7 AI-powered user support, fully embedded into the chargecloud ecosystem, aiming to enhance operational efficiency and service quality for CPOs across Europe.

-

EV transition in Europe slows, but momentum remains after EU climbdown

EU policy flexibility may ease short-term pressure on automakers, yet rising EV sales, infrastructure needs and long-term investment signal that electrification remains the industry’s core trajectory.

-

EnBW and Alpitronic strengthen long-term partnership to scale high-power charging across Germany

The agreement covers fast-charging hardware, joint development of future functionalities and a multi-year maintenance framework to support EnBW’s expanding HPC network.