The expansion of charging infrastructure in Poland is progressing steadily, driven by the strategic focus of the country’s leading charge point operators (CPOs).

Today, the country has over 3,500 ultra-rapid charging points and nearly 7,000 low-power ones available in public spaces.

This ratio of chargers to electric vehicles is relatively high: utilisation rates per point remain fairly low, but it also shows that the network is growing ahead of demand.

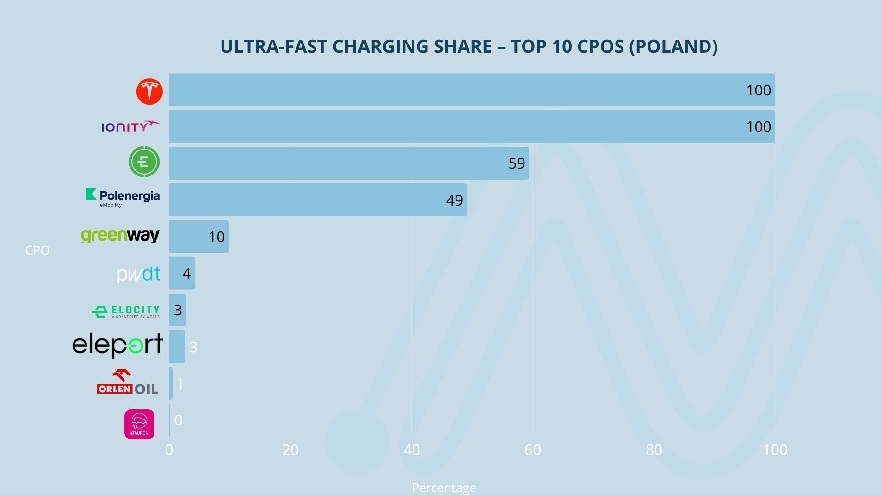

According to recent data from ChargePlanner, analysed by Mobility Portal Data, only four of the ten leading market players have a majority of high-power chargers in their network.

Tesla and Ionity lead with 100% ultra-rapid charging

Tesla Supercharger and IONITY stand out with the highest share of ultra-rapid chargers, as their networks are composed entirely of this technology.

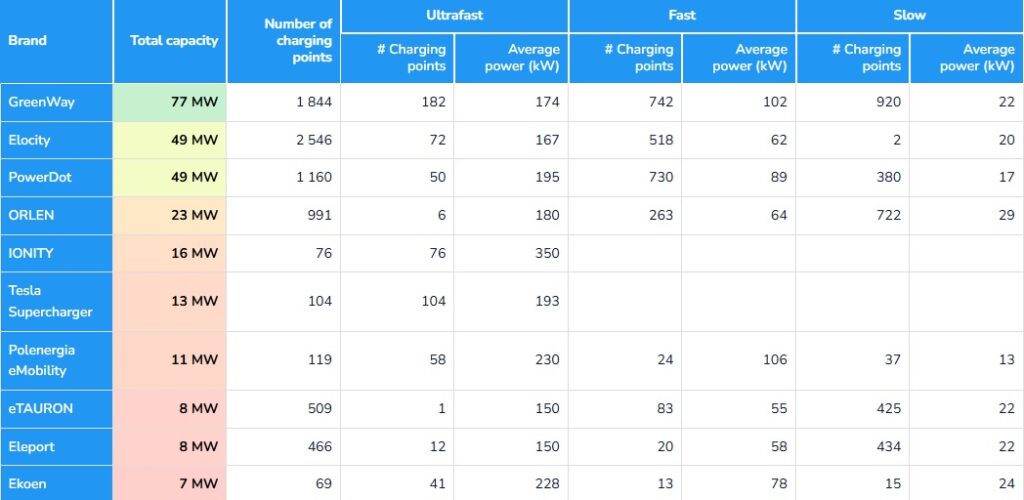

Tesla operates 104 charging points with an average power output of 193 kilowatts (kW), while IONITY runs 76 devices with an average power of 350 kW.

Next on the list is Ekoen, with 41 of its 69 chargers being ultra-rapid (59.42% of the total), along with 13 fast chargers and 15 slow ones.

In fourth place is Polenergia eMobility, with 58 ultra-rapid devices (approximately 49.15%) out of a total of 118. This CPO also has 24 fast chargers and 37 slow chargers.

Companies with a high number of ultra-rapid chargers but not prioritising the technology

GreenWay is one of the companies with the largest number of chargers (1,844 in total). It also has the highest number of ultra-rapid devices (182).

However, it prioritises slow charging, with 920 points of around 22 kW. It also operates 742 fast chargers. As a result, only 9.87% of GreenWay’s chargers are ultra-rapid.

PowerDot, meanwhile, has a total of 1,160 chargers, of which 50 are ultra-rapid – just 4.31%. This CPO leads in fast charging points, operating 730 of them. It also runs 380 slow charging devices.

Elocity is another operator with a significant number of ultra-rapid chargers – more than Ekoen and Polenergia eMobility – with 72 in total. However, they represent only a small share of its overall network (2,546), approximately 2.83%.

It is worth noting that Elocity also has 518 fast chargers and just two slow ones.

CPOs prioritising slow charging

Elport operates 466 charging stations, of which 12 are ultra-rapid (150 kW) (2.58%), 20 are fast (average power of 58 kW) (4.29%), and 434 are slow chargers with a power output of 22 kW (93.13%).

Orlen operates 991 charging points: only six are ultra-rapid, with an average power of 180 kW (0.61%). Meanwhile, 263 are fast chargers (average power of 64 kW) (26.54%), and 722 are slow chargers (average power of 29 kW) (72.85%).

eTAURON, for its part, has a single ultra-rapid charging station of 150 kW (0.19%), 83 fast chargers averaging around 55 kW (16.29%), and 425 slow chargers with an average power of 22 kW (83.52%).

DISCOVER MOBILITY PORTAL DATA

Introducing Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key insights for smart decision-making in the automotive sector—covering both internal combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and clearly organised statistics—all in one place.

With Mobility Portal Data, better decisions are just a click away.

READ MORE

-

Monta CEO reveals strategy: “We aim to run the entire charging network autonomously with AI”

Several companies are investing in creating platforms for human teams to manage EV charging. But Monta argues that this model does not scale—it is costly, slow, and prone to errors. Why should full automation with AI be the way forward?

-

Hellonext supplies charging equipment for the largest EV hub in the Iberian Peninsula

The facility, developed by Galp and BMW Group at Intu Xanadú (Madrid), features 116 charging points and a total capacity of over 3.6 MW.

-

GRIDSERVE begins building its first public electric HGV charging hubs

These new locations form the foundation of the Electric Freightway – a nationwide programme designed to give fleet operators access to high-power public charging designed specifically for electric HGVs.