A decade ago, the rapid growth of electric vehicles (BEVs) in Norway raised alarms among electricity distributors and energy authorities, who feared that the additional demand would overload the grid and cause outages.

Unlike in other countries, such as the Netherlands —where concerns over potential grid collapse remain—, in the Scandinavian nation those fears have subsided.

“Energy companies no longer see BEVs as a threat to the grid,” says Sveinung André Kvalø, Senior Advisor at the Norwegian Electric Vehicle Association (Norsk elbilforening), during a recent webinar.

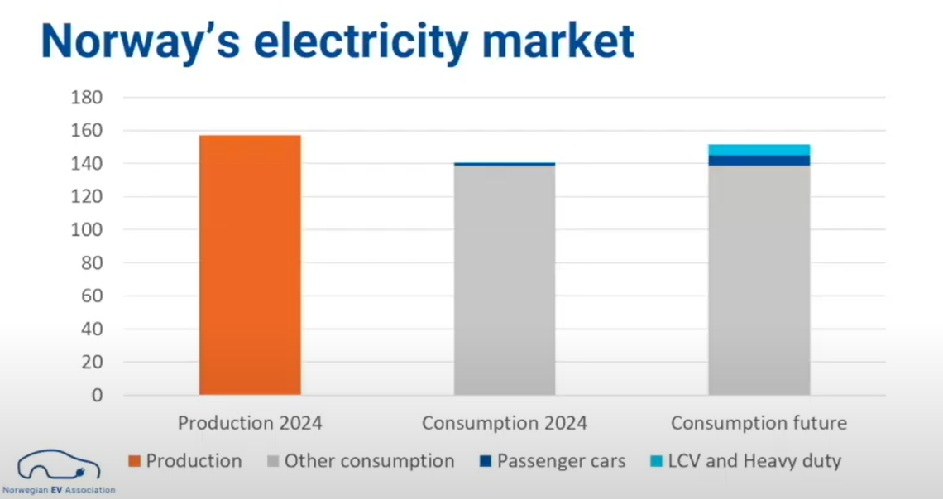

Most of Norway’s electricity —generated almost entirely from renewable sources— is used for industry and heating.

“An average electric car consumes roughly the same amount of energy as a standard household water heater,” Kvalø explains.

In 2024, BEV charging required 1.6 terawatt-hours (TWh), a minimal fraction of the national electricity consumption (139 TWh).

But what would happen if all vehicles, including heavy-duty ones, were replaced by electric models?

Even in that scenario —which is expected to be reached around 2040— the country would still allocate most of its electricity to other uses.

One factor contributing to grid stability is that most users charge their vehicles at night, when demand from other sectors is lower.

“In fact, they can help if electricity is used smartly. There are many opportunities in vehicle-to-grid (V2G) technology,” the representative points out.

“This technology is already well developed and attracts strong interest among Norwegian users,” he adds.

However, it has yet to be widely adopted. There are practical examples in operation, but for the most part it remains in the research phase.

Another noteworthy aspect is that electric cars can serve as a backup power source.

“We also experience blackouts in Norway, usually after severe storms. Last year, a community of about 1,000 households lost electricity for one or two weeks,” recalls Kvalø.

“Those who owned cars with vehicle-to-home (V2H) capability, such as the new Hyundais and Kias, were able to power their homes and keep Wi-Fi, television and lighting running,” he adds.

According to Kvalø, owners of such vehicles can supply their household for three or four days, then drive to a nearby charging station, replenish the battery, and return to power their home for another three or four days.

READ MORE: V2G: The EU’s “unfeasible” solution to blackouts “at the users’ expense”

From public support to independence: how rapid charging is growing in Norway

So far in 2025, 94% of new car sales are BEVs, excluding plug-in hybrids from the count.

With 900,000 units already on the road, the country expects to surpass one million by early 2026.

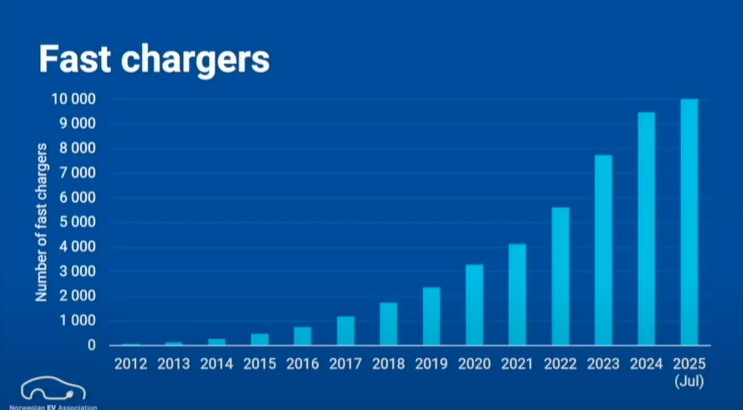

However, the true milestone lies not only in sales figures but also in the maturity of the rapid charging infrastructure market, which has operated and expanded without state subsidies since 2017.

From 2012 to 2017, there was an initial period of public support aimed at encouraging and subsidising private companies to build the first charging infrastructure.

“This is a market that has developed on its own, with almost no government support,” he emphasised.

“Today we have more chargers per car than in the early years. It is a fully functioning commercial market,” the representative adds.

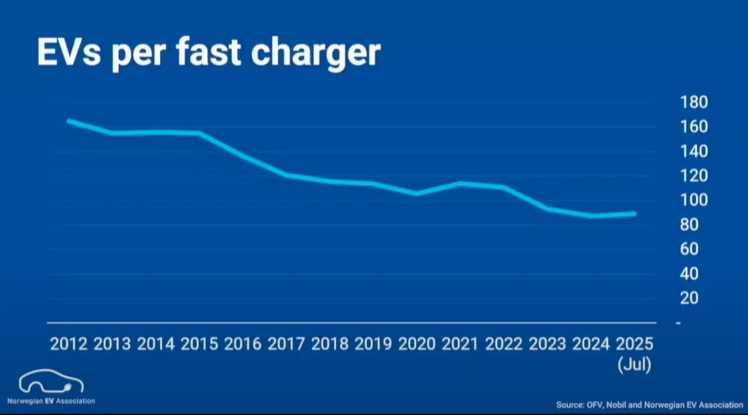

The ratio of BEVs to rapid chargers has steadily improved, with a consistent decrease in the number of cars per charging point, reflecting greater service availability.

Between 2012 and 2015, the ratio remained relatively stable, at around 160–170 vehicles per rapid charger.

From 2016 to 2018, there was a sharp decline, likely driven by an accelerated expansion of the charging network.

Between 2019 and 2021, the decrease was more gradual, with a slight stabilisation.

Then, from 2021 to 2023, another significant drop occurred, bringing the figure close to 90 vehicles per charger.

Finally, from 2024 to July 2025, the ratio stabilised at around 95 EVs per charging point.

This reduction directly improves the user experience by reducing congestion at charging stations and shortening waiting times.

Coherent policy underpinning the transition

Norway aims for all cars and light vans sold from 2035 onwards to be electric.

“Norwegian policymakers have decided to remain global leaders in electric vehicles. This is not just a plan but a concrete policy to encourage people to buy them,” says Kvalø.

To achieve this goal, the country combines supply-side measures, such as manufacturer requirements; demand-side incentives, including purchase and usage benefits; and infrastructure investments, from rapid charging networks and home or on-street points.

“This is a relatively small share of public spending,” he notes.

Norway’s strategy focuses particularly on purchase incentives.

“Our surveys show that the main reason people buy electric cars is cost savings and low total ownership costs. Prices must be comparable for people to choose the most environmentally beneficial option,” he explains.

As a result, BEVs are exempt from VAT up to USD 44,000; if the price exceeds that amount, a 25% VAT applies only to the excess.

They also pay no, or a very low, registration tax, based on the “polluter pays” principle.

“High-emission vehicles are subject to a high tax depending on their emission levels, while low-emission vehicles pay less,” he says.

This tax not only generates state revenue but also balances the system: what is collected from polluters is used to incentivise electric vehicles.

The scheme levels the market, removes the price advantage of fossil fuels, and promotes zero-emission adoption without compromising public finances.

With 94% BEVs, what is Norway’s challenge?

According to a survey by Norsk elbilforening, 95% of drivers are satisfied with their electric car, and almost no one wishes to return to an internal combustion engine.

However, “there is still a long way to go.”

“Even if almost 100% of new sales are electric, replacing the entire fleet will take time,” he warns.

At present, nearly 30% of all passenger cars are electric, but there are still two million combustion-engine vehicles that need to be replaced.

READ MORE

-

UNO alerta que la falta de capacidad de la red eléctrica que puede frenar las inversiones logísticas

La patronal de logística española, UNO Logística, ha alertado de que importantes inversiones en naves logísticas están en riesgo con el actual marco retributivo de las redes eléctricas aprobado sin unanimidad por la CNMC, por lo que esperan su reconsideración urgente. Según su presidente, Francisco Aranda, el sector logístico tiene enormes oportunidades de crecer en nuestro país…

-

El Govern habilita 604 plazas para recarga de coches eléctricos en sus edificios

El Govern ha habilitado 604 plazas para cargar vehículos eléctricos de su flota en los aparcamientos de los edificios de sus departamentos, entidades y empresas públicas desde junio de 2024 y prevé ampliar este número en unas 80 más en el primer cuatrimestre de este 2026. Estas actuaciones se enmarcan en la I Fase del Despliegue de la Red de Recarga Eléctrica Territorial que está en marcha, según…

-

Petit Forestier incorpora 275 camiones eléctricos de IVECO para transporte refrigerado

El grupo líder europeo en alquiler de vehículos frigoríficos avanza en su estrategia de electrificación con la integración del eDaily eléctrico, una solución pensada para la logística urbana sin emisiones y con prestaciones adaptadas al reparto profesional.