Amid steady yet uneven eMobility growth, Paraguay is beginning to emerge as one of the most dynamic markets in the region.

Led by plug-in hybrid vehicles, the country is undergoing not only a quantitative leap but also a shift in the social—and commercial—perception of electric mobility.

“Electrified vehicle imports are close to reaching 9% of total vehicle imports in Paraguay. It’s a relatively slow but consistent process,” states Diego Lovera, President of the Chamber of Automotive and Machinery Distributors (CADAM), in conversation with Mobility Portal Latin America.

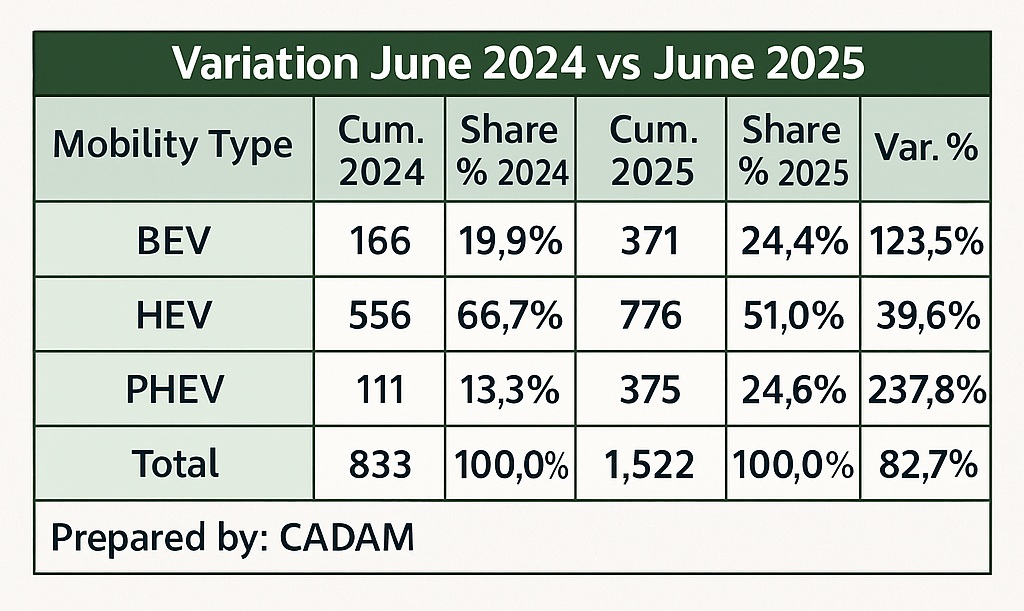

According to figures from the Chamber itself, cumulative imports of electrified vehicles so far in 2025 total 1,522 units, representing an 82.7% year-on-year increase compared to 2024.

Within that total, conventional hybrid vehicles (HEVs) continue to lead in volume, accounting for 51% (776 units).

However, the category showing the largest percentage increase is plug-in hybrids (PHEVs), which grew by 237.8% year-on-year and now make up 24.6% of total electrified imports:

“Plug-in hybrids are gaining prominence because they offer the best of both worlds: electric driving for short trips and no range anxiety,” explains Lovera.

“Moreover, they do not require a robust public charging network like fully electric vehicles, which is a key factor in Paraguay, where charging infrastructure is still lacking.”

Top Brands and New Entrants

In terms of market behaviour, CADAM’s semi-annual report reveals that BYD was the most popular brand for battery electric vehicles (BEVs), with 149 units imported, accounting for 40.2% of the total.

Next came Volvo with 34 units (9.2%) and Nissan with 24 (6.5%).

In the HEV segment, Toyota remains the undisputed leader with 519 units, representing 66.9% of the total, followed by Hyundai (12.4%) and Lexus (8%).

Plug-in hybrids (PHEVs), meanwhile, show greater brand diversity. BYD leads in this segment as well, with 106 units (28.3%), followed by Jetour with 48 units (12.8%) and Volvo in third place, with 46 units (12.3%).

Among recent developments, the first units from Xiaomi, Xpeng, Li Xiang, and Neta have entered the BEV market, confirming the arrival of new Chinese brands in the country.

The first models from LYNK & CO and Jeep were also registered in the PHEV segment, while MG continues expanding its presence in both hybrid and plug-in categories.

“It’s interesting to see how the offering is diversifying. Chinese brands are betting strongly on Paraguay, and that helps broaden access,” notes Lovera.

“Previously, there were only premium electric models; today, there are options for all budgets.”

The ‘Trust’ Factor in Mass Electrification

According to Lovera, the main driver of growth is not just economic or technological—it’s also psychological.

“All three technologies—pure electric, hybrid, and plug-in—are increasingly building consumer trust in Paraguay. That acceptance is key to moving forward.”

He adds: “We are very close to surpassing the 10% threshold in electrified imports.”

“That’s a sign that adoption is no longer marginal and is beginning to consolidate as a real option for a broader segment of the population.”

CADAM is preparing to further support this transition with concrete actions.

On 6 September, World Electric Vehicle Day, a public test-drive event will be held.

“We want to showcase the full range of hybrids and electric vehicles available in Paraguay and debunk myths. When people test them, their perception changes immediately,” he says.

The Emerging ‘Poles’ of Change

Lovera also highlights two key developments that could accelerate the market transformation: the imminent introduction of electric buses in the capital, Asunción, and the Ciudad del Este project as a sustainable industrial city.

“The government is getting closer to deploying electric buses on the streets. When that happens, people will see them in action, will ride them, and that will trigger a new wave of trust,” he says.

At the same time, Ciudad del Este is emerging as a new tech hub.

“Taiwan is opening a tech centre there and has already donated 30 electric buses manufactured in South Korea. The goal is to turn the city into not just a commercial centre, but also an industrial and sustainable one,” the CADAM president details.

eMobility Outlook in Paraguay

Looking ahead to the second half of the year, the sector remains optimistic. The continuation of tax incentives for electrified vehicles, gradual improvements in charging infrastructure, and a wider variety of models are laying the groundwork for a more mature ecosystem.

“We’re in a transitional phase that is steadily consolidating. The technology is available, the interest is there, and now we just need to keep building trust. If we succeed in doing that, Paraguay could position itself as a regional leader in electric mobility,” concludes Lovera.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away. With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

Atlante y su “modelo híbrido”: generación, almacenamiento y recarga ultrarrápida para un sistema más resiliente

Atlante acelera su despliegue en España y en diálogo con Mobility portal, Inés Mackey, Chief of Staff de Atlante Iberia define las prioridades de la empresa y su apuesta por la interoperabilidad de la mano de Charge League.

-

Spain Auto 2030: a point-by-point look at the plan set to redefine the eMobility landscape

Spain has entered a new phase in its industrial strategy for electric mobility. The Government has unveiled Spain Auto 2030, a roadmap designed to mobilise €30 billion over the next five years, reshaping the centre of gravity of the electric vehicle market through fresh incentives, a centralised management model, targeted investment in charging infrastructure and…

-

EMT Madrid licita 120 nuevos buses eléctricos: inversión de 79,35 millones y entregas entre 2026-2027

Con esta incorporación, Madrid refuerza su estrategia de descarbonización y consolida una de las flotas eléctricas urbanas más grandes de Europa.