During the first half of 2025, the progress of electromobility across Southern Europe showed varying levels of advancement in the adoption of battery electric vehicles (BEVs).

According to Mobility Portal Data’s analysis, market share differed significantly among Spain, Italy, and Portugal, reflecting the impact of local incentives, infrastructure development, and public policy.

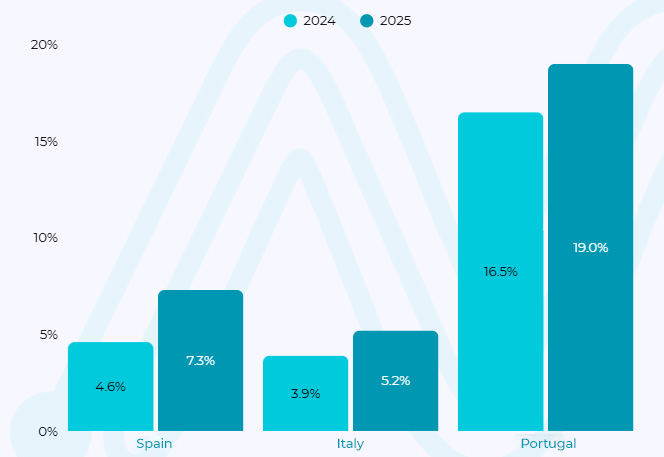

In absolute terms, Spain recorded 52,511 BEVs, representing a 7.3% share, while Italy registered 44,774 units, accounting for 5.2%.

Meanwhile, Portugal achieved a penetration rate of 19%, with 26,558 electric vehicles out of a total of 139,787 new registrations.

Portugal Leads the Way in Southern Europe

Portugal remains the country with the highest penetration of fully electric vehicles in the region.

In the first semester of 2025, 19 out of every 100 new registrations were BEVs—an improvement over the 16.5% recorded in 2024.

The number of electric vehicles increased by 38.3%, compared to a 20.1% rise in the overall market.

Unlike its neighbours, Portugal had already reached high levels of electrification, supported by fiscal policies and direct demand incentives.

In 2025, the government is maintaining a subsidy of 4,000 euros for private individuals purchasing a new BEV and trading in a vehicle more than ten years old. Social institutions may receive up to 5,000 euros per unit.

Companies can deduct 100% of VAT on purchases up to 62,500 euros (excluding VAT), and vehicles are not considered a benefit in kind for tax purposes.

Additional advantages include full VAT deduction on energy used for charging and income tax exemption for recipients of state subsidies.

At the municipal level, cities such as Lisbon, Funchal, Loures, and Oeiras offer extra benefits: free or discounted parking, unrestricted access to low-emission zones, and use of bus lanes in certain areas.

Spain: Steady and Differentiated Growth

Between January and June 2025, the Spanish automotive market totalled 722,229 new registrations, a 12.7% increase compared to the same period in 2024.

Within that overall growth, BEVs stood out with a year-on-year surge of 78.5%, rising from 29,418 to 52,511 units.

This jump allowed fully electric vehicles to raise their market share from 4.6% to 7.3%, in a context marked by the consolidation of public policies and fiscal incentives.

The MOVES III programme, in effect until 31 December 2025, continues to serve as Spain’s primary national tool to promote electric vehicle purchases.

It offers up to 7,000 euros when scrapping an old vehicle, or 4,500 euros without that requirement, applicable to models with a net price of up to 45,000 euros. Grants are retroactively available from 1 January 2025.

Moreover, BEVs are exempt from the Registration Tax, which is based on CO₂ emissions, and can benefit from up to a 75% discount on the annual circulation tax (IVTM), depending on the municipality. Madrid, Barcelona and Valencia apply the maximum reduction.

For corporate fleets, companies may deduct 100% of VAT if the vehicle is used exclusively for professional purposes.

For private users, a 15% personal income tax (IRPF) deduction is available, capped at 3,000 euros, rising to 4,000 euros in regions such as Castilla y León.

“The electrified market in Spain needs to accelerate even further. Compared to the European average, we still lag behind, which currently stands at 24%,” says José López-Tafall, Managing Director of the Spanish Association of Automobile and Truck Manufacturers (ANFAC).

Italy: Electric Growth Amid Overall Market Decline

In contrast to Spain, Italy experienced a 3.5% decline in total registrations, falling from 889,885 in 2024 to 858,354 in 2025.

However, fully electric vehicles posted a 29% year-on-year increase, pushing their market share from 3.9% to 5.2%.

This trend highlights the resilience of the segment and the influence of regional tax incentives.

Among these, the five-year exemption from the circulation tax stands out, followed by a 75% reduction thereafter. Regions such as Lombardy and Piedmont offer permanent exemptions.

Although there are no active national subsidies in 2025, several regions continue to provide their own incentives.

In Valle d’Aosta, for instance, grants of up to 12,700 euros are available for buyers under the age of 35 acquiring a new BEV. Bolzano and other jurisdictions also maintain incentives, often combined with scrappage schemes.

Additionally, BEVs enjoy free or discounted parking and unrestricted access to restricted traffic zones (ZTL) in cities such as Milan, Rome, and Bologna.

Three Markets, One Trend: More BEVs and Emerging Opportunities

Despite their differences, Portugal, Spain and Italy exhibit converging signals: BEV registrations are growing at faster rates than the overall market and, in all cases, market share exceeds the level seen a year ago.

This progress is driven not only by increasing consumer interest but also by policies that support the energy transition in transport.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away. With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

chargecloud Expands Marketplace with AI-Based Support: Cooperation with Lemonflow Technologies

The integration brings 24/7 AI-powered user support, fully embedded into the chargecloud ecosystem, aiming to enhance operational efficiency and service quality for CPOs across Europe.

-

EV transition in Europe slows, but momentum remains after EU climbdown

EU policy flexibility may ease short-term pressure on automakers, yet rising EV sales, infrastructure needs and long-term investment signal that electrification remains the industry’s core trajectory.

-

EnBW and Alpitronic strengthen long-term partnership to scale high-power charging across Germany

The agreement covers fast-charging hardware, joint development of future functionalities and a multi-year maintenance framework to support EnBW’s expanding HPC network.