The first half of 2025 proved challenging for the EU’s commercial vehicle market, marked by significant registration declines in key markets, amidst an already challenging economic context.

While the electrically-chargeable share increased, the growth trajectory is still not fast enough as market uptake continues to be stymied by the near absence of essential enabling conditions.

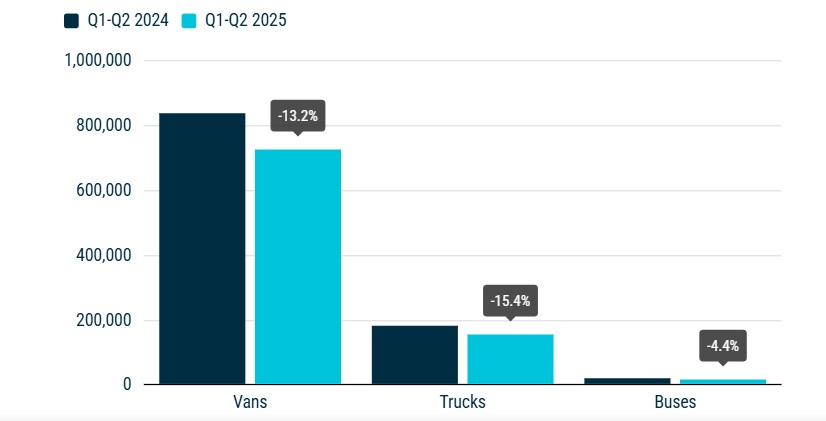

New EU van registrations fell by 13.2%, with the three largest markets contributing to the downturn.

Germany recorded the steepest drop with a 14.7% decline, followed by France (-12%) and Italy (-11.7%). Conversely, Spain saw an increase in registrations, rising by 11.2%.

New EU truck registrations also fell by 15.4%, totalling 155,367 units.

This decline was mainly driven by a 14.5% drop in heavy-truck registrations, alongside a 20% decrease in medium-truck registrations.

All major markets recorded declines, with Germany (-27.5%), France (‑18.8%), Spain (-13.6%), and Italy (-13.3%) experiencing double-digit reductions.

Although at a slower pace, new EU bus registrations saw their demand decrease compared to H1 2025, totalling 18,123 units.

Among major markets, Italy recorded a sharp decline (-24.5%), followed by Spain (-10.7%), France (-8%), and Germany (-3.2%).

On the other hand, markets like Sweden (+222.4%) and Belgium (+76.7%) recorded notable growth.

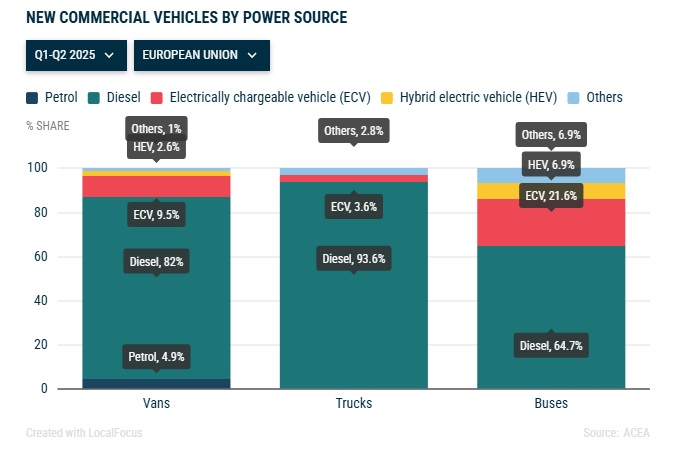

New commercial vehicles by power source

Vans

Diesel remains the preferred choice for new van buyers in the EU in the first half of 2025. However, registrations declined by 15.6% to 598,001 units, resulting in an 82% market share (a decrease from 84.3% in H1 2024).

Petrol models decreased by 29.8%, accounting for a 4.9% share.

Electrically-chargeable vans now capture a 9.5% market share, an increase from 5.8% in the same period last year.

Hybrid van registrations grew by 7.1%, while only accounting for a 2.6% market share.

Trucks

Diesel maintained its dominance in the truck market in the first half of 2025. Diesel trucks accounted for 93.6% of new EU registrations, despite the 15.4% drop in volumes compared to H1 2024.

Electrically-chargeable trucks now secure 3.6% of the market share, up from 2.1% last year. The Netherlands led this expansion with a 187.6% growth in H1 2025, almost accounting for a fifth of the EU’s electrically-chargeable truck registrations.

Bus

The share of EU electrically-chargeable bus registrations increased from 16.4% in H1 2024 to 21.6%.

Germany, the largest market by volume, saw an impressive 105.2% growth, while Belgium recorded the second-largest number of registrations, 523 units compared to 110 in 2024.

Hybrid-electric bus registrations experienced a double-digit decline of 35.5%, accounting for 6.9% of the market.

Diesel bus registrations declined by 6.7%, now holding a 64.7% market share, down from 66.2% in the same period last year.

READ MORE

-

chargecloud Expands Marketplace with AI-Based Support: Cooperation with Lemonflow Technologies

The integration brings 24/7 AI-powered user support, fully embedded into the chargecloud ecosystem, aiming to enhance operational efficiency and service quality for CPOs across Europe.

-

EV transition in Europe slows, but momentum remains after EU climbdown

EU policy flexibility may ease short-term pressure on automakers, yet rising EV sales, infrastructure needs and long-term investment signal that electrification remains the industry’s core trajectory.

-

EnBW and Alpitronic strengthen long-term partnership to scale high-power charging across Germany

The agreement covers fast-charging hardware, joint development of future functionalities and a multi-year maintenance framework to support EnBW’s expanding HPC network.