The United Kingdom (UK) is considered one of the most advanced markets in terms of transport decarbonisation policies.

However, the uptake of electric freight vehicles appears to have entered a plateau phase.

Indeed, the availability of medium- and heavy-duty electric trucks has shown clear signs of stagnation since 2023, following exponential growth in the previous years.

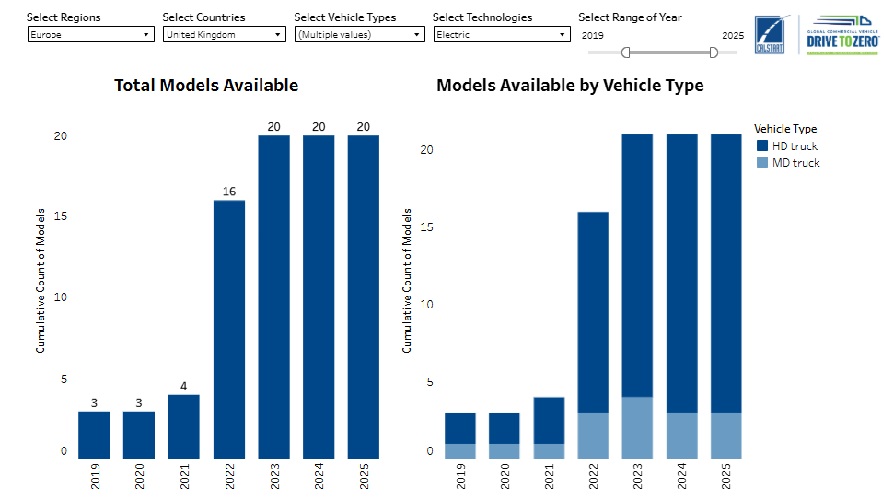

According to the Drive to Zero ZETI Data Explorer, during the first three years of these vehicles entering the UK market (2019–2021), growth was marginal — rising from three to four available models.

This modest increase reflects a period of technological exploration by manufacturers.

A turning point came in 2022, when the number of models quadrupled to reach 16 available versions.

This 300% year-on-year increase marked the beginning of a consolidated commercial phase, with a supply more closely aligned with decarbonisation targets and the growing demand for sustainable fleets.

However, since 2023, the trend has stabilised: no new models have been added for three consecutive years.

The market has held steady at 20 available options, signalling a clear stagnation in product innovation.

Which Electric Trucks Lead the Market?

The report highlights that Heavy-Duty (HD) models account for the majority of electric configurations currently available in the country.

Meanwhile, the Medium-Duty (MD) segment has remained stable, with just three to four active models in recent years.

This suggests a sector-wide focus on decarbonising long-haul heavy transport over medium-duty applications, likely due to the greater emissions impact and potential for logistics efficiency.

Causes of the Stagnation: Maturity or Lack of Incentives?

Several hypotheses have emerged to explain this plateau in the development of new models.

One possibility is that the market has reached a balance between supply and demand, where existing models sufficiently meet the operational needs of fleet operators.

Another perspective suggests that manufacturers are currently prioritising the scaling of production and ensuring the profitability of already-developed models, rather than investing in new configurations.

Lastly, there is concern regarding the potential risks to technological innovation.

The absence of new alternatives may hinder the diversification of solutions tailored to different types of operations, routes, or logistics needs.

Strategic Opportunities Across the Value Chain

The current stagnation does not necessarily imply a halt in the electrification of freight transport.

On the contrary, it opens up strategic opportunities across the entire value chain.

For manufacturers, the slowdown offers a window to invest in new variants or adapt existing models to meet niche demands — such as urban logistics applications or extended-range delivery trucks.

Logistics operators, meanwhile, can benefit from the stability of the market by renewing their fleets with proven technologies, thereby reducing operational risks and optimising total cost of ownership.

Investors may find value in backing manufacturers with consolidated portfolios and scalable business models, gaining exposure to firms with technological advantages.

At the same time, the British government is faced with the challenge of reassessing its support policies, potentially introducing new fiscal incentives, research and development subsidies, or fast-track homologation programmes to reignite innovation and accelerate market diversification.

READ MORE

-

Alicante renueva flota policial con 27 nuevos vehículos SUV híbridos por casi 2 millones

El Ayuntamiento licita un contrato de leasing con opción a compra para reforzar la movilidad de la Policía Local, en una apuesta continua por la modernización del cuerpo.

-

From Poland to Norway: 6 CPOs and an XPeng G6 crossing 5 countries

Agata Rzędowska, CharIN Ambassador, shares first-hand with Mobility Portal Europe the journey she undertook across Poland, Sweden, Norway, Denmark and Germany. The goal? To keep debunking myths about the current state of e-mobility. What lessons were learned – and what still needs improvement?

-

Half of Italy’s motorway service areas have EV chargers – which ones are still uncovered?

Across the motorway network, the number of charging points has reached 1,159. This marks a significant increase compared to the 963 active points in June 2024. However, much still needs to be done to improve network coverage, especially in the south. Which regions have the most chargers – and which have the fewest?