6 April was no ordinary day for the UK’s e-mobility sector: the Government officially confirmed that it will uphold its commitment to phase out the sale of new petrol and diesel cars by 2030, and hybrids by 2035—albeit with adjustments aimed at supporting the industry through the electrification process.

Among the key changes to the Zero Emission Vehicle (ZEV) Mandate are increased flexibility in targets for manufacturers, exemptions for small-volume producers, and new fiscal tools.

These reforms will be accompanied by a new Industrial Strategy, expected to launch in spring, designed to foster future-facing industries.

Prime Minister Keir Starmer stated: “This will help ensure home-grown firms can export British cars built by British workers around the world and the industry can look forward with confidence.”

Transport Secretary Heidi Alexander added that the sector, long hampered by uncertainty, now needs a roadmap: “Our automotive industry deserves clarity, ambition and leadership. That is exactly what we’re offering today.”

The Government also highlights that owning an electric vehicle (EV) is becoming increasingly affordable.

According to official figures, drivers can save up to 1,100 pounds a year by charging at home overnight.

Furthermore, over 50% of used EVs are sold for under 20,000 pounds, and there are 29 new models available for less than 30,000 pounds.

But are these prices enough to stimulate demand?

Chief Executive Officer at EVA England

The Electric Vehicle Association (EVA) England welcomed the confirmation of the phased timeline for phasing out internal combustion engines, describing the decision as “encouraging” and the targets as “an essential roadmap.”

Nonetheless, they stressed that the transition “won’t happen on its own.”

“It’s disappointing that no additional measures were included for drivers who, similarly to car manufacturers, need some support to make the switch,” they stated.

They highlighted the need for government intervention to address the high upfront costs of EVs in the short term, and to help more households access affordable charging, particularly those unable to charge at home.

“Failing to tackle prevailing barriers to uptake will scupper the Government’s rightly ambitious targets to move away from petrol and diesel this decade,” they warned.

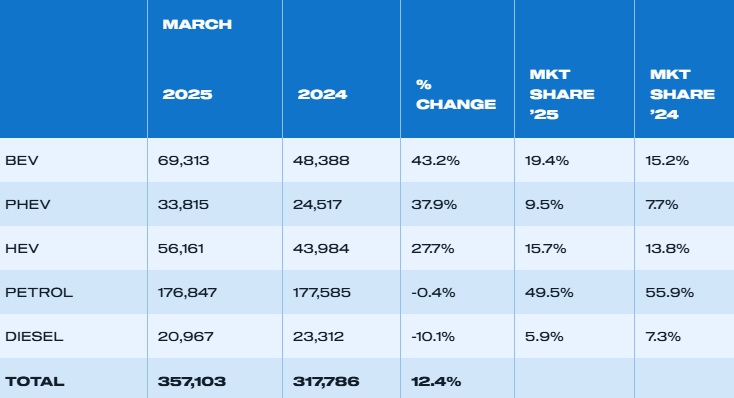

While it is true that battery electric vehicle (BEV) adoption reached a record high in March, with 69,313 units registered, the 19.4% market share still falls short of the target set by the ZEV Mandate.

Moreover, year-to-date figures show that EV adoption accounts for 20.7% of the market so far.

“This highlights the importance of government incentives and mandatory targets for the rollout of charge points, to reassure consumers and stimulate demand,” stated the Society of Motor Manufacturers and Traders (SMMT).

Mike Hawes, Chief Executive of SMMT, said: “We need sustained growth, not a short-term spike fuelled by unsustainable discounts and drivers rushing to avoid a tax hike.”

“Without substantial government support for consumers, the current regulatory framework is unworkable,” he added.

Which technology was the most chosen by the British?

Strong growth in electric cars, but still short of mandate targets

BEVs recorded 69,313 registrations in March 2025, marking a 43.2% year-on-year increase compared to March 2024. Their market share rose to 19.4%, up from 15.2% a year earlier.

While this is a significant improvement, it still falls short of the target set under the ZEV Mandate.

Plug-in hybrid vehicles (PHEVs) also posted robust growth, up 37.9%, reaching a 9.5% market share (vs. 7.7% in 2024), reinforcing their role as a transitional technology.

Meanwhile, hybrid electric vehicles (HEVs) grew 27.7%, accounting for 15.7% of all new car registrations, signalling continued interest from consumers not yet ready for full electrification.

Combined, electrified vehicles (BEV + PHEV + HEV) now represent 44.6% of the market.

This means that nearly one in every two new cars registered in March was electrified—an important milestone.

However, fully electric cars still account for less than one-fifth of the market.

Diesel in decline and petrol losing dominance

Diesel vehicles continued their downward trend, falling by 10.1% year-on-year and capturing just 5.9% of the market, compared to 7.3% in 2024.

This marks an all-time low, reinforcing the view that diesel’s days as a mainstream option are numbered.

Although petrol-powered cars still hold the largest market share at 49.5%, they experienced a slight decline of 0.4%.

READ MORE

-

Connectivity, DC and high power: ORBIS’ three technology bets for eMobility charging in 2026

ORBIS is heading into 2026 with a clear technological focus: stronger connectivity, further development of its DC solutions and a decisive push towards high-power charging. The Spanish manufacturer is fine-tuning its portfolio to align with the evolving European regulatory framework, while introducing its new Viaris ISI charger.

-

The charger’s ‘face’: why the HMI decides the success—or failure—of public chargers

Touchscreens at charge points act as the human–machine interface (HMI). If the interface fails, so does the charger. How can we ensure an optimal customer experience?

-

EV panorama in Europe: electric cars pass the 20% mark as BYD steps up its EU push

Europe’s electric vehicle market continues to gain ground: battery-electric cars exceed a 20% monthly share in November, BYD triples its registrations, and Tesla extends its loss of momentum, according to the latest data from ACEA.