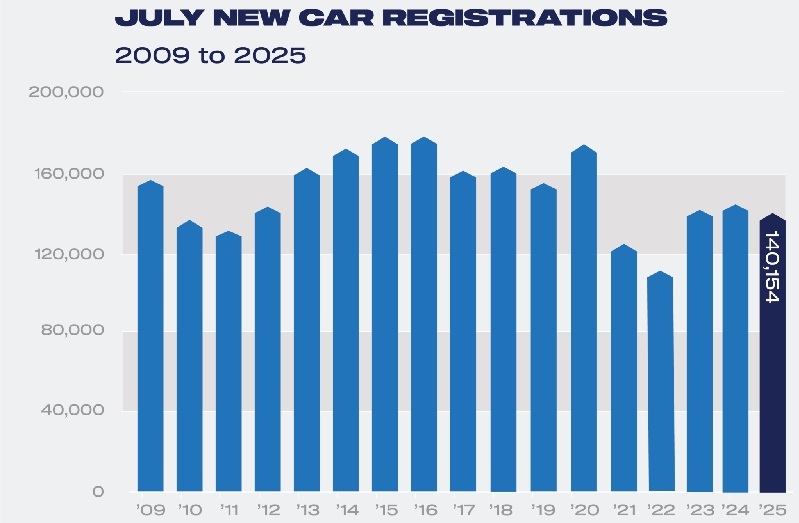

The new car market stalled in July with registrations falling -5.0% to 140,154 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

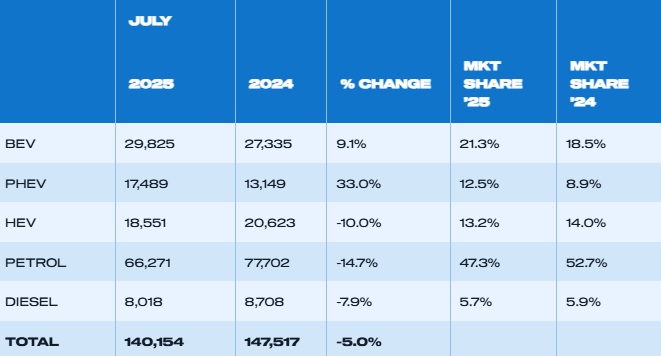

Bucking the wider market performance, registrations of plug-in hybrid electric vehicles (PHEVs) rose 33.0% and battery electric vehicles (BEVs) 9.1%, although the latter is modest in comparison with the 34.6% increase recorded for the first half of 2025.

July was the second weakest month of BEV growth this year, after April’s tax changes distorted the market in that month.

The newly announced Electric Car Grant (ECG) provides a welcome and much-needed fiscal incentive for BEV uptake, but full model eligibility has yet to be confirmed, causing some buyers to hold off pending confirmation of which vehicles will qualify for a discount of up to £3,750.

Mike Hawes, SMMT Chief Executive, states: “Confirming which models qualify for the new EV grant, alongside compelling manufacturer discounts on a huge choice of exciting new vehicles, should send a strong signal to buyers that now is the time to switch.” “That would mean increased demand for the rest of this year and into next, which is good news for the industry, car buyers and our environmental ambitions,” he adds.

BEV market share reached 21.3%, up from 18.5% in the same month last year, but remains short of the 28% required by the ZEV Mandate, demonstrating the importance of accelerating uptake over the remainder of the year.

A lack of governmental purchase and charging incentives, combined with fiscal disincentives such as the newly applied VED Expensive Car Supplement (ECS), which is estimated to impose an effective fine of more than £360 million on BEVs bought from April in this year alone, are acting as a brake on BEV demand.

Industry bosses have reaffirmed this, citing fiscal incentives for private BEV sales as the biggest single action needed to boost BEV demand, economic growth and the UK’s automotive manufacturing base – a key objective of government’s new Industrial Strategy.4

Hybrid electric vehicle (HEV) transactions declined -10.0% to 18,551 units while combined petrol and diesel deliveries fell -14.0% to 74,289 units, but still accounted for more than half (53.0%) of July’s market.

Year-to-date, the overall market remains up 2.4% at 1.18 million units, including more than a quarter of a million BEVs, thanks to a plethora of attractive new models and substantial manufacturer discounting.

July’s decline is expected to be temporary, with the latest market outlook – undertaken before eligible ECG models were confirmed – revised up to 1.9 million units for 2025, with BEV volumes revised up marginally too and expected to take a 23.8% share.3

READ MORE

-

UK updates eligibility criteria for the Electric Car Grant

The UK Government sets new technical and environmental requirements that manufacturers must meet for their electric vehicles to qualify for grants of up to £3,750.

-

Deftpower raises €12.5M to boost European growth and enhance its AI-powered charging tech

Deftpower aims to make EV charging cheaper, cleaner, and smarter for drivers and CPOs, while easing pressure on Europe’s congested power grids.

-

Ekoenergetyka: Investing in EV charging at car parks is more crucial now than ever before

Public car parks are no longer just simple transit points. With the addition of chargers, they are becoming strategic hubs for electric mobility. What is Ekoenergetyka’s strategy?