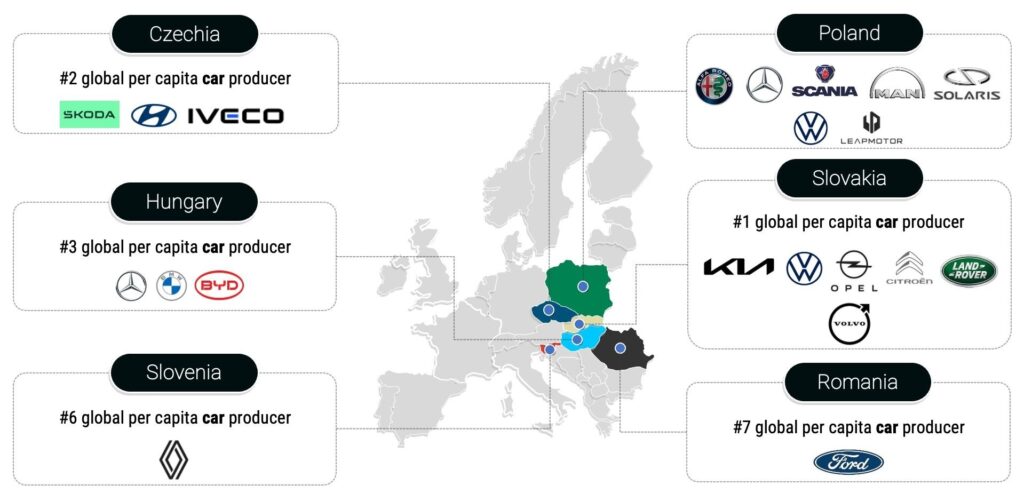

The automotive industry is a fundamental economic pillar in Central and Eastern Europe (CEE), since in 2023, of the more than 12 million vehicles produced across the continent, almost a third came from six countries in this region: the Czech Republic, Slovakia, Poland, Hungary, Romania, and Slovenia.

“This concentration is just a result of decades of development,” says Patrik Krizansky, Vice President of the European Association for Electromobility (AVERE) and Director of Slovak Electric Vehicle Association (SEVA), in conversation with Mobility Portal Europe.

“It was based on lower labour costs—CEE is not that ‘low-cost’ anymore, although still cheaper than Germany—and a sufficient number of skilled workers, although this is no longer the case; the region lacks a significant number of labourers and needs to ‘import’ workers from outside the European Union (EU),” he adds.

Notably, automotive production in these countries is undergoing a significant transition towards electric vehicles (EVs), reflecting the global trend towards sustainability and emission reduction.

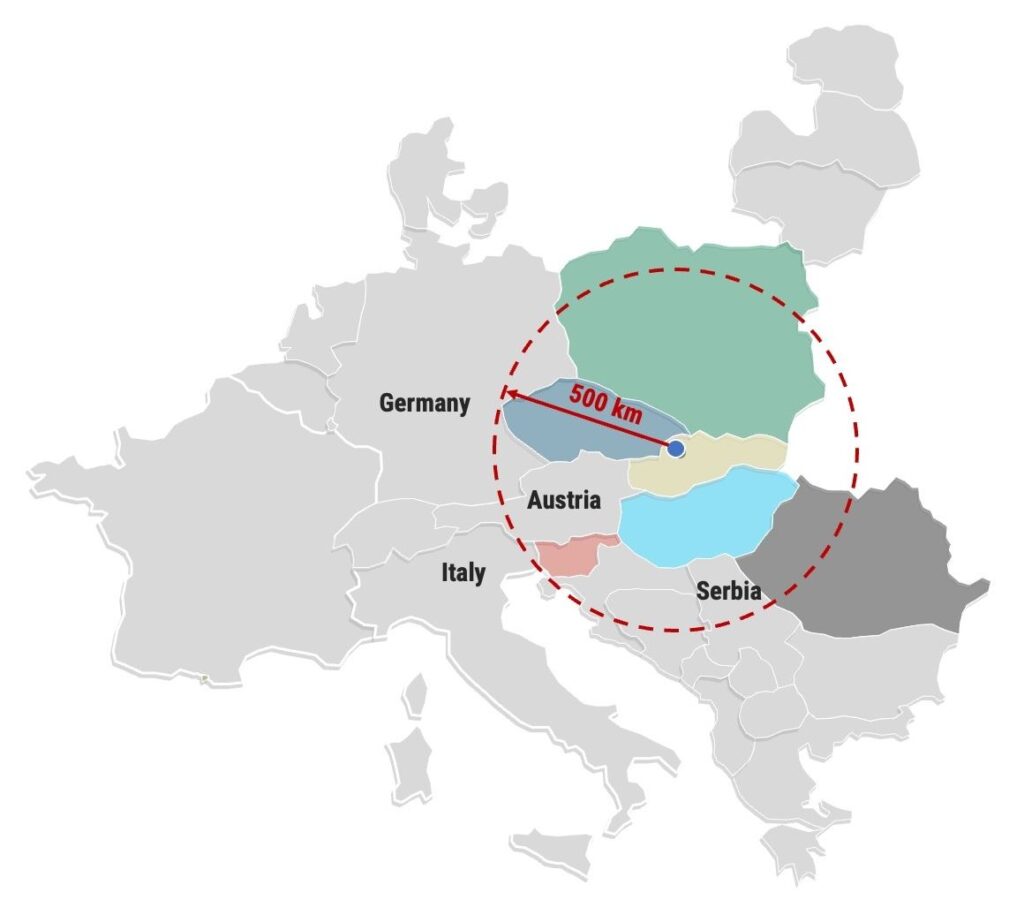

It is worth mentioning that one of the region’s most striking features is its compact geography.

“When looking at a map, much of Central and Eastern Europe’s automotive industry is concentrated in an area that could be covered within a 500-kilometre radius, centred on the intersection of Slovakia, the Czech Republic, and Poland’s borders,” the AVERE Vicepresident states in a LinkedIn post.

This geographical proximity represents a key strategic advantage, facilitating the integration and development of new capabilities within the automotive value chain, including battery production.

Krizansky adds that this advantage has been crucial in attracting new investments.

“However, new investment from OEMs still comes as the region has a strong network of first and second tier suppliers,” he states.

He also highlights the importance of the supplier ecosystem that supports this industry.

“For example, in Slovakia, we have around 350 automotive suppliers around the OEM clusters. All the ‘Bosches’ of the automotive world are here because they need to be close to the customer,” Krizansky says.

This robust supplier environment ensures that the region is not only a production hub but also a key node in the automotive supply chain.

Slovakia’s prominence

Slovakia stands out in this region as the world’s leading producer of cars per capita, manufacturing 1.1 million vehicles in 2023, of which 130,000 were electric.

The shift towards electric mobility is in full swing in this country, with major electric car launches planned by Stellantis, Volkswagen, and Kia in the coming years.

Additionally, by 2026, Volvo will open a new plant that will produce exclusively zero-emission vehicles, with a projected capacity of 250,000 units annually.

The Czech Republic closely follows Slovakia as the second-largest car producer per capita globally.

In 2023, the country manufactured 1.4 million cars, of which 180,000 were electric.

Hyundai and Skoda’s electric models are already on the market, and Skoda is expected to launch a new model, the Elroq, before 2026.

This push towards electrification, according to Krizansky, is part of an inevitable transformation.

“So, now the industry just needs to transform; that is the only option. Fortunately, it’s happening,” he states.

Hungary and Poland: an attraction for automotive investors

Hungary and Poland have also emerged as key players in electric mobility.

In Hungary, with a total production of half a million vehicles, BMW is investing two billion euros in a plant dedicated to producing EVs in its Neue Klasse series.

Mercedes, meanwhile, is allocating one billion euros for a new electric model that will join the production of the EQB.

In Poland, Leapmotor, a Chinese company, has started producing electric cars at a Stellantis plant specialising in affordable models.

Furthermore, Poland is the second-largest producer of electric buses in Europe.

However, in the Polish region, experts in the sector are increasingly concerned about the declining demand for electric cars due to the suspension of the “Mój Elektryk” subsidy programme by the Polish National Fund for Environmental Protection and Water Management (NFOŚIGW).

Romania and Slovenia as emerging destinations

Romania and Slovenia are also part of this transformation.

While the first one is beginning to manufacture the new electric Ford Transit Courier, Renault plans to start production of a new electric model at its plant in the second country to complement its Twingo.