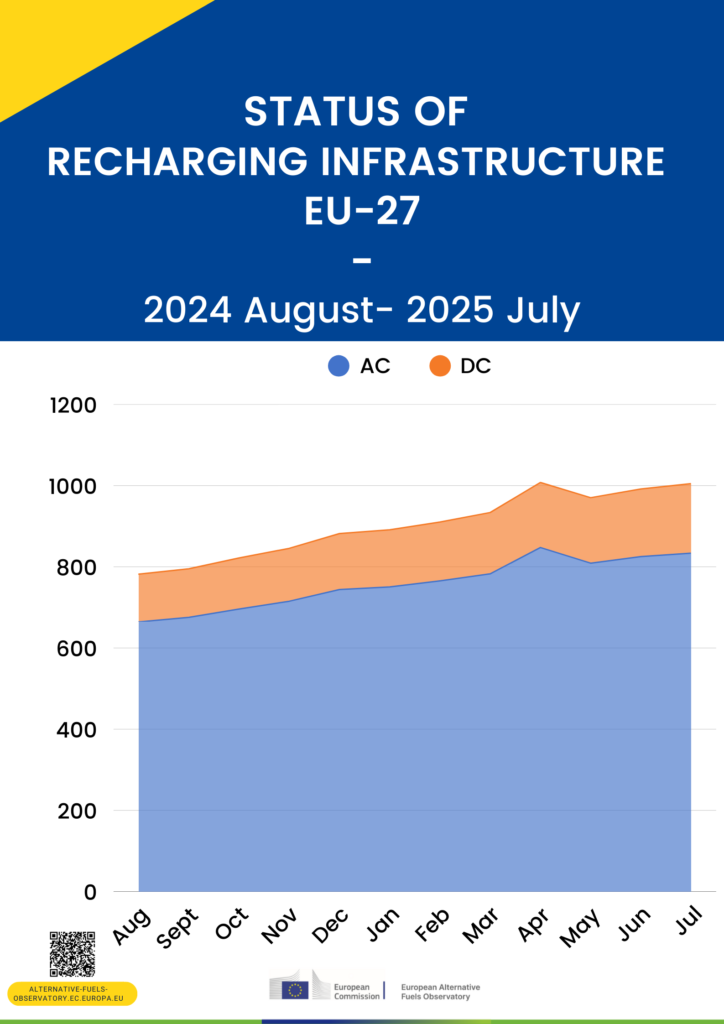

The European Union (EU) reached a historic milestone in July 2025, with the combined number of publicly accessible charging points surpassing one million, according to data from the European Alternative Fuels Observatory (EAFO).

Specifically, by the end of the seventh month, the EU had 1,005,080 charging points, of which 833,643 were alternating current (AC) and 171,437 were direct current (DC).

These figures reflect steady growth in both segments.

Compared to June, AC chargers increased by approximately 8,500 units, while DC chargers rose by nearly 5,000.

Fast charging continues to gain momentum, growing at a faster pace than standard AC infrastructure.

It is worth noting that since January 2025, the EU network has added over 90,000 AC points and more than 30,000 DC points, highlighting the rapid expansion needed to meet the targets set out in the Alternative Fuels Infrastructure Regulation (AFIR).

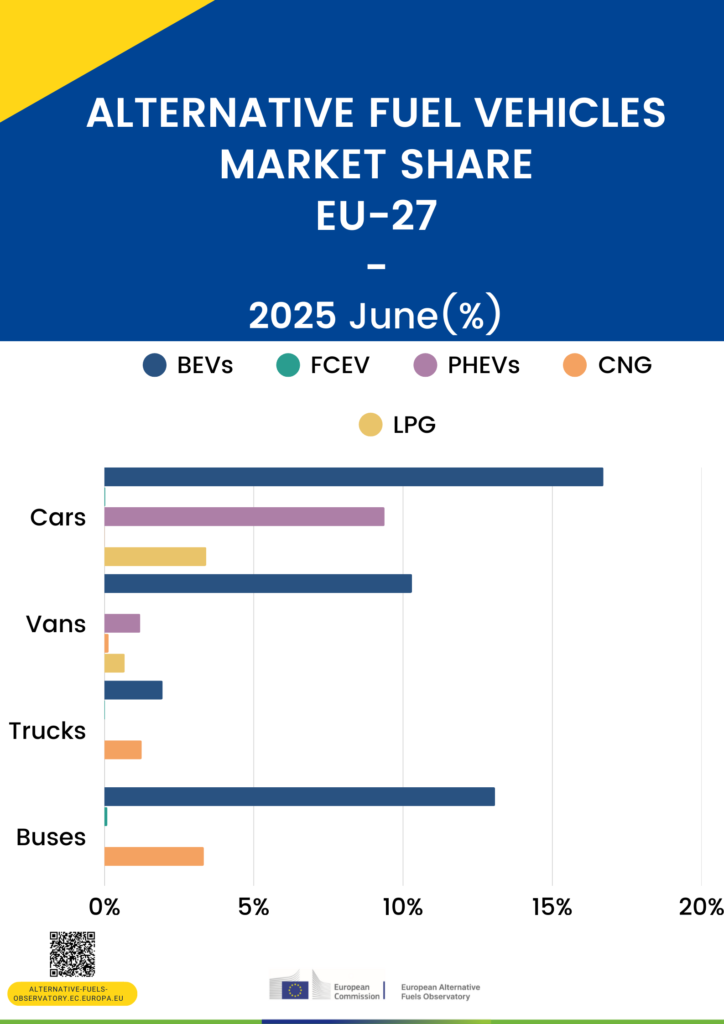

Alternative fuel vehicle market share in EU-27

Battery electric vehicles (BEVs) strengthened their role in Europe’s new vehicle market by mid-2025.

BEVs reached 16.7% of new car registrations, making them the clear leader among alternative drivetrains, followed by plug-in hybrids with 9.4% and LPG cars with 3.4%.

For vans, BEVs held a 10.3% share, far ahead of PHEVs (1.2%) and gas-fuelled options.

In the truck sector, BEVs made up 1.95% of new registrations, while CNG trucks retained a 1.25% share and fuel cells remained marginal.

Buses showed strong electrification, with 13.1% of new registrations battery electric and a further 3.3% CNG.

Fuel cell buses accounted for just 0.1%. Overall, electricity is now the most significant alternative fuel across all segments.

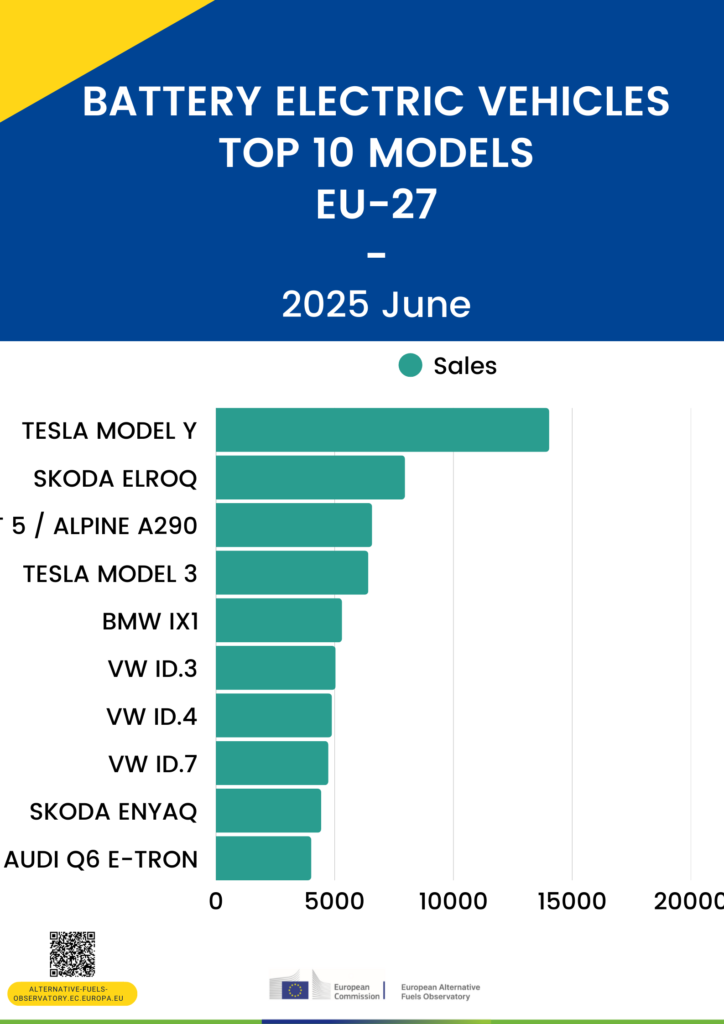

Top 10 BEV models

In June 2025, the Tesla Model Y continued to dominate Europe’s BEV market, registering over 14,000 new units.

The Škoda Elroq secured second place with almost 8,000 sales, followed by the newly launched Renault 5 with 6,600 units, both underlining the strong momentum of compact EVs.

Tesla’s Model 3 remained in the top five, with 6,400 units.

German manufacturers also performed strongly: the BMW iX1 sold 5,300 units, VW’s ID.3 and ID.4 added over 9,900 together, while the ID.7 reached 4,700 sales.

The Škoda Enyaq and Audi Q6 e-tron completed the top 10, each exceeding 4,000 units, confirming the broadening appeal of European models.

READ MORE

-

E-Mobility milestone at Munich Airport: SBRS powers up new depot with 50 e-bus chargers

With 50 charging points delivering 120 kW each, the new Munich depot already supports 37 electric buses—soon to be scaled up to 72—setting a new benchmark for sustainable airport mobility.

-

Strategic alliance aims to boost the flexibility of smart electric vehicles in Europe

The partnership combines Voltalis’ nearly two decades of expertise aggregating flexible energy assets with Virta’s advanced EV charging platform, spanning over 120,000 charge points and more than 1,000 business customers across 35 countries.

-

ChargeLeague lanza WATT 2025 y llama a “redefinir la experiencia de carga” en Europa

El evento marca el debut oficial de ChargeLeague —nuevo nombre de Spark Alliance— y sienta las bases para una hoja de ruta común hacia la adopción masiva del vehículo eléctrico en Europa.