The Society of Motor Manufacturers and Traders (SMMT) is urging the EU and the UK to reach an immediate agreement to avoid detrimental Brexit tariffs on EVs.

This appeal, supported by the EU auto sector, calls for the postponement of the introduction of stricter new Rules of Origin (ROO) requirements concerning batteries.

The introduction of these requirements could make EU and UK-made electrified vehicles less competitive in each other’s markets.

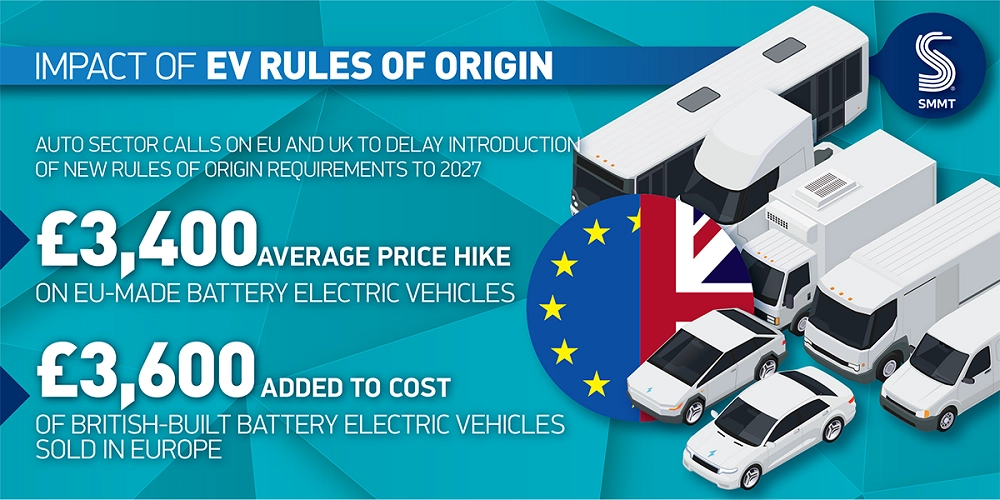

With less than 75 days until the implementation of the ROO on January 1, 2024, new calculations reveal the impact these new rules would have on vehicle affordability and competitiveness.

EVs that fail to meet the new criteria will face a 10% tariff when traded between the EU and the UK, resulting in a combined cost of £4.3 billion.

This could mean an average price increase of £3,400 for EU-manufactured battery electric vehicles (BEVs) purchased by British consumers and a £3,600 increase for UK-made BEVs sold in Europe.

Despite the challenges posed by the pandemic, semiconductor shortages, and trade tensions, EU-UK trade in electrified vehicles has more than doubled recently, aided by the Trade and Cooperation Agreement (TCA).

It has grown by 104% in the three years since the TCA was signed, increasing from £7.4 billion at the end of 2020 to £15.3 billion last year, with much of the growth occurring in the past 12 months.

However, this growth is now under threat due to the implementation of rules agreed before the pandemic, the conflict in Ukraine, and supply shortages.

Nearly half (49.1%) of all new BEVs registered in the UK in the first half of the year came from the EU.

Any increase in costs could hinder their competitiveness in an important and growing market, and applying a 10% tariff to electrified vehicles alone could undermine ambitions to be global leaders in zero-emission mobility.

Conventional petrol and diesel vehicles would remain unaffected by tariffs, potentially encouraging the purchase of fossil fuel-powered vehicles.

This scenario could deter British car buyers from choosing the vehicles necessary to achieve net-zero targets and result in a reduction in consumer choice, especially if electrified models become uncompetitive overnight.

These challenges arise as manufacturers also face the UK Zero Emission Vehicle Mandate, expected to come into force on the same date, requiring the sale of increasing numbers of zero-emission models, starting at 22% next year and rising to 80% by 2030.

A three-year delay in implementing the stricter rules of origin is seen as a pragmatic solution.

It would provide time for EU and UK gigafactories to come online and support the development of local battery components and critical mineral supply chains.

This postponement can be readily achieved within the existing TCA framework, avoiding the need for formal renegotiation and providing a boost to the manufacturers.

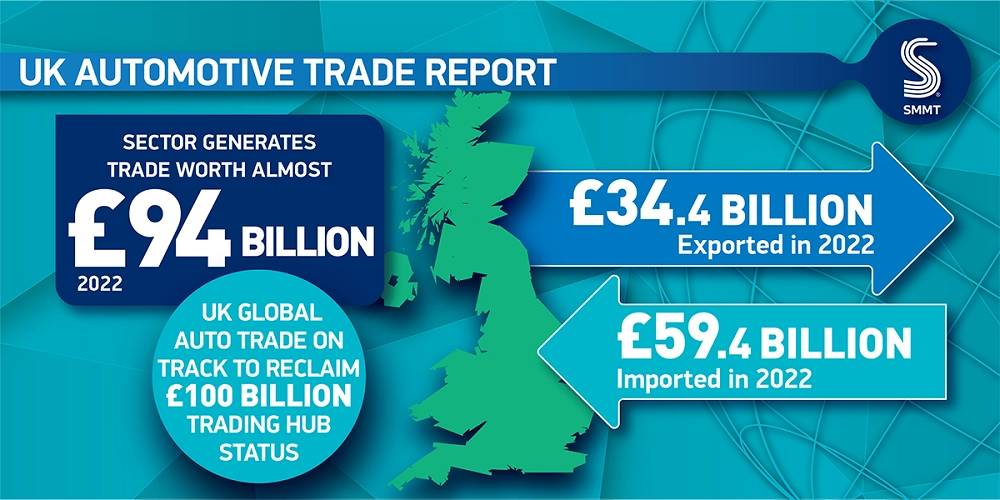

Mike Hawes, Chief Executive of SMMT, stated, “UK Automotive is a trading powerhouse delivering billions to the British economy, exporting vehicles and parts around the world, creating high-value jobs and driving growth nationwide.”

“Our manufacturers have shown incredible resilience amid multiple challenges in recent years, but unnecessary, unworkable, and ill-timed rules of origin will only serve to set back the recovery and disincentivise the very vehicles we want to sell. A three-year delay is a simple, common-sense solution that must be agreed upon urgently,” he added.

Read more: How to Prevent the Imposition of Taxes on EVs Traded Between the EU and the UK?