Roby Moyano, Head of Product and co-founder of Biapower.io, was the one to close the “Storage, Renewable and Electric Vehicles Integration Forum” organised by Mobility Portal Europe.

The executive outlined the company’s vision to transform smart charging into a strategic revenue-sharing tool with electric fleet operators.

“Our mid- to long-term vision is to offer the Smart Charging service for free, so that we all make money from charging the bus or truck. It’s quite revolutionary,” anticipates Moyano.

The goal is clear: by connecting charging operations to energy flexibility markets, such as demand response, the system could increase or decrease charging power depending on the needs of the grid.

This would allow for the monetisation of that flexibility and redistribution of the revenue with the end operator.

“We already manage over 100 megawatts worldwide. Compared to the blackout that occurred in Spain, this represents a significant portion of the first group that was disconnected,” explains Moyano.

This scale is what enables Bia to participate in pilot projects under regulatory sandboxes, where they can test these advanced functionalities.

In the meantime, the company is deploying smart charging solutions for operators such as EMT Madrid, Primafrío, and TotalEnergies.

Technical Optimisation Leading to Economic Benefits

In the case of EMT Madrid, Bia’s software already manages 235 chargers with a total capacity of 15 MW, integrating brands such as Jema Energy, XCHARGE, and Power Electronics.

“We help reduce power excesses and facilitate operations without compromising fleet availability,” details Moyano.

The system prioritises charging based on the planned operation and energy availability, avoiding penalties and maximising efficiency.

A critical feature is phase balancing. “The system evaluates how each charger is wired and adjusts the power to avoid imbalances,” he points out.

Additionally, Bia automates operations according to time-of-use tariffs, optimising energy costs.

“We have scheduled times based on the day, the vehicle, and the connection time,” he explains.

This approach has delivered results such as with Primafrio, where, during negative price days in OMIE, they charged almost at no cost.

“Even without photovoltaics, they only paid for charges without tolls because the megawatt-hour was zero,” he adds.

Integration with client-owned energy management systems is a key part of Bia’s model.

On an operational level, they can set up a garage in minutes, adjusting charging rules according to daily needs.

“This flexibility is what allows us to grow with different operator profiles,” says Moyano.

For example, in public bus fleets, the system prioritises overnight charging, when the infrastructure is heavily used for just a few hours. In contrast, for logistics operators, it adapts to daytime charging schemes, leveraging photovoltaic production and dynamic pricing.

Data in Action: How Bia Anticipates Charging Operation Failures

The company is actively working on predictive maintenance, a field gaining importance given the increasing complexity of electrified depots.

By analysing data generated by chargers (including operational states, error codes, and communication protocols), they identify potential failures in vehicle-charger negotiation.

“Many problems in depots are due to occasional errors in negotiations, which can disrupt an entire shift,” warns Moyano.

Their cloud-based platform seeks to mitigate these risks and resolve them automatically, increasing the reliability of operations.

A key aspect of Bia’s model is that its platform operates in the cloud, facilitating deployment.

Moreover, from the early stages of the project, Bia provides technical consultancy to select the appropriate infrastructure.

“We do not have exclusive agreements with manufacturers, but after six years, we know which ones work best for each case,” says Moyano.

Common Challenges in Fleet Electrification

The electric transition is not without obstacles. One of the most common, according to Moyano, is the electrical infrastructure and its inefficient use.

“There are more vehicles than available chargers, which requires optimisation through shifts to ensure availability,” he warns.

Challenges also arise from complex electrical topologies, which require real-time balancing to prevent overloads or disconnections.

Another critical point is compatibility between chargers from different brands, an issue Bia has addressed in projects such as EMT Madrid.

“Our team works to improve compatibility with charging infrastructure, adapting to existing hardware to ensure integration and functionality,” he explains.

Regarding the technical maturity of the sector, Moyano observes varied scenarios: “We’ve seen operators who knew more than us and others who needed support from scratch.”

Focusing on public transport and logistics, Bia is consolidating itself as a strategic partner in operational electrification across Europe.

“Our goal is to make electrification as easy as possible for our customers,” concludes Moyano.

DISCOVER MOBILITY PORTAL DATA

Discover Mobility Portal Data, a new exclusive market intelligence platform offering reliable data and key reports to support smart decision-making across the automotive sector — covering both combustion and electric vehicles, as well as charging infrastructure.

Research, trend analysis, and neatly organised statistics presented with clarity and precision, alongside up-to-date insights — all just one click away. With Mobility Portal Data, good decisions are on the horizon.

READ MORE

-

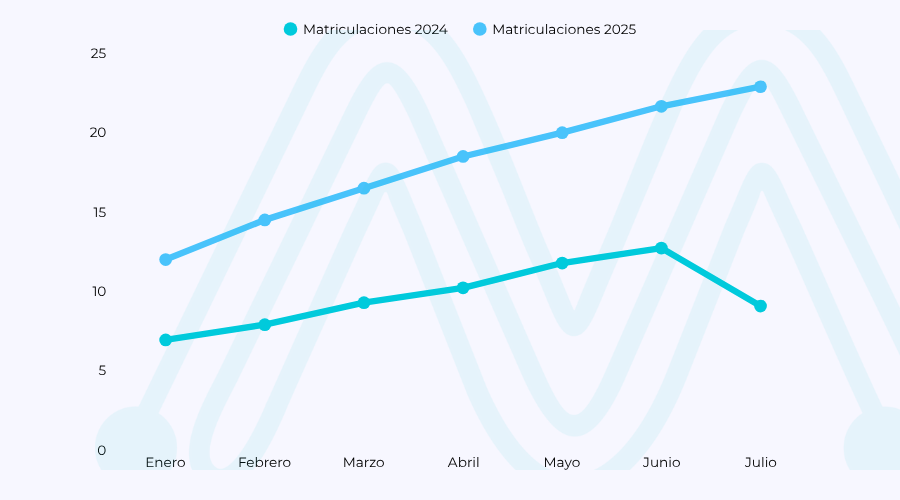

MPD: España matricula 134.063 vehículos electrificados hasta julio y supera todo 2024

Con un crecimiento interanual del 92%, el mercado de vehículos eléctricos e híbridos enchufables avanza a ritmo récord. El análisis de Mobility Portal Data destaca como Madrid y Cataluña concentran más del 50% del mercado.Aquí, todos los detalles del desempeño eMobility de julio.

-

The UK enters a “decisive” phase: can the network ease charging anxiety enough?

The government recently announced that it has reached 82,000 public charging points. This is a positive sign for those who own or are considering purchasing an EV. However, beyond focusing on quantity, the UK must also prioritize quality. Which areas have the least charger coverage?

-

From Amsterdam to Pamplona: Sungrow targets eMobility leadership with European I+D and local presence

With an innovation centre in the Netherlands and an operational hub in Spain, the global firm combines technology tailored to the European market with local stock, after-sales support, and integrated solutions. Its goal: to lead the EV charging infrastructure market with efficiency and proximity.