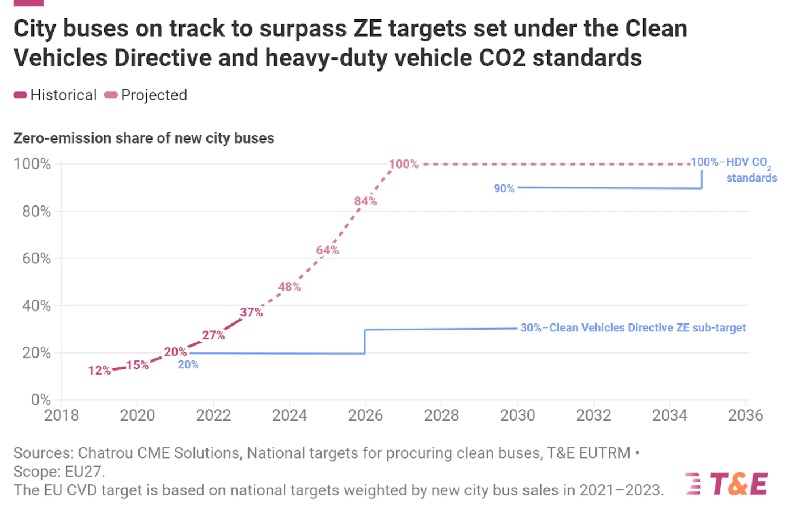

Battery-electric buses reached 36 per cent of new city bus sales in 2023 in the European Union (EU), overtaking diesel as the main fuel type for the first time, according to the analysis by Transport&Environment (T&E).

At this growth rate, all new units could be zero emissions (ZE) by 2027.

This only proves that EU regulation is falling behind market realities, says T&E.

The recently adopted CO2 standards for heavy-duty vehicles (HDVs) require 90 per cent of new city buses to be ZE by 2030, and 100 per cent by 2035.

The even less ambitious Clean Vehicles Directive (CVD) sets average ZE procurement targets of only 20 per cent in 2021–2025 and 30 per cent in 2026–2030.

Which countries are leading the adoption of e-buses?

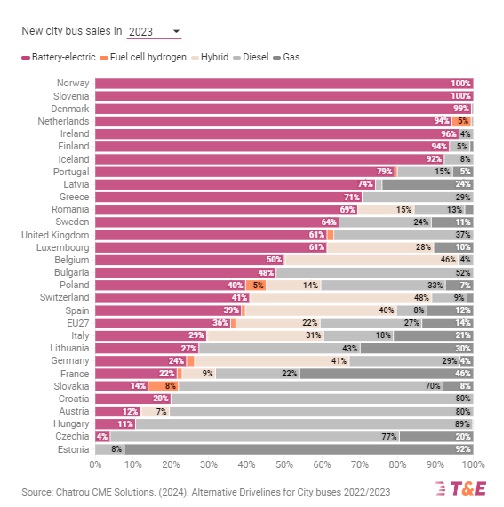

At the country level, 15 Member States outperform the EU average in 2023, including five where ZE city buses already account for more than 90 per cent of new sales: Slovenia, Denmark, the Netherlands, Ireland, and Finland.

Among major markets, ie. markets with at least 1,000 new city buses in 2023, the United Kingdom (UK) ranks highest with a ZE units share of new sales of 63 per cent in 2023.

Spain ranks just above the EU average, with a 40 per cent ZE share.

Italy and Germany come in 3rd and 4th places respectively, with ZE shares of 29 per cent and 26 per cent.

France ranks last of the major markets, with a 23 per cent ZE share. Notably 46 per cent of new city buses in this country in 2023 are gas buses, a share that is second only to Estonia.

Estonia comes last in the overall ranking with a zero per cent ZE share. However, the country is expected to start catching up soon, as the first electric buses arrived in Tallinn a few months ago.

Cities at the vanguard with ZE fleet targets

Leading the deployment of ZE buses are cities and local operators.

At least eight cities plan to have 100 per cent ZE fleets by 2025, an additional 19 by 2030, and another 13 by 2035. 14 other cities have also set bus fleet targets below 100 per cent by 2035 or earlier.

Setting targets is not limited to capital cities in Western Europe.

Cities in 23 countries have targets, including in the Baltics, Czechia, Poland, and Romania.

Indeed, regional cities have set higher or earlier targets than capital cities.

ZE bus fleet targets are also popular with countries.

Both the Netherlands and Denmark have set targets for all urban buses to be zero-emission by 2030.

Tackling emerging competition in the eBus market

As demand for ZE buses will continue to climb in the coming years, busmakers play a crucial role to make sure cities can procure sustainable, made-in-Europe units.

Some are already racing ahead and going beyond what European legislation will require, such as Daimler Buses which aims to sell 100% ZE city vehicles by 2030.

Without proactive ambition to go beyond the targets set in the HDV CO2 standards, European busmakers risk being blindsided by soaring demand and emerging foreign competition.

Since 2017, one in five new battery-electric buses sold in Europe has been of Chinese origin.

Keys to driving a successful transition

Until EU regulation catches up with the ZE bus momentum, other actors can play a crucial role in driving the transition.

Firstly, cities should set targets for 100 per cent ZE bus fleets by 2035. They should stop purchasing any more gas units and focus tenders on ZE vehicles. They should also implement zero-emission zones.

Secondly, to supply cities with made-in-Europe buses and fend off foreign competitors, OEMs should anticipate soaring demand and aim for 100 per cent ZE city bus sales by 2030 at the latest.

Thirdly, National governments should consider new public procurement criteria to promote sustainable, made-in-Europe production, thus making sure climate and industrial policy go hand-in-hand.