The United Kingdom (UK) continues to advance in its transition towards electric mobility, with the government strongly supporting the deployment of charging infrastructure.

This presents a significant opportunity for charge point operators (CPOs) looking to establish a presence in the region.

However, before investing in the UK, there are several factors to consider, including regulations, available incentives, project execution timelines, among others.

Below, Mobility Portal Europe provides a comprehensive guide on the key aspects that CPOs should take into account.

Subsidies for less attractive sectors (for now)

At present, the government is supporting sectors that are less commercially attractive to private operators.

“They are focusing on slow and residential charging because, in many cases, these have lower commercial viability for private operators. Subsidies are being channelled in this direction,” explains Gustavo A. Prince, Head of Wenea UKWenea, to Mobility Portal Europe.

“The idea is that by incentivising individual charging infrastructure, users will be encouraged to take the step towards electrification,” he adds.

However, Prince acknowledges that once the early adopters phase is surpassed, additional incentives may be introduced to continue supporting the transition.

“That could be the next step, although there have been no clear signs of it yet,” he notes.

Do not rely 100% on incentives

As mentioned earlier, the current UK incentives are focused on a specific type of technology.

For this reason, subsidies should be seen only as a ‘bonus’ rather than a primary source of funding.

“Incentives cannot be the main driver for deployment, because in cases like ours, it would not be possible to roll out fast and ultra-fast charging infrastructure,” says Prince.

“Other funding sources and private financing need to be considered. It has to be a mix,” he adds.

Engaging in OZEV workshops

Across Europe, private companies interact with governments through organisations or associations that centralise industry feedback.

In the UK, regulatory discussions are conducted through workshops organised by the Office for Zero Emission Vehicles (OZEV).

OZEV brings together key stakeholders to align market demands with available solutions, ensuring effective policymaking.

“In the workshops held over the past 18 months, discussions focused on subsidies for slow charging,” Prince notes.

He continues: “However, separate workshops were also organised with private operators to listen to their input.”

Towards the end of 2023, these sessions focused on upcoming regulations.

Later, the emphasis shifted towards highlighting new subsidies and defining the technologies they would apply to.

“Subsequently, efforts were made for several months to standardise KPIs, aiming to unify charging solutions across the UK as much as possible,” says Wenea’s representative.

Currently, these workshops continue to take place on a monthly basis.

Stricter recommendations for CPOs

From a regulatory standpoint, the UK follows a three-stage process: it first issues recommendations, then guidelines, and finally formal regulations.

Recently, new accessibility regulations for charge points have been introduced, addressing aspects such as space allocation and the height of holders, ensuring ease of use for people with disabilities.

However, Prince acknowledges a tightening of these regulations over time: “Little by little, these recommendations have become stricter.”

“Compliance deadlines have also become more rigid, requiring public CPOs to adhere to specific timeframes for implementing these regulations.”

Fixed timeframes for distribution companies

Energy distribution companies in the UK operate within fixed timelines when electrifying charging hubs.

“The process can take between six and eight months, though in some areas it may take longer due to network constraints,” Prince explains.

These companies work closely with CPOs from the very beginning of a project to certify available power capacity and set realistic timelines for infrastructure deployment.

“While these processes can be lengthy, the key advantage is that once you know the timeframe, you can plan accordingly to complete your part of the project on time,” he states.

Credit card payments and regulatory alignment

All public chargers in the UK with a power output exceeding 7.3 kW must offer contactless card payments in addition to app-based payments.

This regulation is a priority for the UK government.

“This is a rapidly growing sector, and as a result, companies must maintain technological flexibility to adapt to these regulations and work accordingly,” comments Wenea’s representative.

“It is important to be prepared, as this sector is expected to continue evolving until multiple criteria become fully standardised,” he concludes.

Read more

-

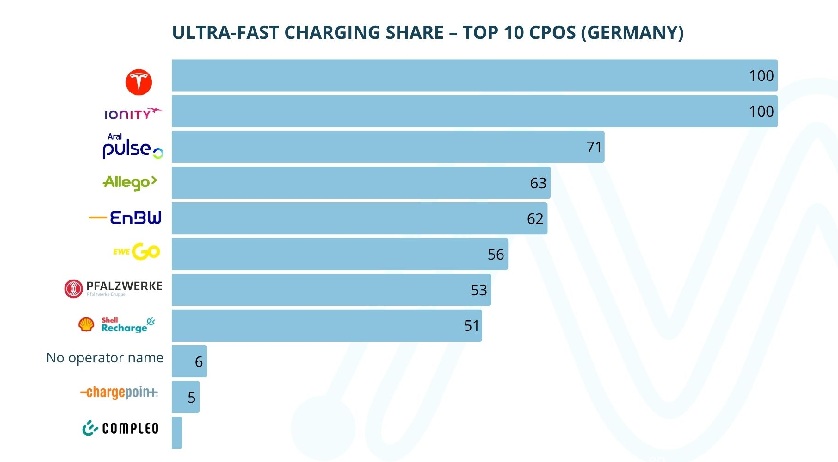

MPD: 80% of Leading CPOs Prioritise Ultra-Fast Charging in Germany

Eight of the ten players with the highest installed gigawatt capacity in Germany already have more than 50% of their infrastructure made up of ultra-rapid chargers. However, the charging market in the country is not without its challenges. Which brands are leading the way?

-

The EU Records Nearly 1 Million Public Chargers in June

June was a good month for electromobility: over 21,000 public chargers were installed. In addition, fully electric vehicles dominated registrations. Which model replaced the Tesla Model Y?

-

ON Power and Autel Launch Europe’s First MaxiCharger MCS

The collaboration between Autel Europe and ON Power not only brings megawatt-level charging to a key freight route in Iceland but also sets a precedent for scalable, future-proof infrastructure across Europe.